EP 51 of the ANDIKA BULLETin

New Bitcoin RECORD Price! Records are made to be Broken!

'Trump Election Quake' Sparks Greatest Post-Election-Day Stock Market Gain In History. The # 1 Investment to own during Trump's 2nd Term

Where do I start?

Trump has won the presidency and Republicans have kept the Senate. Meanwhile, the House remains too close to call - however Republicans have picked up two seats from the Democrats.

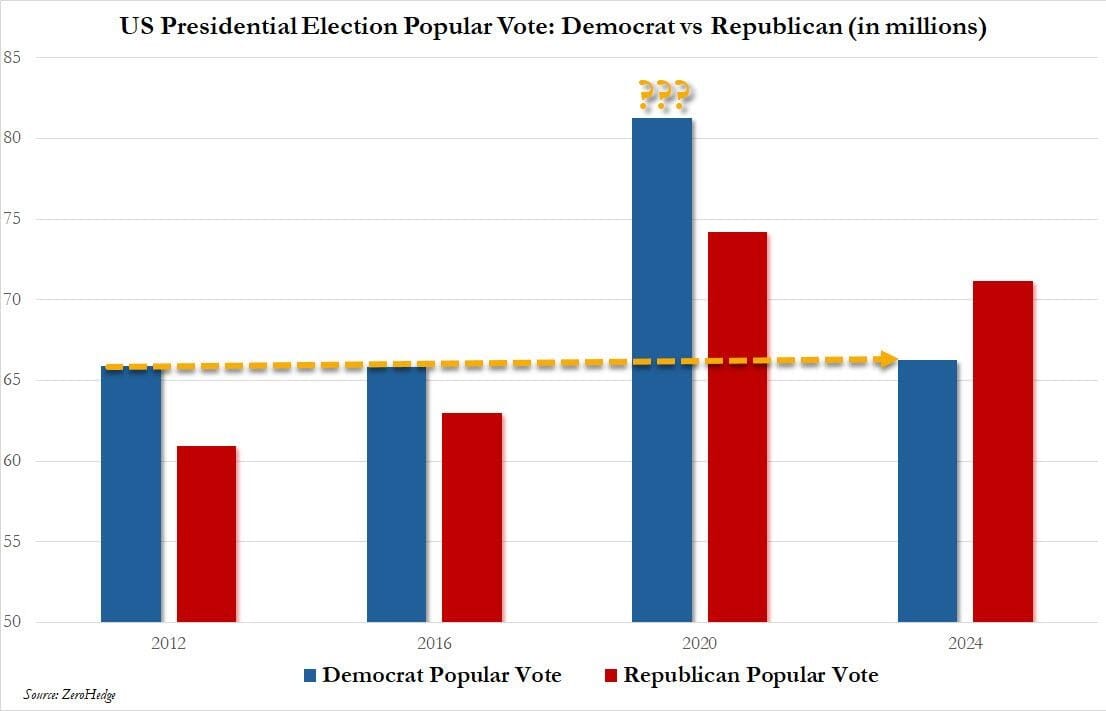

After a blowout victory by Trump in the presidential race - not just in the electoral vote but the popular vote as well, one which casts a huge question mark on those 16 million "Biden votes" that mysteriously disappeared since 2020.

Probably nothing...

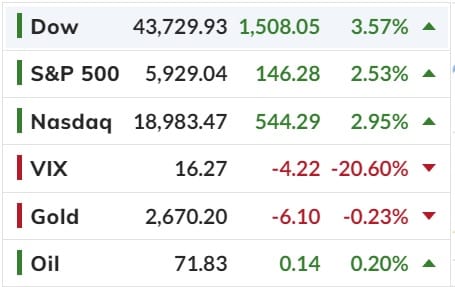

Overnights 2.95% rally in the S&P 500 was the largest post-election-day gain in history.

Overall, all the majors were up bigly on the day led by a massive short-squeeze in Small Caps (up almost 6%). A little profit-taking at the cash-open was quickly met with BTFD algos.

TSLA shares soared 15% to their highest since July 2023...

