EP 51 of the ANDIKA BULLETin

New Bitcoin RECORD Price! Records are made to be Broken!

Mega-Cap Meltdown Continues as 'Good News' Sends Rate-Cut Hopes Reeling. Check out the Price of a Big Mac Across the World

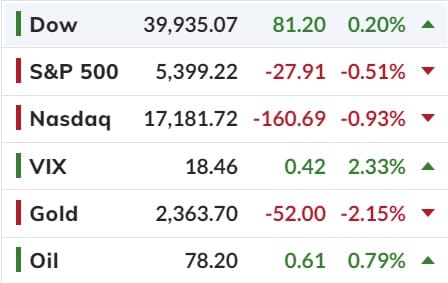

So the Nasdaq lagged again with Small Caps ripping higher. The S&P ended red again with The Dow clinging to gains.

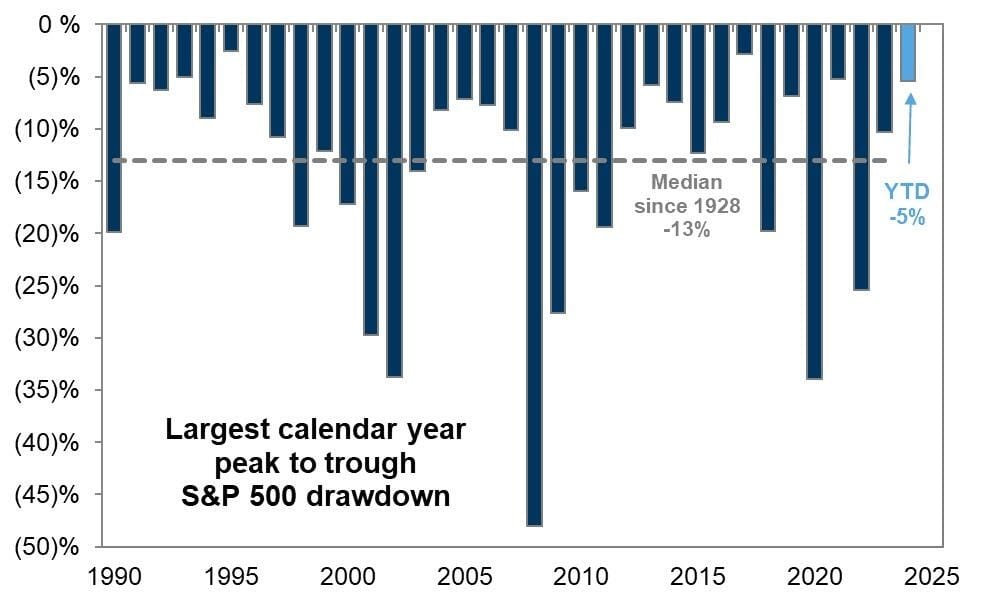

More downside to come? Sure there's more room to fall. SP500: over the last ~100 years, median year has a SP500 peak to trough drawdown of 13%. Believe it or not only been 4% which a typical draw-down taking us to 4900...

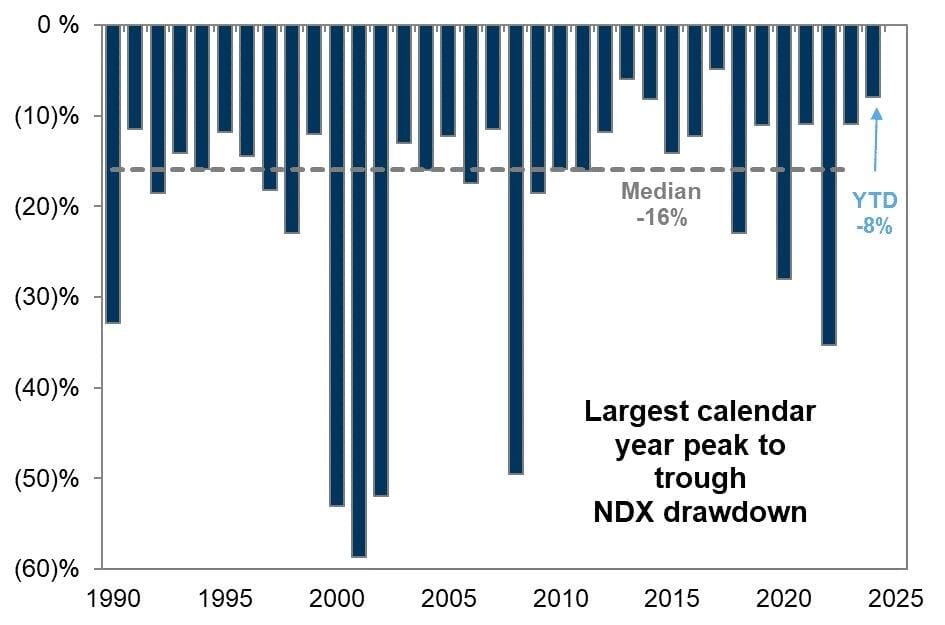

Nasdaq 100: median drawdown is 16% or around another 9% from here based on last 40 calendar years – would put you at the ~1700 level...

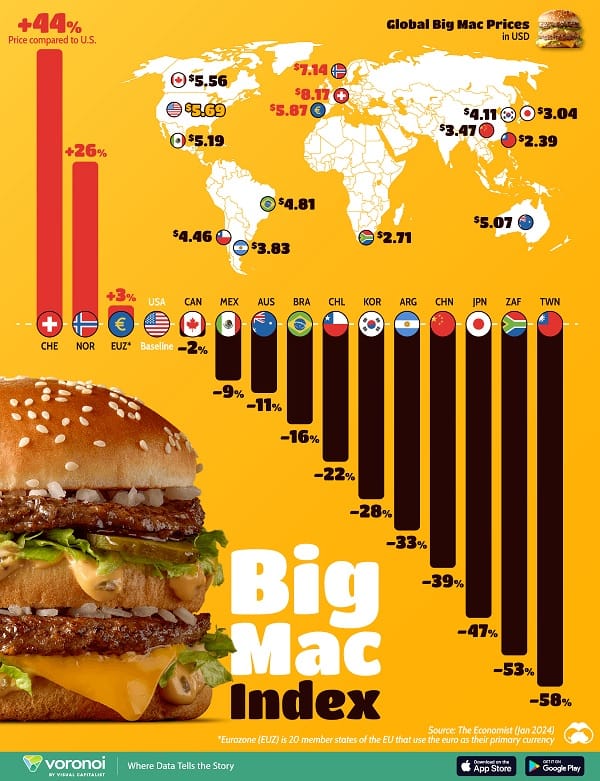

Lastly, What can a Big Mac tell us about currency rates? As it turns out, quite a lot.

The Big Mac Index, created by The Economist in 1986, started out as a simple tool to make currency theory more digestible. Now, it’s a widely-known measure in popular economics to assess and compare currency valuations.

In short, the Big Mac index compares the purchasing power parity (PPP) of currencies using the price of a Big Mac in the U.S. as the benchmark. It shows how much a Big Mac costs in various countries compared to the U.S., but it also works as a way to assess exchange rates.

In this graphic, we visualize the price of a McDonald’s Big Mac in U.S. dollars between 13 different countries around the world, the eurozone, and the United States, using the latest January 2024 data from The Economist’s Big Mac Index dataset.

So Switzerland, Norway and the Euro Zone are overvalued currencies while Taiwan & South Africa are severely undervalued currencies when measured against the USD.

Have a good weekend!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).