Administrative State

The administrative state bit off more than it could chew during COVID

Gold, Bonds, & Stocks Rip After 'Bad' Data On 'Quietest Day Of The Year'

So we're aware of the time old saying "Sell in May and go away" which has been associated with weaker mkts between MAY and OCTOBER but I can't help but feel it also go something to do with low trading volume and just steer mkt boredom.

Take the ASX200 which for the week has traded from approx 7,665 to a weekly high of 7,808 mainly on the back of the three major banks, ANZ, NAB & WBC all announcing lower H1 profits but all announcing share buy backs of their respective shares which are trading at 3 year highs!

It's a lazy way to use shareholders capital - buy back shares at 3 year highs! Right now even I struggle to find anything of value on the ASX 200 to trade.

Same is happening in the US. Last night was the quietest notional trading day of the year so far which probably explains the Dow Jones liftathon.

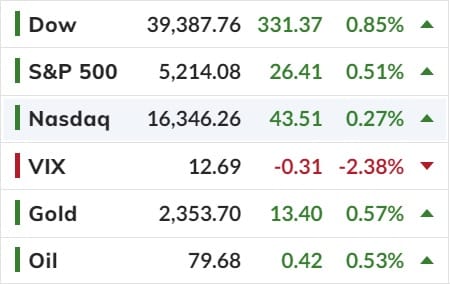

The Dow led the way - up almost 1%, and Nasdaq lagged on the day - barely holding on to green..

So the USD went, down, Gold went up and Bitcoin has also had a run nearly back to USD$63k

Next week we'll see the US APR24 CPI print so that will next weeks key data piece and could again set the scene for 'will there be a rate cut or not' which seems to tug a war between no cuts and now some cuts.

So again another nothing burger trading session. so have a good weekend and Happy Mothers Day Sunday to all the mothers out there.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).