EP 51 of the ANDIKA BULLETin

New Bitcoin RECORD Price! Records are made to be Broken!

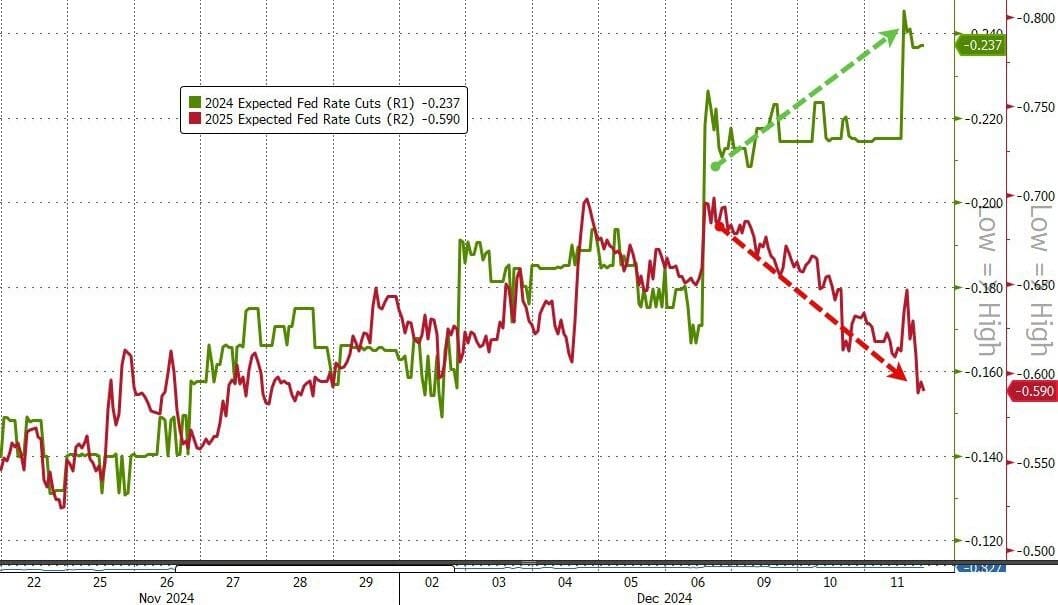

US Rate-Cut Hopes Soar As Markets Shrug Off Hot-flation

Just a sporadic BULLETin note. As we pull in closer to Xmas and the New Yr, I'll only drop a BULLETin note if there is something worth reporting. So if you don't see many of these BULLETin's drop over the coming weeks don't be too worried. Everything seems to be on auto-pilot market wise.

Elon Musk has become the first person to reach $US400 billion ($AUD625 billion) in net worth, the latest milestone for the world’s richest individual.

Tesla’s stock is up about 65 per cent since before the election, buoyed by expectations that Trump will streamline the rollout of self-driving cars and eliminate tax credits for electric vehicles that help Tesla’s competitors.

On Wednesday, SpaceX and its investors agreed to purchase $US1.25 billion of shares from employees and other company insiders. The deal, which values the privately held space exploration firm at about $US350 billion, makes SpaceX the most valuable private start-up in the world.

The company makes most of its money on contracts with the US government, and can likely depend on more support under a Trump administration. The president-elect lauded Mr Musk’s vision of putting astronauts on Mars in campaign speeches and joined him at a SpaceX launch in Texas shortly after the election.

According to the US STIR's market, A rate-cut by The Fed next week is now a lock.

Why? Because the overnight US CPI report - the final important economic report of 2024 - came on the screws with every Inflationary metric coming in as expected (if somewhat hotter when looked at a bit closer). Still, the market was relieved that the print did not beat estimates (as some whispers hinted), and for many this was enough to assure that the Fed cuts rates by 25bps next week before potentially pausing in January.

But forgive me my ignorance - The Fed has two mandates, right? Employment and price stability... well the former is strong-like-bull and the latter is re-igniting in not-a-good-way...

...so WTF is the market thinking in pricing in certainty for another cut next week?

While Dec rate-cut odds rose, expectations for 2025 rate-cuts are tumbling.

Now just over two 25bps cuts now priced in for the entire year 2025 as Trump takes office. As a reminder, in September the market was pricing in six full 25bps rate-cuts in 2025!

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).