Tech Utopia: Freedom or Digital Prison?

Technology promises to make our lives easier, but it can also enslave us. What do you think the politicians and tech titans would prefer?

Bitcoin & Black Gold Bounce as Economic 'Animal Spirits' Wreck Rate-Cut Hype

Question. Do investors really expect The Fed to cut with GDP (and PCE) expectations surging once again?

Fresh US GDP numbers came in last week and it was a blowout.

The kind of blowout only USD$2.7 trillion of deficit can buy. While the real economy crumbles.

To see why, in the past 12 months the federal deficit increased by USD$1.3 trillion. Yet the US only got half that in GDP. In other words, everything else shrank.

It's even worse for that brave and stunning Q4 – there the US got just USD$300 billion in extra GDP for – wait for it – USD$834 billion of new federal debt.

The lapdog media will keep playing alone with the government statisticians and the gaslighting academics.

This matches up with other data saying most new jobs — hence most new spending — is either government or government-assistance like migrants or welfare. What the Wall Street Journal calls the “Welfare Industrial Complex.”

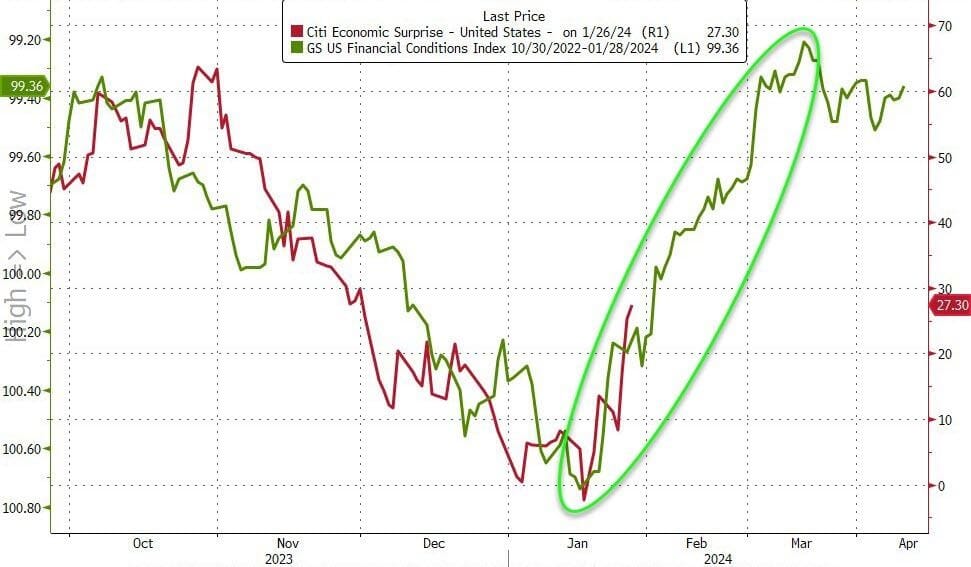

But that shouldn't be a surprise since I have warned that the lagged impact of the massive loosening of financial conditions was set to ignite 'animal spirits' - and with it, the end of any "soft"-landing narrative with the potential for re-acceleration of inflation...

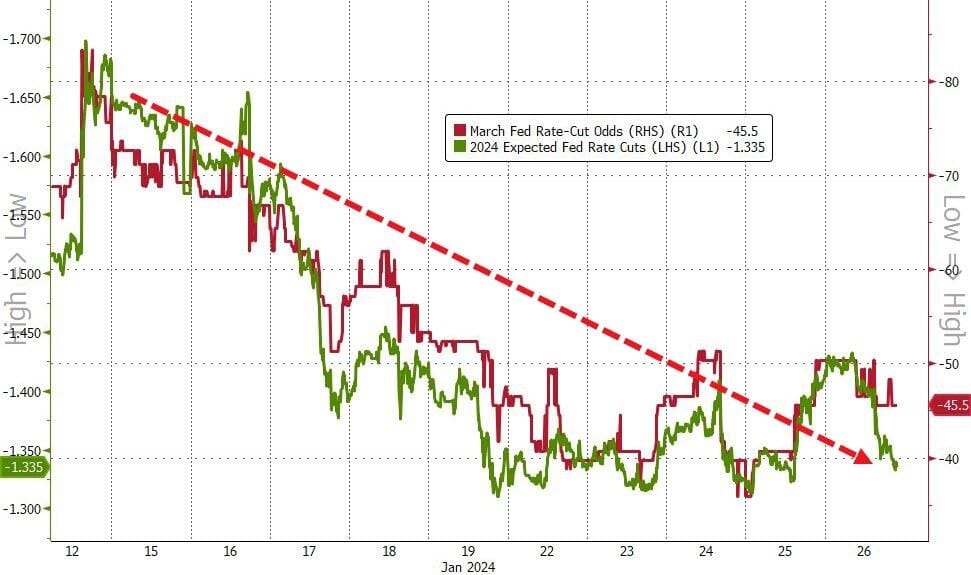

...and that has pushed rate-cut expectations lower (hawkishly), with a 45% chance of a cut in March and 133bps of cuts in 2024 (down from 85% and 165bps just over a week ago)...

