Jihadi Preachers

The silence of many surrounding the vile hate speech of Muslim clerics says a lot about the threats within the West.

The European Central Bank fired a Socialist salvo by releasing a new white paper claiming one particularly scarce asset is causing 'inequality'.

We saw another brick laid in the wall of socialism this week.

This time it was shared via a 'white paper' issued by the European Central Bank (ECB).

And while it was only targeted at one particular asset, the shameful principle could be applied to almost anything.

In this case, the asset was Bitcoin, but even if you have zero interest in the crypto currency, the argument the ECB put forward should make you shudder.

In effect, the ECB claims that those who invested early in BTC are essentially stealing wealth from those who are late to the party.

"In absolute terms, early adopters exactly increase their real wealth and consumption at the expense of the real wealth and consumption of those who do not hold Bitcoin or who invest in it only at a later stage."

The then go on to advocate for legislation to make Bitcoin disappear or prevent it rising in price.

Now, divorce yourself from how you personally feel about Bitcoin and apply the same approach to any other asset class.

Many readers will have purchased Commonwealth Bank shares when the government sold them off. That investment has appreciated more than 50 times, and that excludes multiples of that in annual dividends.

Should we legislate to take away those profits or stop the stock from going up more?

Or what about those who bought a home two decades ago. Everyone in that camp would be sitting on massive profits today and, if the principle holds, that's not fair to today's struggling home buyers.

Supporters of this Socialism will point out that the number of BTC is finite and that's the difference.

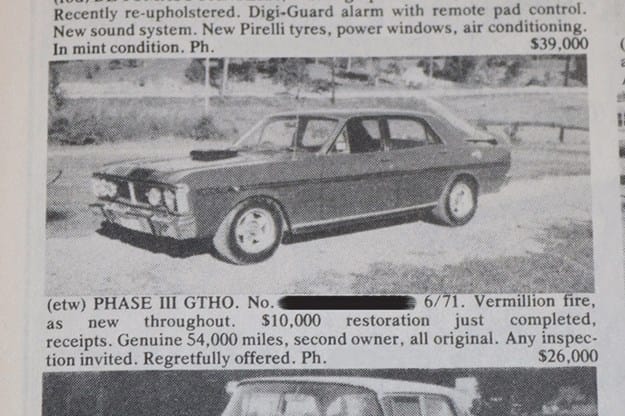

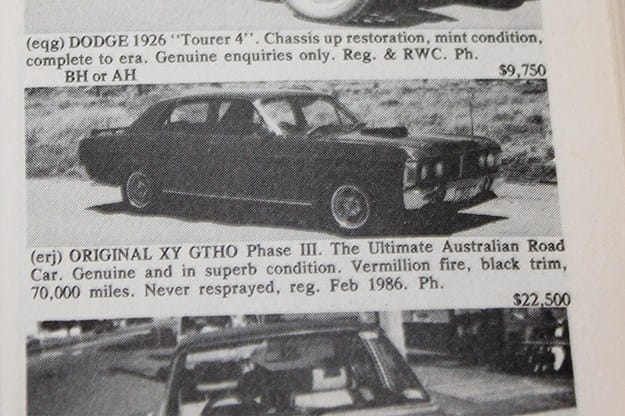

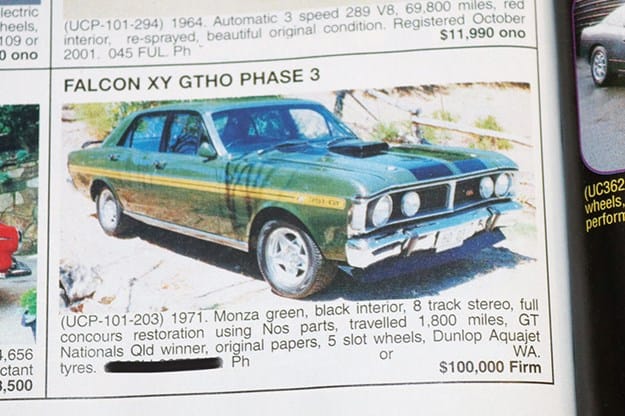

I'd counter that the number of Ford XY GT351 Shakers are finite too.

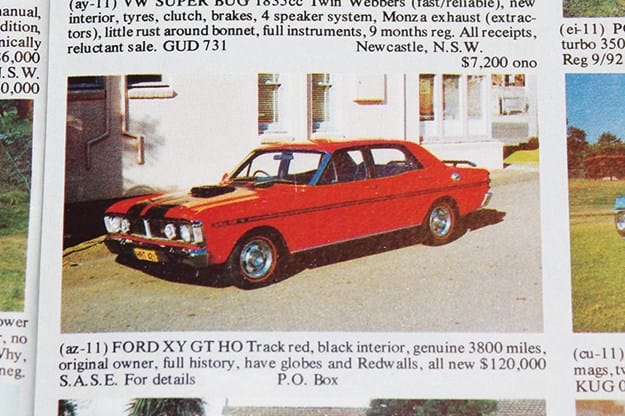

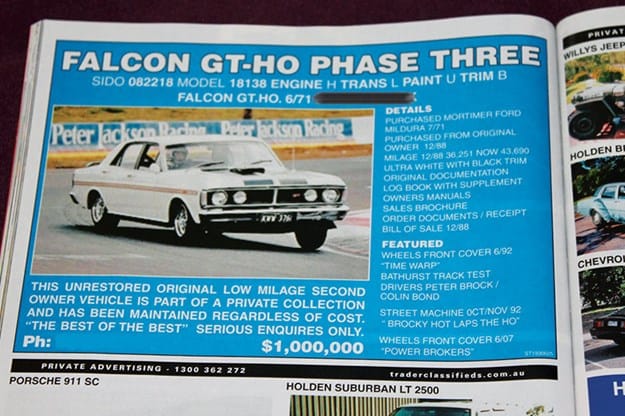

The Price of GTs through the years.

The early GT adopters could have picked on up brand new one for a little over 5k. Now, I've seen auction sales as high as $1.15 million!

The same can be said for almost everything that people covet.

If something is in limited supply and has high demand relative to that supply, then prices rise.

So why this latest assault on a digital asset that many consider has no value whatsoever?

Put simply, it's because a non government controllable store of wealth is a threat to the greatest power that governments have - the ability to declare what is legal currency and the ability to create it out of thin air.

For many years, currencies were pegged to the price of gold (or silver) but this became an impediment to being able to create more money.

Hence, as far back as the Romans, government reduced the precious metal content to be able to create more with what gold or silver they had.

When paper notes were introduced, they were meant to be redeemable for bullion. That lead to governments arbitrarily fixing the price of gold and later abandoning the system altogether.

In the United States, even owning gold was once declared illegal.

Now the ECB has telegraphed they want the same approach to BTC.

It's got nothing to do with wealth inequality and everything to do with keeping their control over the people.

It doesn't matter how you feel about the BTC phenomenon, the underlying concept behind this outrageous proposal should send a shiver up your spine.

You can read the ECB paper by clicking the link below.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation […] Deficit spending is simply a scheme for the “hidden” confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.”

Alan Greenspan, Gold and Economic Freedom (1968)