Tech Utopia: Freedom or Digital Prison?

Technology promises to make our lives easier, but it can also enslave us. What do you think the politicians and tech titans would prefer?

Gold Hits Another Record High On 'Goldilocks' Data. Goldman Hikes Its Gold Price Forecast

Seems US Micro Data topped macro on the day.

ADP jobs soared (doubling expectations... definitely not dovish), GDP missed expectations (but nobody wanted to think about that because consumption soared), Core PCE hotter than expected (but also, no one wanted to think about that because it was down QoQ), Pending Home Sales soared (but mortgage rates have exploded higher since the data).

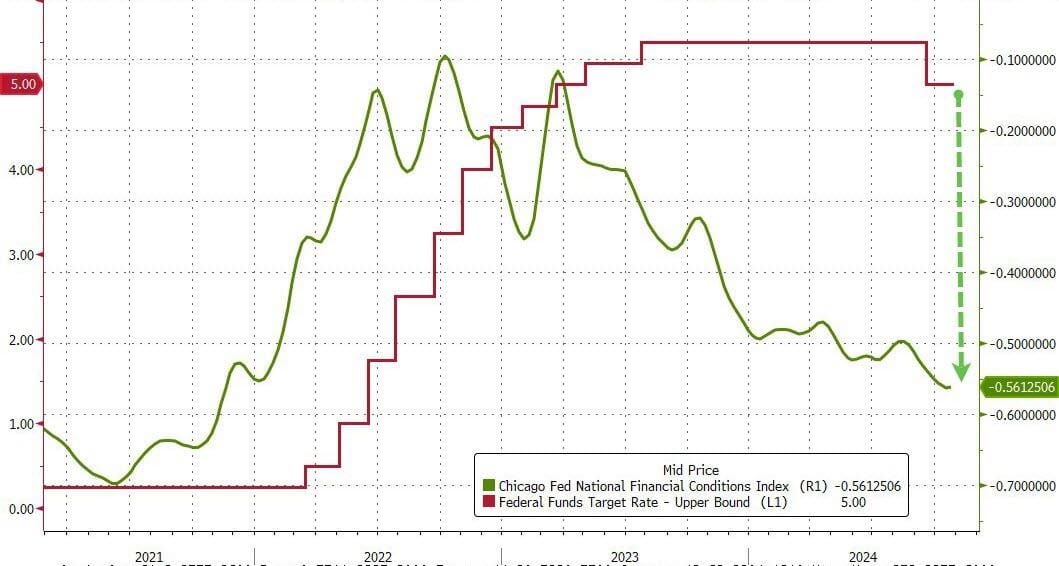

Forgive me but that does not look like 'Goldilocks' - it looks like 'animal spirits' ignited by a desperately dovish Fed's 50bps cut prompting excessively easy financial conditions.

Goldilocks or not - Gold was bid again, hitting another new record nominal high of USD $2,797 amid the upcoming US presidential election and ongoing geopolitical tensions, on target for the best year since 1979.

For direct Gold exposure look at ETF's PMGOLD (Perth Mint), GOLD (yes that's its ASX code) and GXLD.

NEM after a recent sell off looks good value given the spot gold price. It's share price is trading at when Gold was trading around USD$2,300

On a real, inflation-adjusted, basis, Gold remains below its all-time high (for now)...

Goldman Sachs just increased their forecast, predicting gold prices will "climb higher than previously expected."

The report points out that central banks in emerging nations have boosted purchases of the yellow metal and highlights three key factors:

Structurally higher central bank demand (adding 9% by December 2025) and a gradual boost to ETF holdings as the Fed cuts the funds rate (adding 7%) outweigh the drag from Goldman's assumption that positioning gradually normalizes (subtracting 6%).

“Gold usually trades closely in line with interest rates. As an asset that doesn’t offer any yield, it typically becomes less attractive to investors when interest rates are higher, and it’s usually more desirable when rates fall,” the report stated.

Goldman's new model estimates that every 100 tonnes of additional gold demand lifts the gold price by 1.5%-2%.

This assumption boosts the end-2025 gold price by an additional 9%.

History suggests that gold positioning tends to rise with uncertainty and when investors seek safe havens.

Goldman now expects gold to hit $2,900 per ounce by early 2025, up from the earlier $2,700 estimate, and to reach $3,000 by December 2025.

Meanwhile Digital Gold Bitcoin closed at USD $72,400

Happy Thursday

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).