Weekend Open Forum

Can you believe it's the last weekend of October! Time flies when you're having fun.

Crypto Flops As NVDA Suffers Worst Week In 2 Months while the Unsustainable AI-Driven Lending Boom continues to grow.

Today I'll mainly show off a few interesting charts I saw over the weekend.

Super Tech Stock Nvidia suffered its first down-week in 2 months (probably because they aren't allowed to buy back any of their stock?)

and what concerns me is last week's NVDA weakness a sign of things to come???

Nvidia vs Cisco is the chart for ages...

Or is the macro picture signalling something that stocks don't know...

Meanwhile, Weakening Bitcoin signals an imminent S&P 500 summer correction and consolidation phase. With the NASDAQ 100 now at the very high end (2 sigma) of Bitcoin post-peak cycle overlays since 2011, we have yet another strong signal that an imminent NASDAQ 100 correction is possible

One of the recent AI "derivatives" trades, the long copper logic, so many have been pushing, has crashed over the past month. There is obviously more to copper than AI, but the gap between copper and NVDA makes you go a bit hmmmm....

And does this look like a playground you would like to play in???

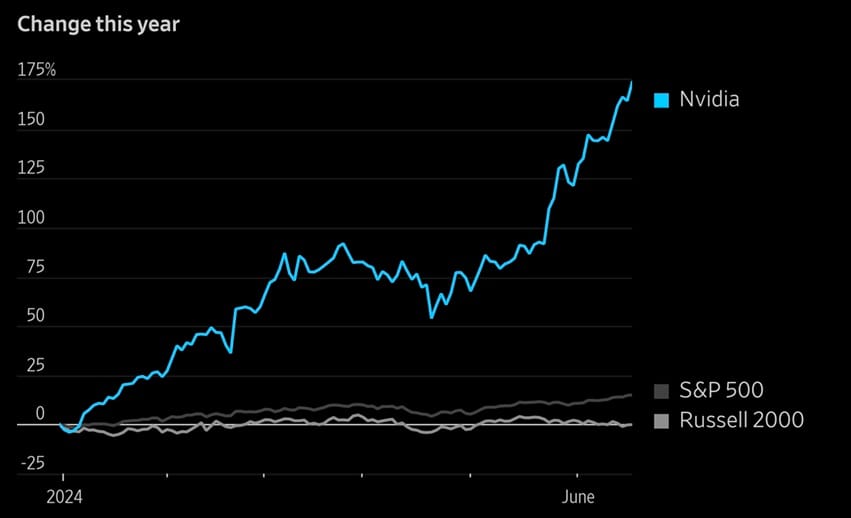

The S&P 500 is driven by a single company, Nvidia, while less-important companies fall and remain far below their highs.

1. The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and has made no progress at all this year.

2. In the S&P 500 the average stock is about where it was at the start of 2022, and more than half of the current constituents are down since then.

3. If Nvidia stops performing—because demand for chips weakens, because AI hype runs into reality or simply because everyone already owns it—the index would be reliant on the rest of the market. And the rest of the market is much less solid.

And lastly, for readers wondering when and what may cause the next market accident have a read of this:

Aggregate margin debt outstanding registered at $775.5 billion at the end of April according to FINRA. That’s up 23 percent from the year-ago period and equivalent to 2.8 percent of 2023 GDP, roughly matching the output-adjusted figure logged at the peak of the late 1990s dot.com bubble.

Those numbers are no match for the $936 billion reached in the 3rd quarter of 2021, equivalent to 3.43 percent of the GDP.

Of course, lending and borrowing success depends on the strength of the AI boom.

For the moment, the demand for AI chips appears insatiable.

At the same time, big tech companies and startups can’t seem to generate enough revenue from AI to justify the cost of the computing power that underlies it—a story that sounds very familiar.

Not much on this week. Major highlight is the first completely staged first Presidential Debate airing around 11am our time on Friday!

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009