ANDIKA BULLETin 25 OCT 2024

USD, Bitcoin, Gold and Silver...one Hell of a Combination.

After yesterday's selling in bonds, stocks, gold, and crypto; overnight saw the reverse as the US dollar dipped and everything else (except crude) rallied... as rate-cut expectations increased modestly.

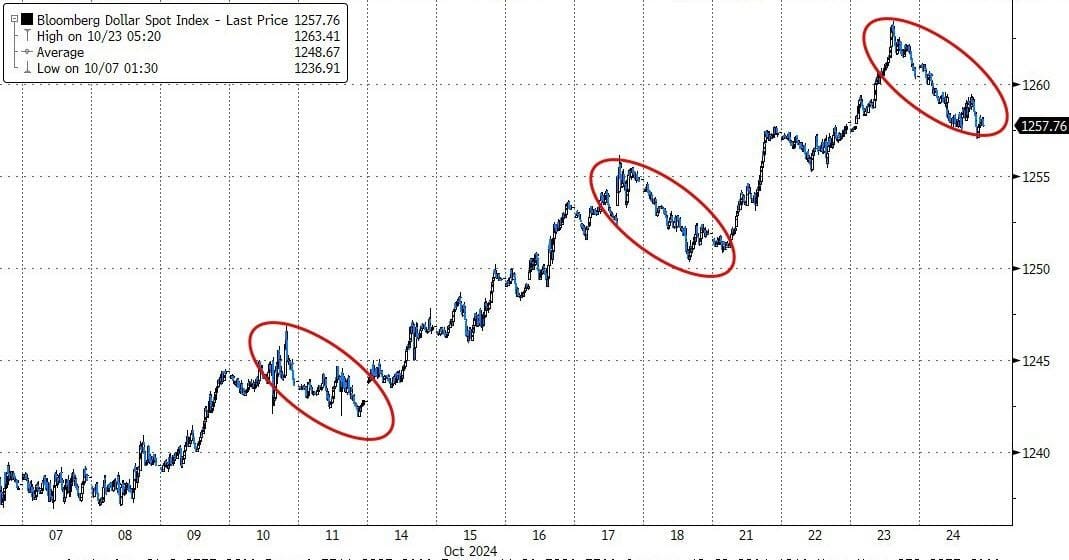

The USD pause that seems to refresh for another run...

The Dow lagged on the day, down for the 4th straight day. The S&P and Small Caps managed to fight for small gains as Nasdaq outperformed.

A few short hedge funds got a huge whack after the massive 21% surge ($145BN) in TSLA stock overnight after their strong earnings print.

Bitcoin also rallied back over USD$68,000.

And Gold moved to a new 'real' (inflation-adjusted) high since January 1980.

and Silver accelerated further after Russia central bank headlines.

Today, nations no longer hold silver as a monetary or strategic asset.

Until now, that is. The Russian government recently announced it would begin adding silver to its precious metal reserves.

There’s a good chance that other countries will follow Russia’s example and begin building their own strategic silver stashes.

Around USD$33 per ounce Silver looks like a bargain compared to Golds' USD$2,750 price let alone Bitcoin's USD$68,000 price!

Silver is a tiny market compared to gold. A small amount of additional investment demand may upset the balance and send prices far higher. If we see nations buying silver, along with additional investor demand, the result could be explosive.

The best Silver ETF on the ASX is ETPMAG

Have a good weekend.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).