Weekend Open Forum

There's another weekend ahead and so much to talk about. Here's a safe space to raise whatever is on your mind.

Protecting your assets from the excesses of a global debt binge should be a priority. It means making sure there's a financial moat around your personal castle.

Today I'd like to give you a top down view of the financial state of the world.

But first a warning, it isn't a pretty picture.

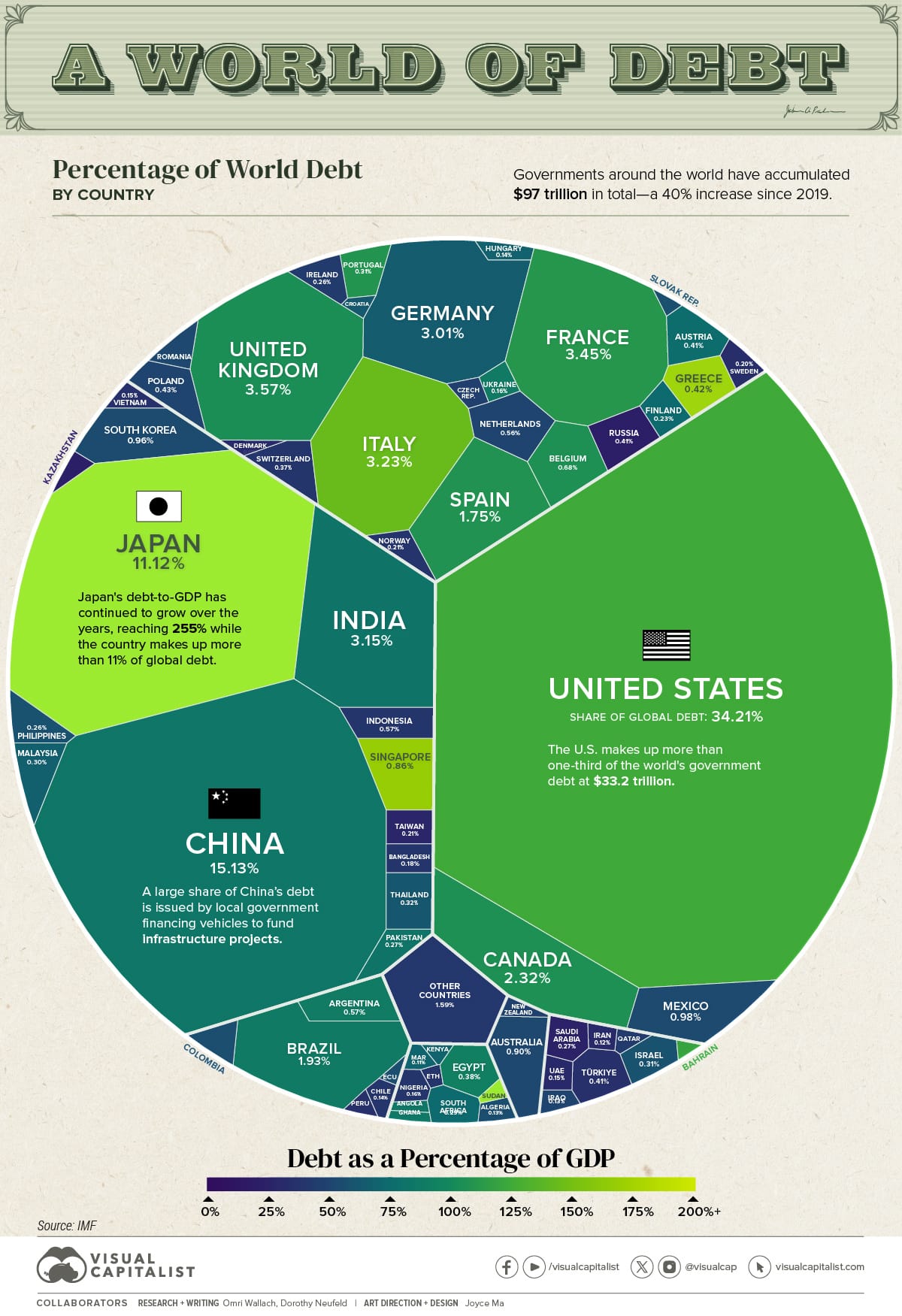

Global government debt is scheduled to hit USD 97 trillion this year. That's a near 40 per cent increase in just four years.

