Weekend Open Forum

There's another weekend ahead and so much to talk about. Here's a safe space to raise whatever is on your mind.

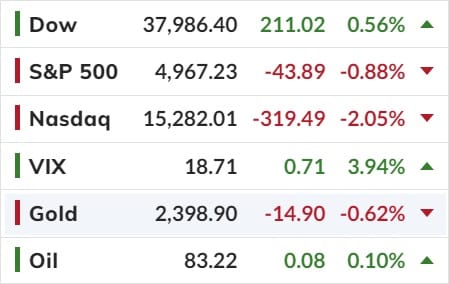

Nasdaq Tech Wrecks As FedSpeak Spooks FOMO-Followers while Gold Hits New Record High

Well, that escalated quickly...

FedSpeak that was without exception - hawkish!

As they suddenly realized that all that 'pivot' optimism did nothing but dramatically ease financial conditions and wreck their 'best laid plans' for a rate-cut and soft landing...

Even the dove-est of the doves - Austan Goolsbee - bent the knee today:

“So far in 2024, that progress on inflation has stalled,” Goolsbee said Friday in remarks prepared for an event in Chicago.

“You never want to make too much of any one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed.”

“Right now, it makes sense to wait and get more clarity before moving,” Goolsbee said.

And sure enough, Fed rate-cut expectations for 2024 and 2025 have both plunged last week...

...with now a less than 40% of any rate cuts in 2024 moving to over 60% chance of cuts in 2025!

and that has finally started to weigh on investors' risk appetites (that's a long way to catch down to reality - the crocodile jaws)...

Most traders thought the worst was over Friday night our time as the panic-puke in futures was BTFD'd back to unchanged ahead of the cash open, but then the selling started (on Nasdaq) and never really stopped. On the day, Nasdaq was down over 2% while The Dow managed to gain 0.5%.

Nasdaq is down for six straight days for its biggest weekly drop since Nov 2022, breaking below its 100DMA as CTA 'sell threshold's were crosed. Goldman's trading desk noted:

"The NDX now pacing for its worst week in over a year (down 6 of 7 weeks) as a complicated technical backdrop (CTAs, lower retail participation, NDX now testing 100-dma, seasonality), sideways earnings revisions thus far (ASML, TSM and even Sheridan’s NFLX EPS revisions were only 1-2% last night), a tense geopolitical backdrop (overnight headlines) and elevated positioning are testing conviction into a busy week of earnings … some debate if this all ‘helps’ the set-up into FAAMG prints or if the market is just read to ‘take a breather’ and sell any good news..."

Even The MAG7 basket broke below its 50DMA this week - the first time since October, when The Fed 'pivoted' and save the world. The market cap of the MAG7 is now down over $1 Trillion from its highs a week ago...

Even Nasdaq darling Nvidia plunged 10% on Friday back to 2 month lows and it's actually now down over 22% from its (insane) highs and the Cisco dot-com boom bust chart doesn't look so crazy now!

And let's be mindful that next week brings 43% of SPX set to report earnings highlighted by META/MSFT/GOOGL (aka $6.1T of mkt cap) reporting on Thurs night.

Meanwhile, with all this negativity, Gold has made new record highs!

And you should see the price of Cocoa - it's real edible GOLD!

And finally, are bank reserves at The Fed still the driving force for reality?

We saw the reality check from Aug-Oct last year and I think we need to ask are we about to get another?

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009