Meanwhile, The growthiness and ongoing shitshow in the Middle East pushed WTI to its best week since September, with its highest weekly close since the first week of November.

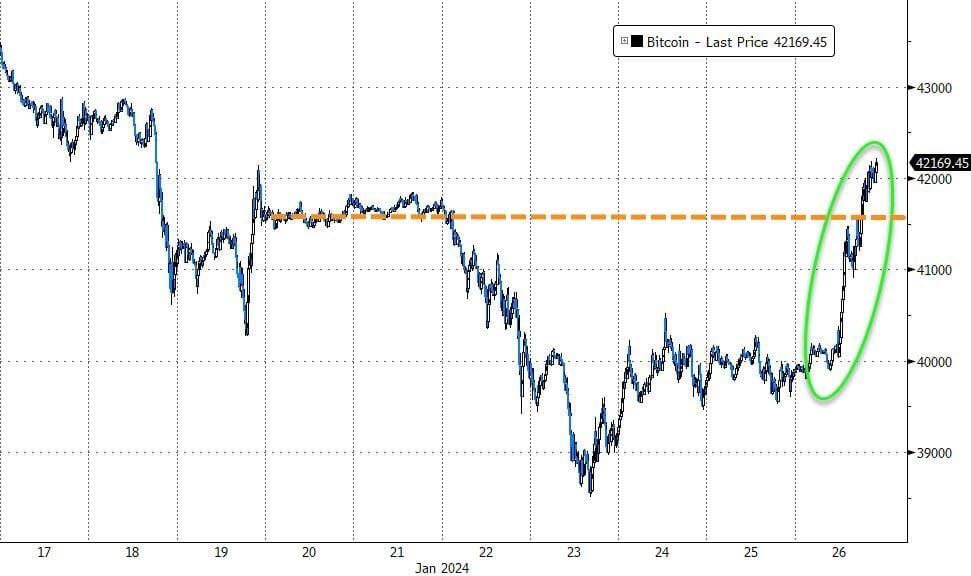

Bitcoin ended the week higher too, surging back above USD$42,000 today after an almost endless stream of selling since the spot ETFs were unleashed...

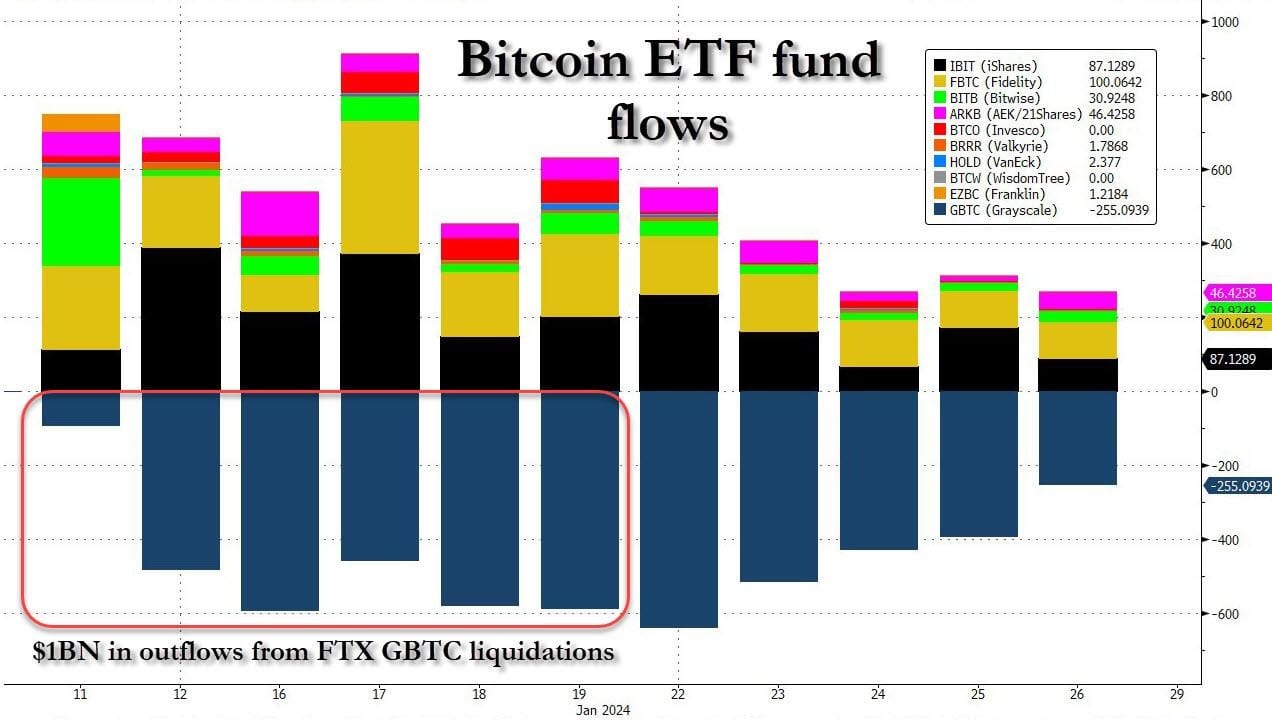

the primary reason why bitcoin has been sliding ever since the arrival of bitcoin ETFs on Jan 10 - an event that had been lauded as very bullish for the crypto space but instead promptly sparked a bear market has been the relentless liquidation of residual bitcoins by the bankrupt FTX estate which has been aggressively building up cash - and selling bitcoin into every market meltup - to maximize recoveries for stakeholders.

