EP 51 of the ANDIKA BULLETin

New Bitcoin RECORD Price! Records are made to be Broken!

US Stocks Shrug Off Week Of Higher Inflation, Higher Rates, & Lower Growth while Yellen Will Unleash Another Market Meltup

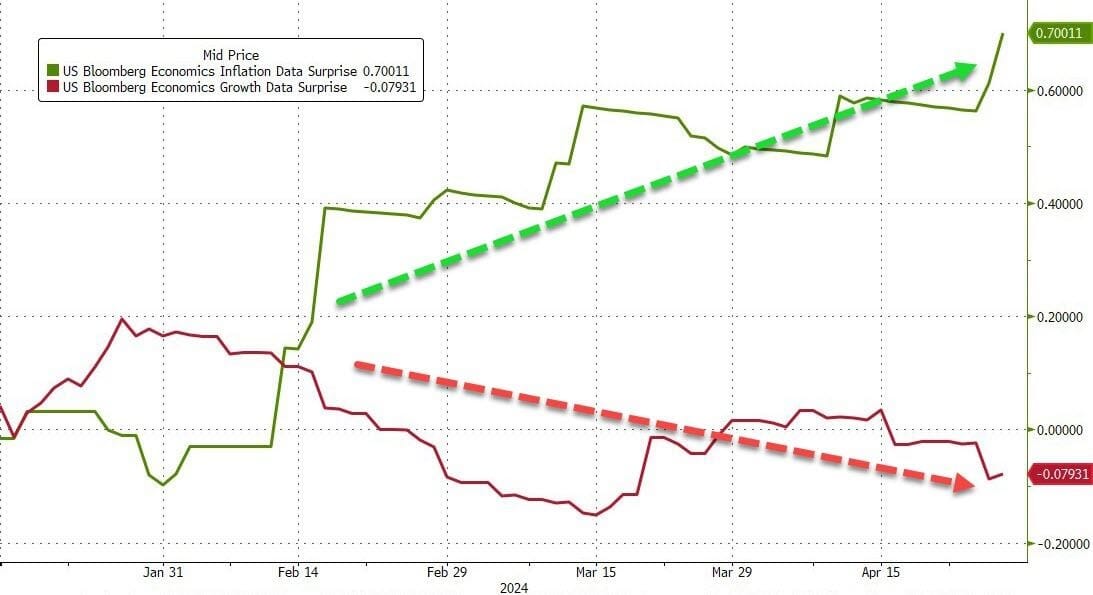

So it was an ugly macro week and worse still, 'growth' surprises disappointed significantly while 'inflation' surprises surprised to the upside significantly.

While Soaring inflation expectations sent rate-cut expectations to new cycle lows pushing yields higher across the board (led by the long-end).

But, US stocks didn't care about any of that because a handful of mega-cap tech stocks' earnings were awesome (except META) - and that's what matters (for now)

As the basket of Magnificent 7 stocks soared over 5% this week, its best week since the first week of November (Fed Pivot) - but it was noisy as TSLA surged, META tumbled, and then GOOGL/MSFT lifted the lid.

TSLA pushed back above $500BN market cap this week and Alphabet (Google) soared above $2TN market cap for the first time ever.

And this week the US Fed meets (for no rate change) meanwhile Treasury Sec Yellen could use the next two days to drop a big hint to the mkt that because of a larger TGA balance of USD$905bn - some USD$205bn more than expected, Treasury Yellen could AGAIN surprise the market with another “low” financing estimate thanks to said TGA build, which would allow her to communicate a lower expected total bond issuance number for the next 3 month period ahead versus Street’s prior estimates of financing needs, which could help drive a Bond short-squeeze AGAIN and boost risk-sentiment.

This would dramatically ease Financial Conditions, and also lead to a powerful tailwind for US stocks as well for the next several months.

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).