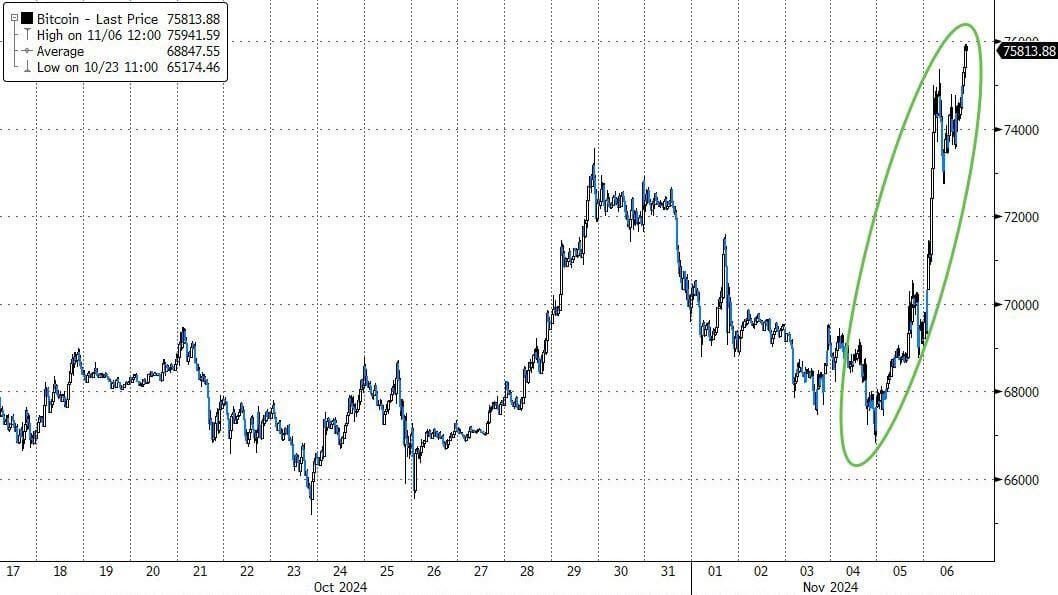

Crypto loves Trump and Bitcoin exploded to a new record high of USD $76,420

And this is a real question everyone needs to know. Next stop USD$100k-plus?

Tomorrow's 25bps rate-cut appears to be a lock (95% odds implied by the market)... but after that who knows?

The US dollar exploded higher, hitting 12-month highs at its peak overnight. This was the dollar's biggest daily gain since Feb 2023.

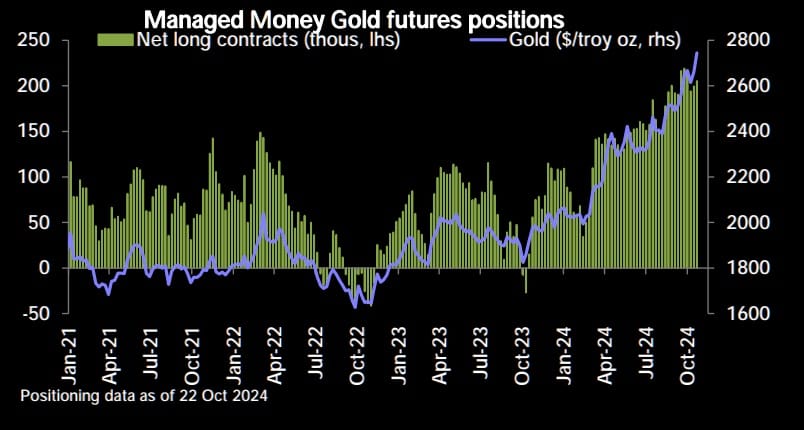

The US dollar strength was just too much for gold to handle and it was monkeyhammered lower. This was Gold's worst day since June and pushed it down to test the 50DMA. Spot Gold now trading around USD$2,670

And the Gold crowd is very long Gold...

Now, I'm now going to provide my opinion on The #1 Investment to own during Trump's 2nd Presidential Term.

First and foremost, President Trump LOVES the stock market.

During President Trump's first term then-Treasury Secretary Mnuchin stated that the Trump administration viewed the stock market as a "barometer" for the economy. Put another way, with stocks, President Trump had a real-time measure he could point to when claiming that his agenda was benefiting Americans' net worth.

Between 2016 and 2020, President Trump posted 256 tweets mentioning the term"market", 162 tweets mentioning the terms "stock market" another 26 tweets mentioning "stocks," 23 tweets mentioning "highs" in relation to stocks, and finally 15 tweets mentioning the "S&P 500."

All told, we're talking about 500 or so tweets touting the US stock market in a four year span. That comes to at least TWO tweets per week during Trump's first term!

I do not anticipate this focus on stocks to change during Trump's 2nd Term. Say what you will about Donald Trump, but he loves wealth. And the US stock market is the 2nd most-owned asset class in America behind housing: 56% of American households have exposure to stocks vs. 65% who own real estate.

With that in mind and as witnessed in the overnight US market trade the US stock market will push higher. This is particularly true when you consider the macro environment President Trump will inherit and create.

The Fed is already started cutting interest rates and is likely to do another cut tomorrow. So, Trump will inherit a stock market driven by Fed initiating a new easing cycle, at a time when the economy is still growing.

This is as close to a "goldilocks" environment for stocks you can get. And Trump will inherit this without lifting a finger.

Which brings me to the #1 investment to own during Trump's second term.

It's one the President has personally endorsed. Heck his Vice President, JD Vance, even owns it!

I'm talking about Bitcoin.

