Tech Utopia: Freedom or Digital Prison?

Technology promises to make our lives easier, but it can also enslave us. What do you think the politicians and tech titans would prefer?

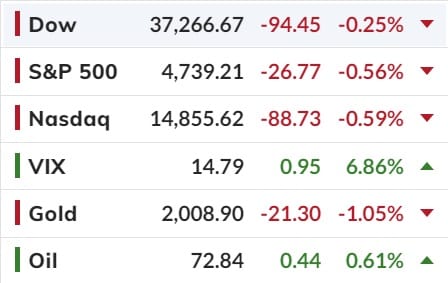

'Good News Is Bad News' As Goldilocks Reality-Check Wrecks Dovish Dreams

TLDR; Retail sales - strong; Housing home builder optimism jumped; Industrial Production - better than expected.

'Real' economic data is rising once again as 'soft' survey data collapses (Empire Fed anyone?)...

Nothing there screams "six rate-cuts or we all die" as the issue remains: the current growth trajectory of the economy does not suggest that rates need to come down at all.

And as this growth/rates tango persists, yields on 10-year Treasuries are creeping higher (up 4bp today to 4.10%), putting pressure on risk assets that are priced relative to rates.

The strong overnight data, along with last week's slightly higher than expected inflation report may suggest to some that rate cuts may not be as necessary as urgently as markets have been pricing.. and Waller's comments yesterday pre-enforced that.

Sure enough, rate-cut expectations (timing and size) are tumbling...

The big drop in rate-cut expectations prompted bond yields to surge higher at the short-end.

The 10Y Yield extended its spike back above 4.00%overnight and closed above its 200DMA for the first time since 12/12/23...

Higher-rates hammered hot stocks as growthy-stuff and crappy-stuff was dumped. Nasdaq and Small Caps lagged, The Dow was the least ugly cow in the abattoir but still lower. A late-day bounce put a bit of lipstick on the pg but still not a pretty day...

Bitcoin continued in a narrow range since the chaos of last week's spot ETF launch...

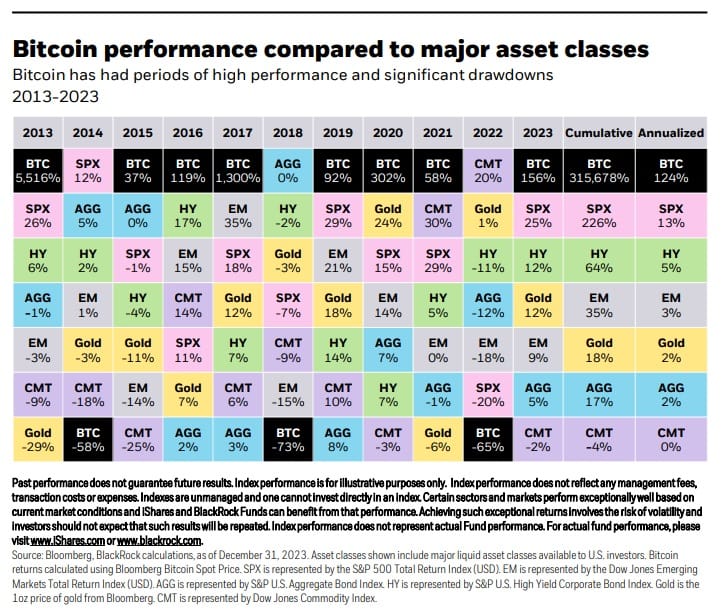

Speaking of Bitcoin, did you know it's been the BEST performing Asset Class in 8 of the last 11 years?

Meanwhile the USD is having its best start to a year since 2015.

And as the US dollar rallied, so gold and the AUD declines.

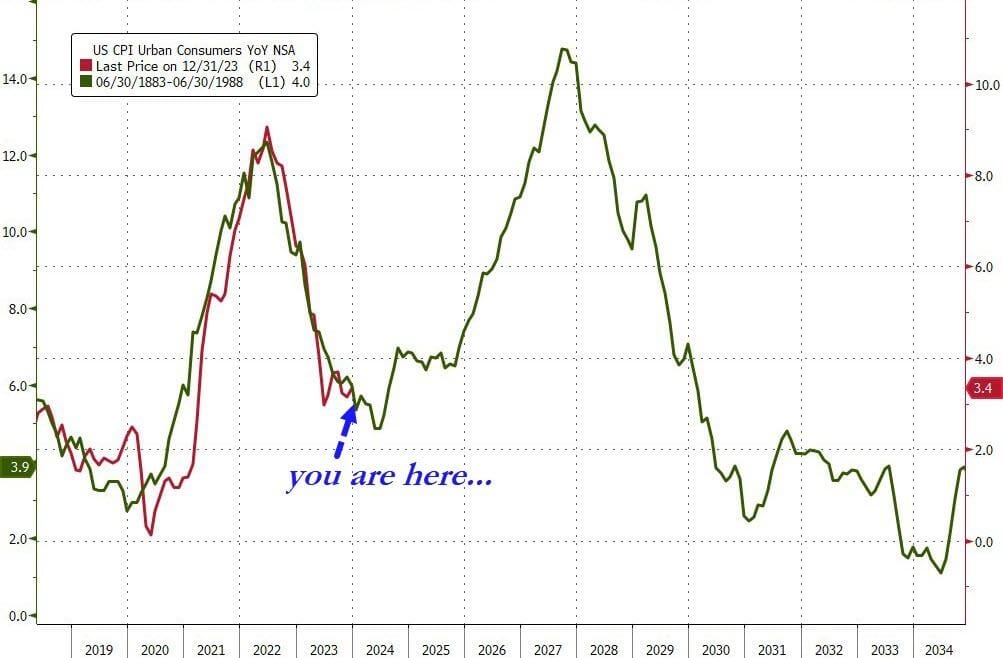

And finally, never forget the 'twin inflation peaks' of the '70s...

Does Powell really want to be the guy who executed a massive rate-cutting cycle in an election year only to see what is left of The Fed's credibility utterly destroyed when inflation comes roaring back?

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).