The Coming Tax Grab

Our government are desperate for more of your money so they can give more to their pet policy areas.

US Mag7 stocks are now down an incredible AUD $3.5 trillion or 1.45 times the entire mkt cap of the ASX 200!

*** NO ANDIKA BULLETin on Monday.

That really escalated quickly...

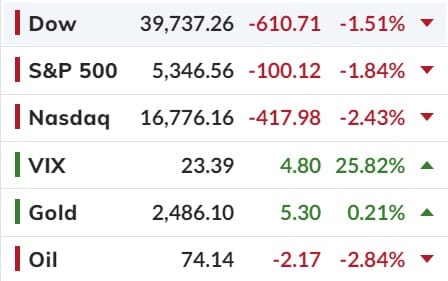

Just like Biden's dementia - economic weakness became too much for the mainstream to ignore and while Fed Chief Powell hinted at cuts to come, the market demands more (again) and stocks won't be satisfied until they get them.

"Growth scares" now dominate the narrative (maybe growth's demise is not so 'transitory')...

Unlike Australia, the US economic weakness prompted the market to bet large on bigger (and sooner) rate-cuts - now pricing in 116bps of cuts in 2024 (and 100bps more in 2025)...

If you feel like you've heard this story before, you have...twice!

And neither time did things work out as the market had hoped...

and that smashed Treasury yields lower on the week, with 2Y yields crashing almost 30bps yesterday alone and down a stunning 50bps on the week!

US Stocks did not love the dovishness as the 'soft landing' narrative morphed into 'growth scare' and 'we are gonna need a bigger boat'-gull of rate-cuts. Small Caps (the most sensitive to the economy) collapsed this week, but while they were the worst of the bunch, all the US majors puked big time!

And The Nasdaq is now officially in correction phase.

Magnificent 7 stocks are now down an incredible USD$2.3 trillion (or AUD$3.53 trillion) market cap from their record highs...

To put this figure into some perspective, the ASX 200 total mkt cap as of May 2024 is approx AUD$2.45 trillion so so the Mag 7 decline is over 1.45 times the size of the ASX 200!!!

88% of the ASX index closed lower on Friday as the index was weighed down by the influential resources and miners and next week the local reporting season kicks off in earnest so we could see a lot of volatility locally.

Given Friday's US close, ASX futs are already pointing to a 115 pt hit on Monday.

And volatility is back baby! The US options markets soiled the bed with VIX exploding to almost 30 at its peak Friday - the highest read since Oct 2022!

USD, Bitcoin and Oil plunged on Friday!

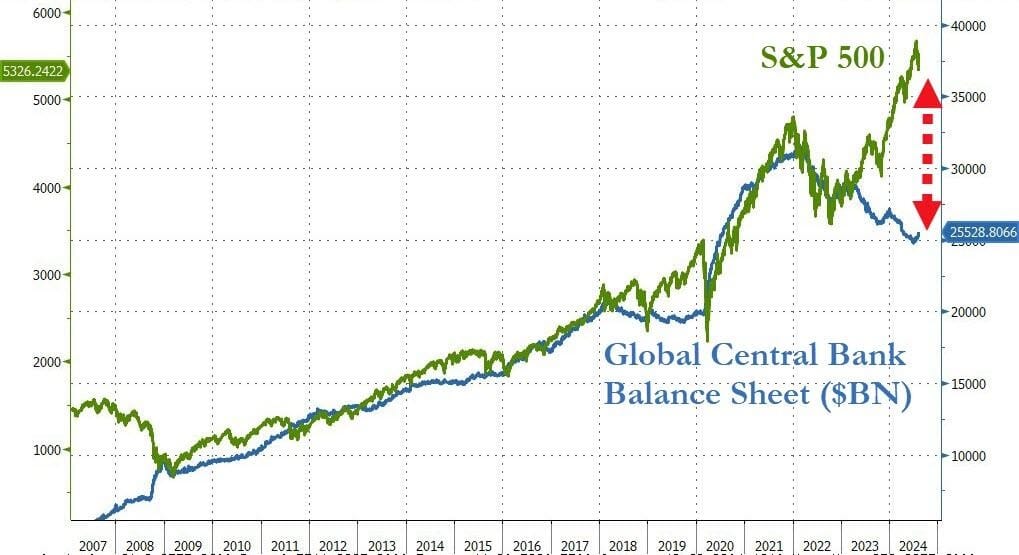

Finally, look out because if it's time for US stocks to catch down to 'economic' reality then these recent falls are nothing burgers...

SP500 closed on Friday at 5,345 so a potential decline to around 3,800 would be a sickening 1,545 pt or 28% fan hit!

So how far will the world's central banks allow stocks to fall before the liquidity fire hose is unleashed?

...well it is an election year (for Dems and maybe Aust Labor going to an early election before the RBA hikes rates?).

Have a good weekend!

We'll be back on Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).