A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

As governments debase their currencies to try to survive, our societal divide is set to increase between those with assets and those without.

A lot of people are experiencing cost of living pain, but few really understand why.

Sure, the price of almost everything is rising faster than incomes, making those with assets feel wealthier because the value of those assets is going up, too.

That's why we all feel good when the house we bought for 100K thirty years ago is now worth North of a million (or more).

But in reality, the increase in net worth is mostly just dollar devaluation, meaning it takes more dollars to buy the same thing because each dollar is worth less.

That's inflation, and it's built into the current fiat system as governments produce more cash out of thin air to keep themselves (and the economy) afloat.

It's apparent when you measure things in values outside of fiat currency.

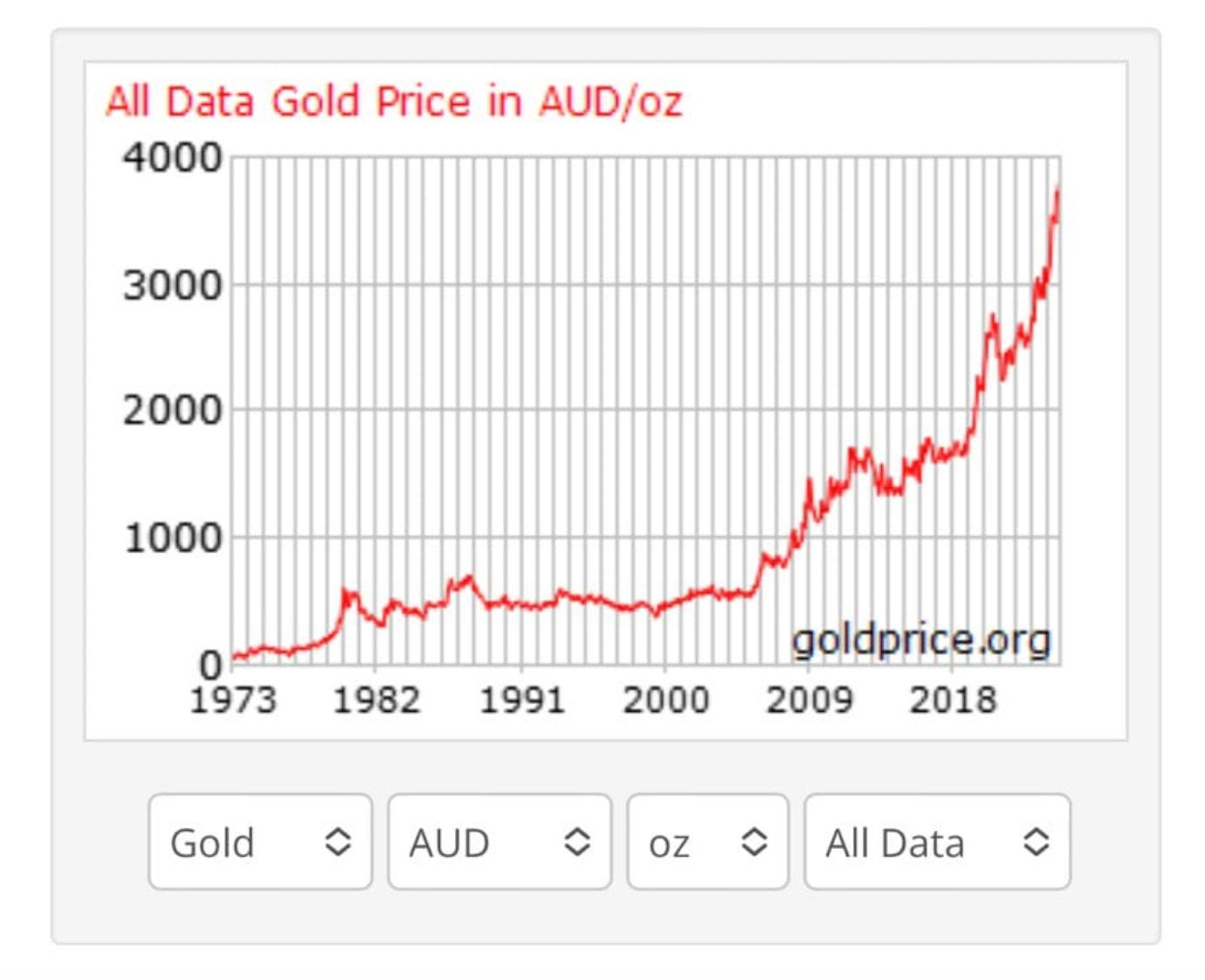

Here's a chart of the value of the Gold price in Australian dollars over the past 51 years.

In terms of gold purchasing power, the Aussie dollar has lost about 90% of its value over the past 25 years.

When the AI service Chat GPT was asked about the devaluation of the dollar in terms of Gold and house prices, the response was:

“Both assets have appreciated substantially over 30 years.

• Gold: Approximately 400% increase from 1991 to 2021.

• Real Estate: Varies by location, but major cities saw increases of 500% or more.”

So what does this tell you?