Administrative State

The administrative state bit off more than it could chew during COVID

April the Month of 'Stagflation' Crushes US Stocks, Bonds, & Crypto while Amazon Swings Wildly After Reporting Blowout AWS Results

Sell in May and Go Away!

Sell in May and Go Away is a well-known adage in the business and financial world. The phrase refers to an investment strategy for stocks based on the theory that the stock market unperforms in the six-month period between May and October.

Historical data have generally supported the “Sell in May and Go Away” adage over the years and since 1945. The S&P 500 index has gained a cumulative six-month average of 6.7% in the period between November to April compared to an average gain of around 2% between May and October.

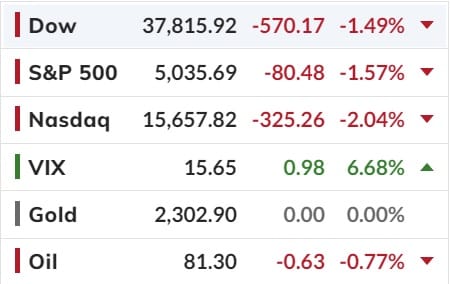

Which is really interesting as The final trading day of April was really ugly: ECI way hotter than expected (spooked markets), Case-Shiller home prices soared far more than expected (spooked markets more), Chicago PMI puked (while prices paid increased), Consumer Confidence crashed, and Dallas Fed Services slumped... all of which left US stocks, bonds, gold, crude oil, and bitcoin all languishing into month-end while the US dollar rallied.

So US Stocks puked into the month-end close today ahead of AMZN earnings, which actually reported a blowout AWS (that's Amazon Web Services) which not only grew revenue by a whopping 17% (ex. FX) and 16% including FX, both of which handily beat estimates of 14.5%, and were the strongest growth in a a year, but whose Q1 operating income of $9.42BN on revenue of $25.04BN, meant that margin surged to 37.6%, which was the highest AWS margin in history!

The stock initially tumbled, only to rebound sharply and then fade, closing roughly unchanged with where it was for much of the day around $180.

In the US After Hrs mkt AMZN is up 1.26%.

And Go Away in May 'may' play out because US stocks have a long way to catch down to the new reality priced into the short-end of the bond market...

...especially the US 2Yr which finally broke above 5% yield to 5.04%!

Fo the month of APR - Gold managed to hit a record high over USD $2,400 but has since come back to USD$2,299 while Bitcoin had an ugly month, down 15% after 7 months of massive gains.

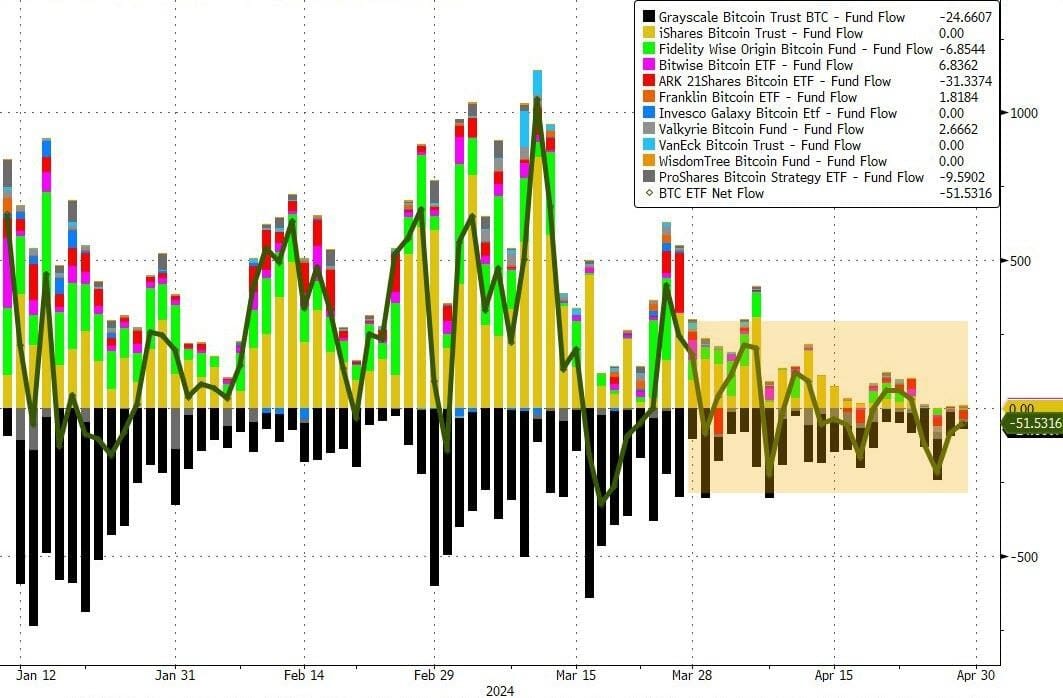

As BTC ETF flows started to ebb - Net Flows (including GBTC): April -$183mm, March +$4.62bn, February +$6.03bn, January +1.47bn...

