EP 51 of the ANDIKA BULLETin

New Bitcoin RECORD Price! Records are made to be Broken!

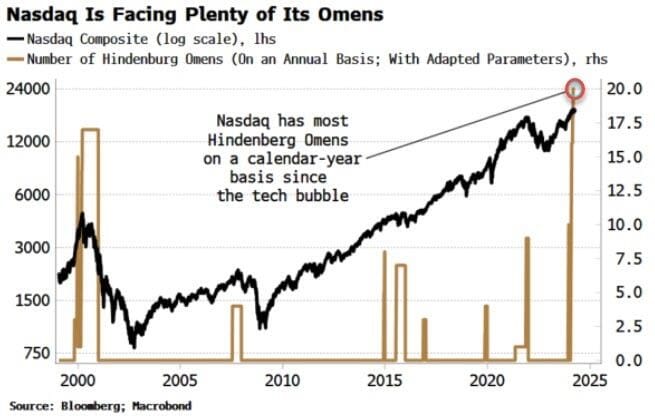

Bad Omens for the NASDAQ as a Technical Signal Hits Levels not seen since the Tech Bubble

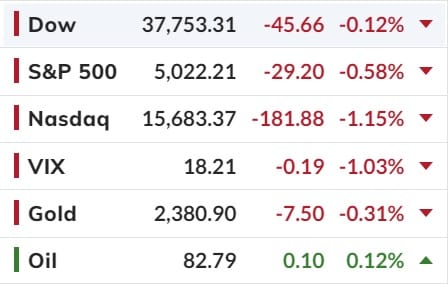

Something a bit different today. But before I get into today's note, here's the overnight scoreboard

Oddly enough, ASX 200 Futs are up 20 pts...Not sure why but let's see if the ASX goes up today.

A technical sell signal for the Nasdaq has hit levels not seen since the tech bubble.

However, it should be taken in the context of a still supportive economic backdrop, with buoyant excess liquidity and low near-term recession risk.

The Hindenburg Omen compares the percentage of stocks in a stock index making new 52-week lows versus 52-week highs.

When both are rising above a certain threshold, and we are near a one-year high in the index, the signal activates.

For the Nasdaq, more omens have triggered so far this year than in any calendar year since the 2000 tech-driven top.

As the chart shows, previous rises in the number of omens have coincided with the Nasdaq selling off or moving sideways.

But before traders hit the sell button, there are some caveats to take into account.

Still, it would be remiss to ignore the notable short-term risks in equities, which the Hindenburg Omens are potentially drawing attention to.

Probably nothing!

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).