The surge in debt was prompted by the irresponsible COVID-19 response by governments where they basically shut everything down and printed money to hand out to people for doing nothing.

The money printing and supply chain disruption fuelled the subsequent inflation we are now experiencing.

In turn, inflation has prompted higher interest rates which is making government and private debt repayment more difficult.

The impact of debt on nation states can differ according to many factors. It can also be measured in different ways.

The absolute debt level is one method but it doesn't account for the economic size of the nation concerned or the global acceptance of their currency.

An alternative is to measure debt as a portion of Gross Domestic Product

(GDP) which provides a sense of the scale of debt relative to their economic output.

The third factor is the ability of the nation to print money to pay their debt. It's irresponsible and a short-term solution but debt denominated in your own currency is far easier to repay than that owed in another one.

Hence, the United States has the most debt in the world (more than $33 trillion) but it is a smaller percentage of GDP (123 per cent) versus places like Japan ($10 trillion in debt but 255 per cent of GDP)

The currency factor is a very important one.

Many smaller nation states can only borrow in US Dollars and as their currency devalues against the dollar, they must use ever more of their reserves to repay their debts.

Some of our farmers were caught in a similar trap when they were encouraged to take out low interest Swiss franc loans back in the 90s. The currency movement cost many almost everything they had.

Egypt for example, are now using 40 per cent of government revenues to meet their obligations. That's a sure-fire way to going broke and/or facing revolution.

Other countries, like Lebanon, faced an even worse prospect and have decided to default on their debts.

It's a reminder that debt is always repaid, sometimes but the borrower and sometimes by the lender.