Believe it or not, a 2nd Trump Term will also be extremely beneficial for Bitcoin.

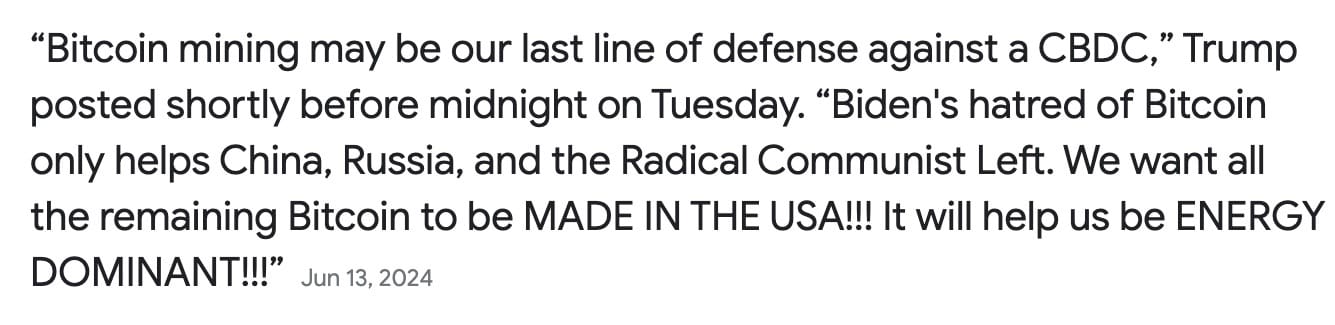

Indeed, Trump views Bitcoin and Bitcoin mining as part of his "America first" economic plan as the below quote demonstrates.

This is not Trump just posturing...

Trump is speaking (spoke) at a Bitcoin Conference in Nashville on July 27th. He did NOT cancel his appearance despite being shot two weeks' prior. This is a strong signal that this conference is of personal significance to Trump.

Trump won't be the member of his administration who is pro-Bitcoin, his pick for Vice President is J.D. Vance, who personally owns between $100,000 and $250,000 worth of Bitcoin as detailed by financial filings.

And finally, Elon Musk, who we know has developed a very a strong relationship with President Trump, is a big proponent of crypto currencies, including Bitcoin. Indeed, Tesla (TSLA) itself owns nearly $1 billion in Bitcoin.

Put simply, the President, the Vice President, and one of their biggest economic supporters and advisers are all involved in Bitcoin in some fashion.

Bitcoin is fundamentally a liquidity play. And as I've outlined earlier in this Bulletin (see and study the 4th chart from the start) the Fed has initiated a new easing cycle. And Trump will be pushing HARD on the Fed to do more.

How to buy some Bitcoin.

2 ways you can easily own some Bitcoin and become a HODL'er (hold on for Dear life)

1: Open an account with a crypto exchange and buy direct from them.

I personally use Australian firm Coinspot. Because they are an Australian Crypto firm all the Crypto is traded in AUD not USD so it's easy for your accountant to work out your tax return. The ATO treats BTC as any other asset and capital gains tax applies. But if you do buy direct then you need to take responsibility for your Bitcoin's custody or ownership. It's vital as you build up a qty that you transfer off the Crypto exchange you trade on and onto your own highly secure external hard wallet (aka a Thumb Drive). You also need to securely protect your 12 or 24 word seed phrase.

A seed phrase consists of 12 or 24 randomly chosen words that are required to restore your Crypto holdings should you lose your hard wallet or should your hard wallet malfunction (it is a piece of tech hardware after all and these thing can break)

Now if that sounds all too hard then there are currently three ASX listed spot Bitcoin ETF's

Below is a summary of them

At the time of writing this BULLETin spot Bitcoin in AUD is $114,589 per coin

The VBTC ETF seems to trade closest to the Spot Bitcoin price so I would tend to go with them over the other 2 - purely a price reason nothing more as the other two are equally fine BTC ETF's

Now these trade like a regular share, like BHP, so you just need a broking account to trade them.

Now 4,912 shares of VBTC will equal 1 Bitcoin but you don't have to own 4,912 shares of VBTC. You can own just 49 shares (1%) or pick any amount of shares to get a position in BTC.

These are very liquid so easy to trade but you can only trade when the ASX is open - so Monday to Friday during mkt hours. Bitcoin itself does trade 24/7 365 so you can't trade ETF on the weekend or when the mkt is closed. But you don't have to worry at all about the self custody of the Bitcoin. The ETF issuer covers all that for you.

So with VBTC (or the others if you like), we've got a new, more liquid, easier means for investors to own Bitcoin... with the next President of the United Stated and his closest advisers all favouring Bitcoin as an investment.

This is about as perfect of a set-up as an asset class can get.

Action to Take: Buy the ASX listed VanEck Bitcoin ETF - VBTC

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).