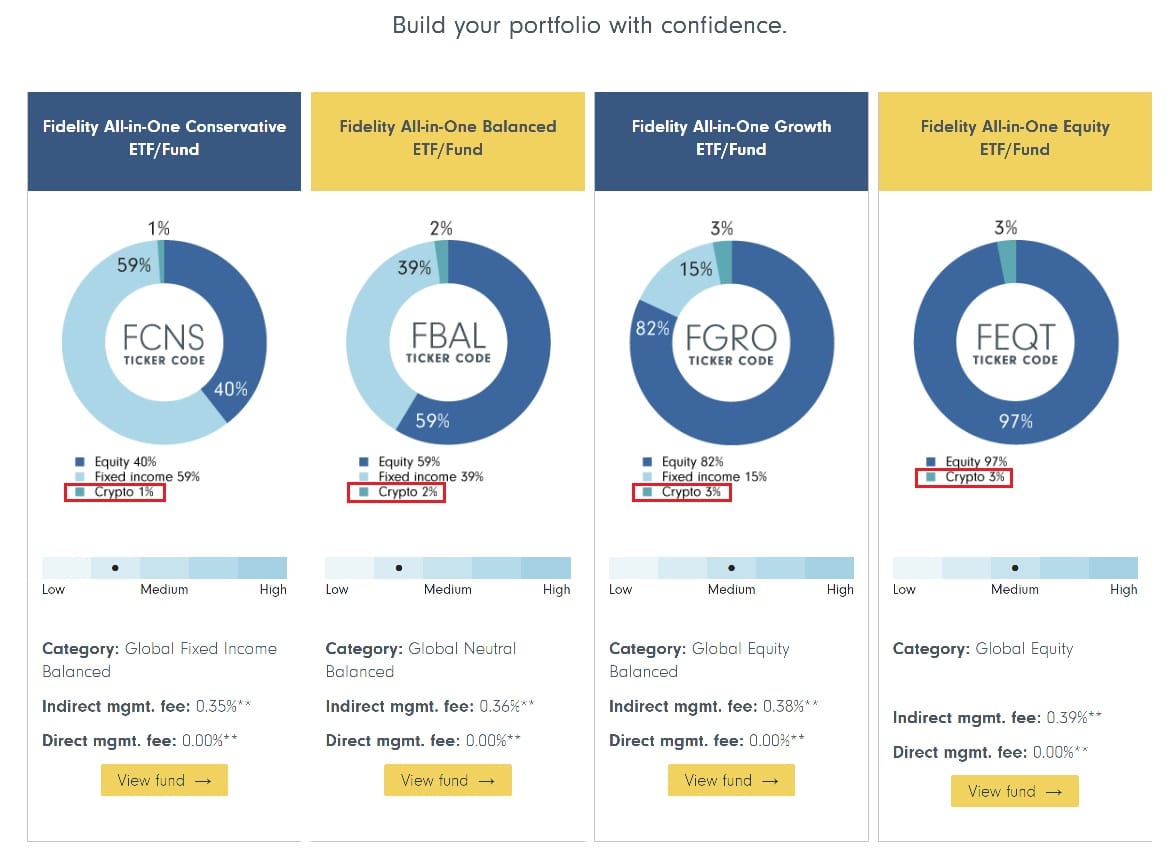

Given the US Bitcoin ETF push has now been fully priced in the next catalyst in my opinion is the slow but sure push of the US retail adviser mkt getting their retail clients into some low exposure into crypto. With the likes of Asset manager Fidelity now actively applying a crypto allocation between 1 - 3% it won't be long before the Citi, Merrill Lynch and Morgan Stanley's of the world start applying a similar asset allocation to their retail portfolios. The mkt potential here is very significant with IBISWorld claiming the market size, measured by revenue, of the Retail Trade industry was USD$7.3tr in 2023.

But this will take time to flow into crypto so don't expect a huge pump from these inflows like the ETF's did at the start. They will be gradual inflows against outflows over time.

Lastly, The FOMC are expect to keep US rates on hold overnight. What the mkt will focus on is the presser with Chair Powell to gauge when the Fed may begin its rate-cutting cycle. Given the sticky inflation and dreadful GDP, i suspect the Fed won't gave the mkts any sense of future rate relief but they'll also probably indicate they'll stay put for the foreseeable future. So no cuts on the horizon but no hikes either. Maybe mkt will be ok with that? We'll know tomorrow.

Happy Wednesday

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).