Weekend Open Forum

There's another weekend ahead and so much to talk about. Here's a safe space to raise whatever is on your mind.

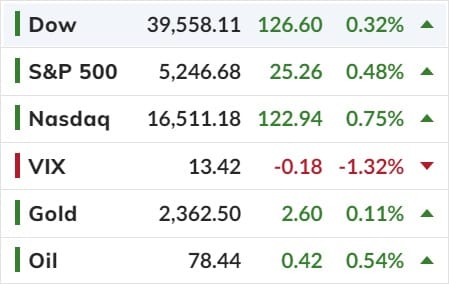

US stocks/Powell Shrug off Stagflation Signals while Grimm Jim delivers an Early Election Budget

Ok - a lot to unpack here. I'll start with the overnight mkt and then finish with my quick take on Grimm Jim's 3rd Budget.

Hot PPI initially spooked markets (yields and dollar up, stocks down) but that faded fast (on lower revisions) - but the stag-flation trend continues this week...

Powell did briefly spook stocks around 1030ET with the following comment:

"it's a possibility - but I dont think it will be the case - that the next action we take will be a rate hike... most likely we will stay the course...."

Between that comment (basically jawboning away any rate hikes) and the CPI-related components within PPI actually looking positive (well actually not positive and thus implying CPI may come softer), we actually saw rate-cut expectations rise overnight. 2024 now pricing in almost two cuts and 2025 now pricing in just over three cuts...

Another big day for the 'meme stocks' with AMC and SunPower (among others) joining GameStop.

All of which means that 'indicative' hedge funds were clubbed like a baby seal for the second straight day - down a stunning 15% at the lows of the day...

The Nasdaq closed at a record high and so did the basket of MAG7 stocks.

USD down, so AUD & Gold up, Bitcoin erased yesterday's gains which erased Friday's losses..

Finally, spot the odd one out - Nasdaq at record highs while US macro data at its weakest in two years...

Financial Conditions are as easy as they've been in years...and Fed Funds are at 23 year highs...

So who is the greater fool? You for trading or the mkt?

IMO this is a early-election Budget and Grimm Jim is betting certain things will play out their way and they'll be off to the polls sometime in NOV2024.

Now the QLD State Election is scheduled to be held on 26 OCT 2024 and QLD Labor look like being electorally annihilated. Albo and Grimm Jim will want to say clear of this wreckage so hence I think late NOV

Now Grimm Jim is betting on inflation falling to around 2.75% yet the RBA are tipping an inflation rate of 3.2%

MAR2024 Inflation currently sits at 3.6%

Now neither treasury or the RBA have a great track record in predicting where the inflation rate will go. The old but true joke that Economists are paid a lot of money to guess wrong has stood the test of time and it will be no different this time around.

Now here is where it gets risky for Labor. If inflation, as it appears, stays sticky in the mid 3's then his call of inflation being around 2.75% will look highly speculative and if the JUN24 and SEPT24 CPI reporting periods are closer to the RBA's target rate than his he won't want to stick around and wait for DEC24 read. Worse, if inflation does stay sticky, what then if the RBA hikes rates? What if the RBA react to a bad SEPT24 CPI print and hike rates? If that happens Labor are in deep poo. Heaven forbid if the RBA did a second hike. Then Albo is a one term wonder. So Albo and Grimm Jim are making a big bet here.

This budget is highly inflationary. The tax cut in the end is 4/5's of Sweet FA and the $300 power rebate (which is just $25 per month) is designed to nullify Albo's first lie of $275 in power reductions he made during the last election

We get a "surplus" this year but the next four years we run up a deficit of a staggering $122.1 billion dollars taking our national debt to $1.112 trillion. At $1.112 trillion every Australian man, woman and child would owe approx $38,500 each

The treasury are tipping wage growth of 3.5% pa in the next 4 yr cycle while GDP growth of only 2.5%

When wages grow faster than the economy its inflationary. Even an idiot knows this. Hence, rate hikes are on the cards. Rate cuts aren't on the horizon and definitely no cuts in calendar year 2024 IMO.

Further, its huge deficits in the forward cycle and you can see why when the black hole known as the NDIS will cost between now and 27/28 a further $270.6 billion alone to fund. This is unsustainable. Everyone knows it. But no one wants to be around when it does crash. It's pass the parcel until then.

Albo's future made in Australia light bulb idea is also BS. This nonsense that with Billions in taxpayers help, Billionaire Andrew "twiggy" Forest will somehow commercialise Green Hydrogen and this will save us all economically and guarantee we'll be ok in some Net Zero world (we won't - we'll all be poorer because that's the true meaning of Net Zero).

The Green Hydrogen (scam) alone will cost $6.7 billion over the medium term.

I won't go into the full science of Green Hydrogen but the part where is fails is when the separated Hydrogen (H) and Oxygen (O2) are now needed to be transported on a Ship to say Japan. To transport Hydrogen it must be converted into Ammonia (NH3) which can under pressure be made into a liquid. Then it can be transported and when it arrives it can convert back into a ammonia gas but it takes a lot of energy to separate the N from the H3 and then to break the H3 atoms in singe H atoms.

Seriously, its like walking back 10 steps so you can walk 4 steps forward. You are still 6 steps behind.

Green Hydrogen only works (in theory) on the site of atom separation. When it has to be transported long distances it just doesn't stack up.

Lastly, this Budget is an illusion. Australians will pay $299.4 billion in personal taxes in 23/24. this drops a little to $293.7 billion in 24/25 thanks to the modified stage 3 tax cuts. But by 25/26 income tax will pass $300 billion and reach $350 Billion by 27/28

So spend that $15 per week tax cut wisely.

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009