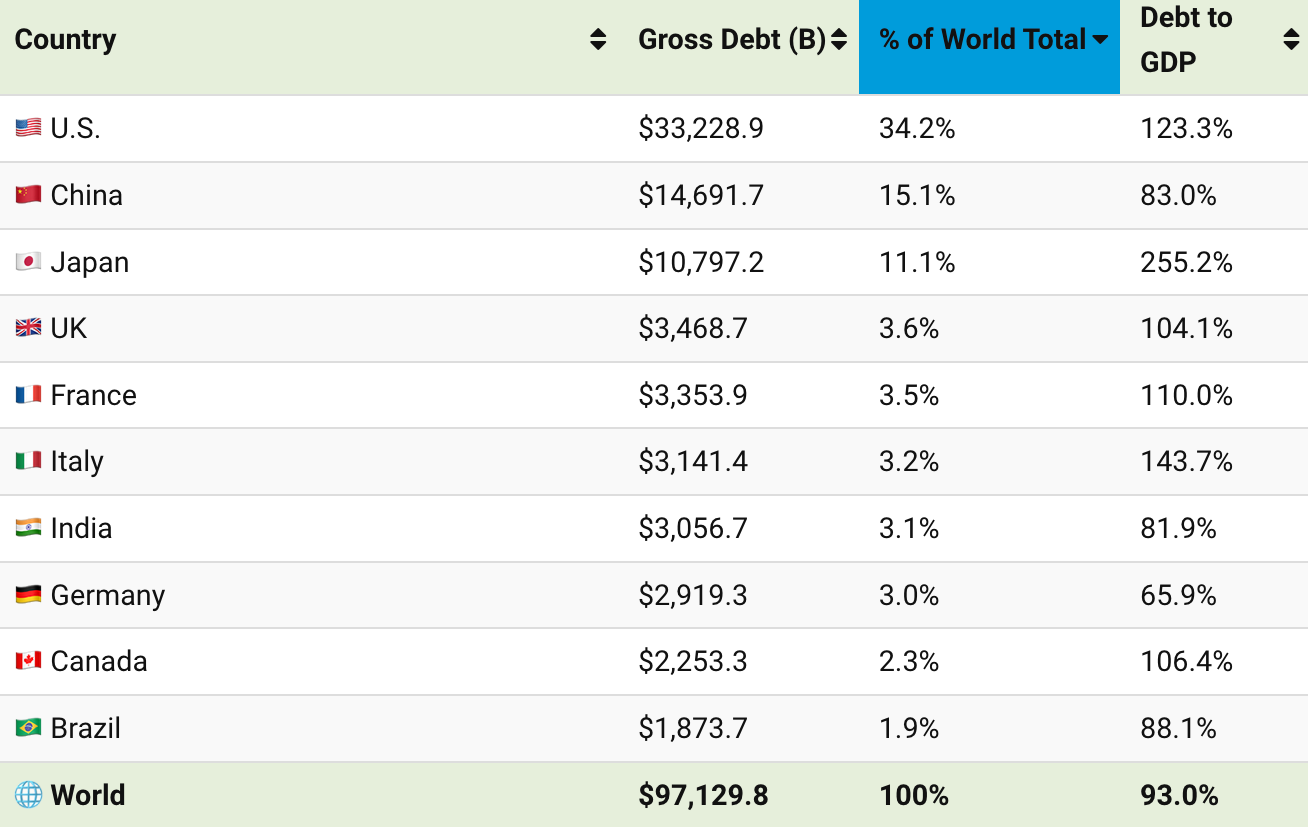

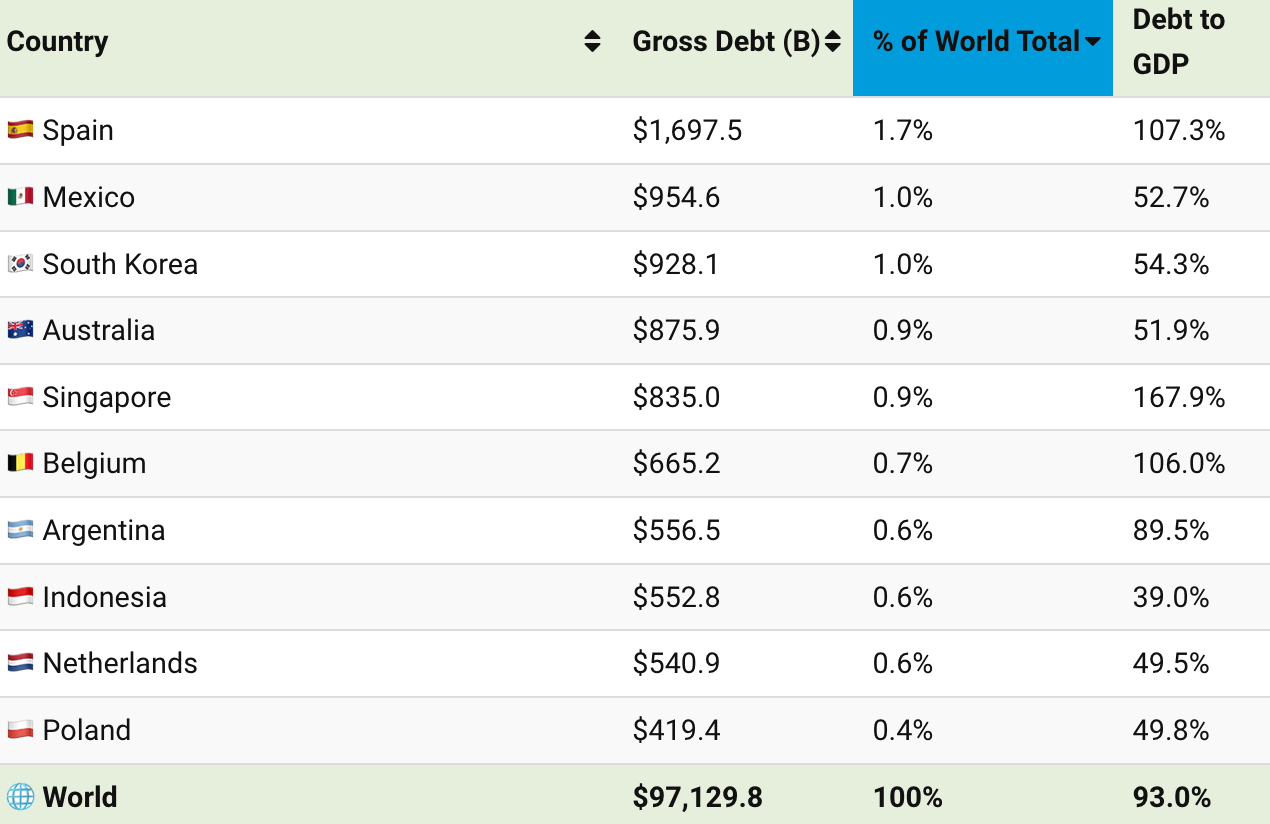

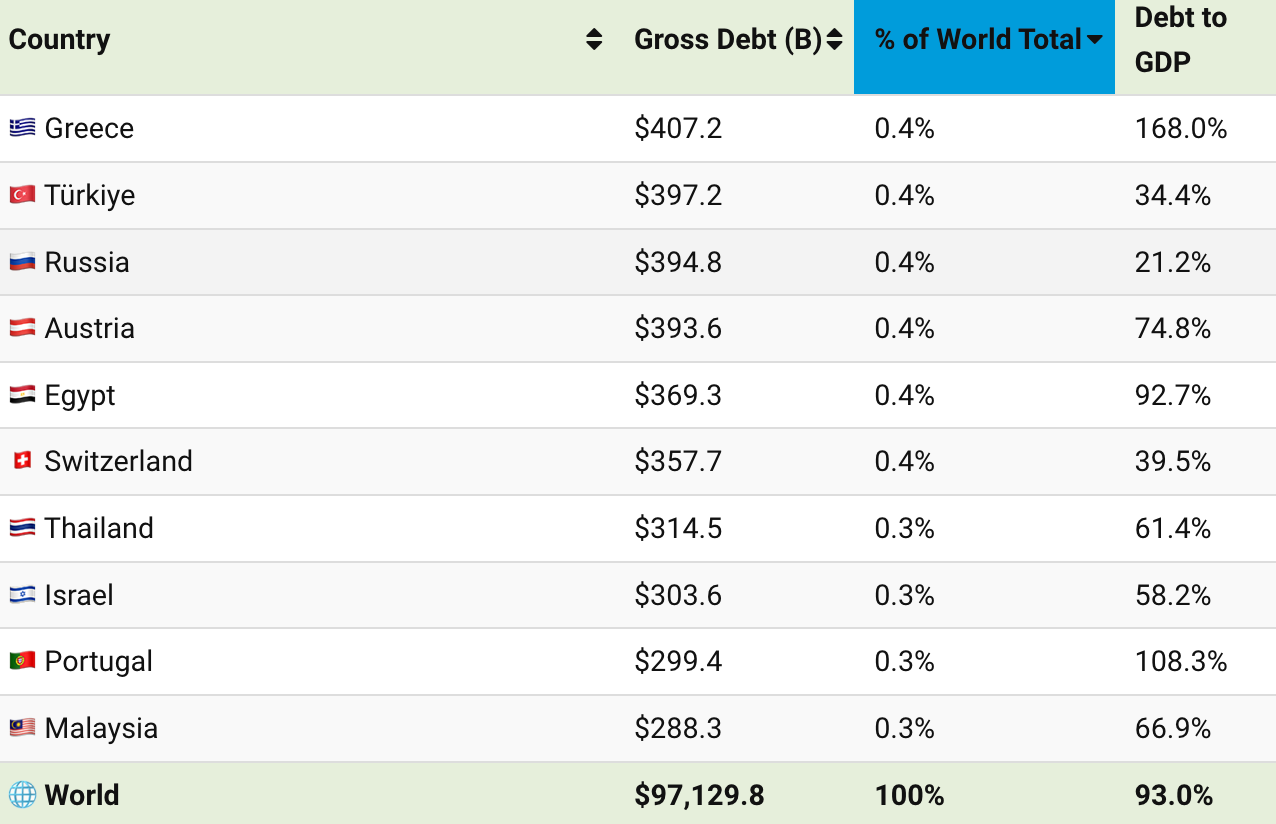

Here's a table of the top 30 nations (measured by the percentage of world total)

With USD 875 billion in gross debt, Australia has less than one per cent of the world total, accounting for nearly 52 per cent of our GDP.

It's not good but relative to a lot of other countries it could be a lot worse. You can thank the mining industry for that relative outperformance.

The team at Visual Capitalist have created the following graphic based on information provided by the International Monetary Fund (IMF).

I told you earlier it wasn't a pretty picture!

The real questions are how long can this global debt binge continue and more importantly, what happens when it stops?

Almost every asset today is reliant on debt of some type for purchase. What happens to asset prices when debt isn't readily available?

We had an experience with that during the Global Financial Crisis of 2008. When loans were called in and money was hard to find, those with cash purchased some incredible bargains.

However, for every opportunistic purchaser there is a corresponding distressed seller.

Avoiding the latter scenario is reason to build your personal financial moat. It's the only way to protect yourself and your family.

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009