Specifically, as CoinDesk reported first, whereas legacy bitcoin vehicle GBTC had seen aggressive outflows at the time when the pack of new ETFs were pulling in new cash to convert into bitcoin, a large chunk of the exodus from GBTC was FTX's bankruptcy estate dumping 22 million shares, or about $1 billion of the USD$2.5 billion in GBTC outflows through Jan 22. And, asIpointed out, it also meant that instead of the GBTC outflows being recycled and netted off, a large portion of them was FTX liquidations - a one-off event, and not a systemic pressure on the underlying crypto asset, contrary to what some bears had said.

Well, over the long weekend we got confirmation that it was indeed the bankrupt FTX (or rather Mike Novogratz' Galaxy which was picked last summer as advisor on managing the estate's holdings) that was responsible for much of the selling in crypto in the past two weeks. According to Bloomberg, FTX is "unloading cryptoassets and hoarding cash as bankruptcy advisers look for a way to repay customers whose accounts have been frozen since the platform collapsed in 2022."

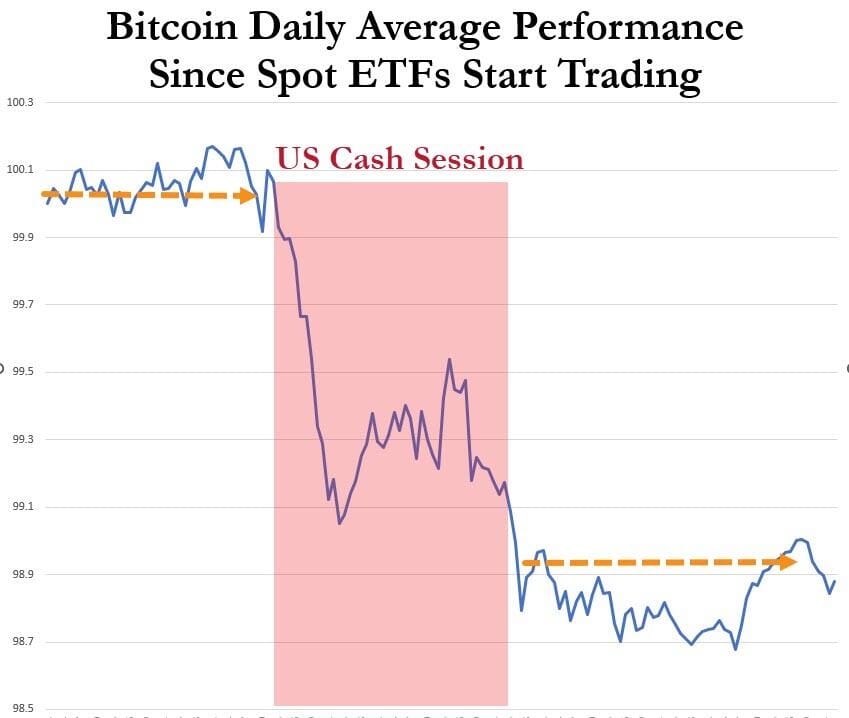

And all the selling in the underlying bitcoin has been focused (since the ETFs began trading) during the US equity trading session... Is that constant pressure about to abate?

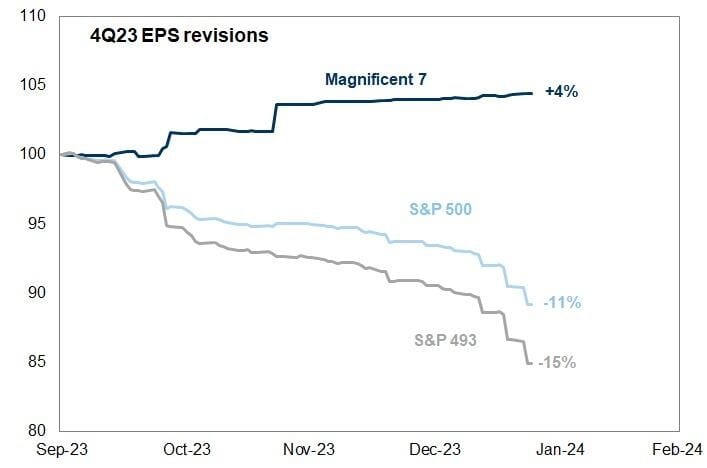

Also - Don't forget - the mega-cap tech names report in the next week...

Everyone's favourite pet rock Gold (spot) went nowhere on the week, hovering around USD$2,020...

Finally, "you are here" in the dotcom meltup analog...

With The Fed confirming the end of its BTFP facility (and RRP withdrawals accelerating), March2024 is lining up for something big (especially if The Fed doesn't cut as so many hope).

Are you prepared?

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).