Jihadi Preachers

The silence of many surrounding the vile hate speech of Muslim clerics says a lot about the threats within the West.

One of the wealthiest countries in the world has a relatively low percentage of personal home ownership. Are they on to something?

It's been labelled the "Great Australian Dream"; the concept of owning your own slice of Terra Australis complete with a 'forever home' to raise your family.

For many, the dream has become a nightmare as their over-leveraged property plays havoc with the household budget.

It's also an increasingly unaffordable goal for many people today.

With average house prices rising by more than wages and the cost of living also taking its toll, saving a deposit and qualifying for a loan is tough.

But what if much of what we have been told about home ownership errs on the glossy side of salesmanship?

For starters, in this country you never really own the property you pay for, even if you don't have a mortgage. There are myriad State government wealth taxes attached to the principle place of residence including land taxes, levies and rates.

If you fail to pay these state sanctioned imposts (that are linked to the value of your property) then it will be seized and sold by the government. In that respect you are paying to rent with perpetual tenure (as long as you keep paying!).

There's also a bunch of other costs that add to the annual bill. Maintenance and Insurance are two that immediately spring to mind.

That keeps us all on the treadmill for the 40 years of servitude to a company (and a government) that only care about our economic utility.

Then there's the opportunity cost.

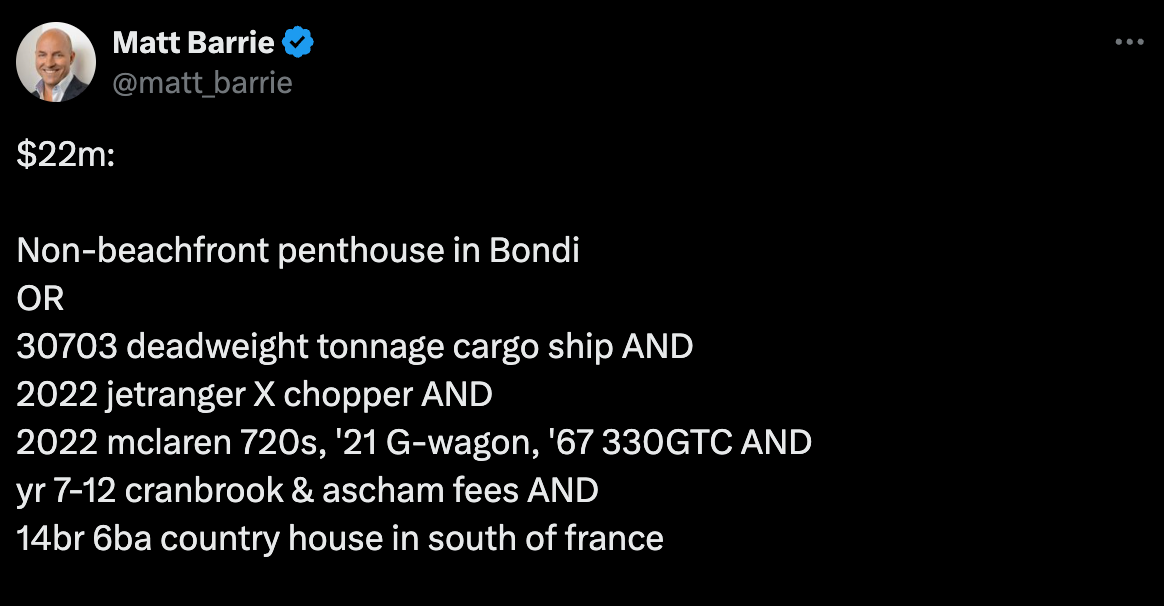

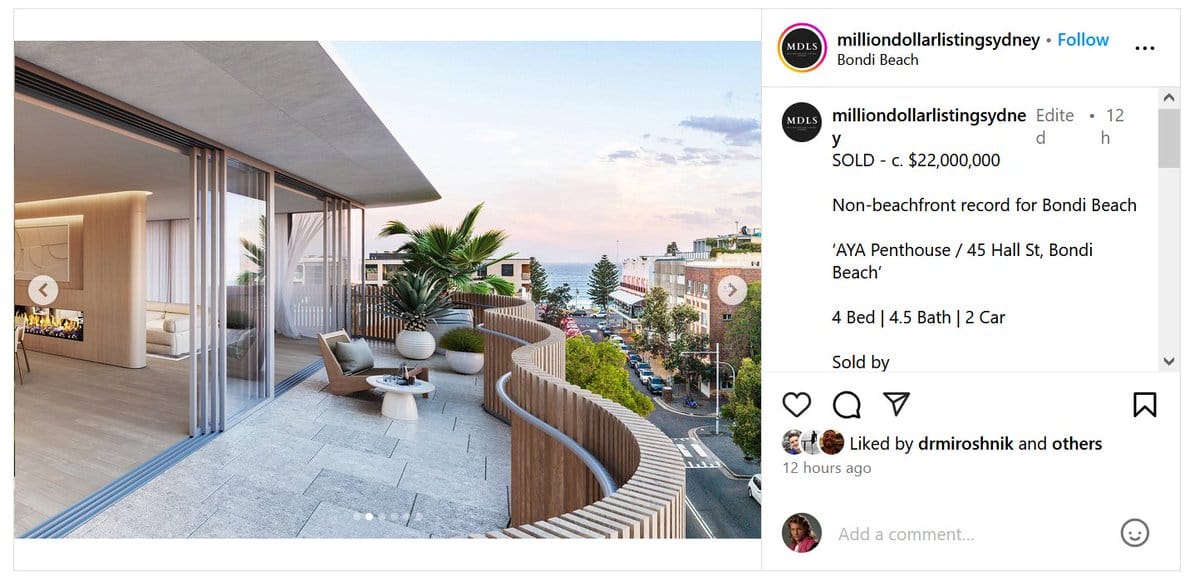

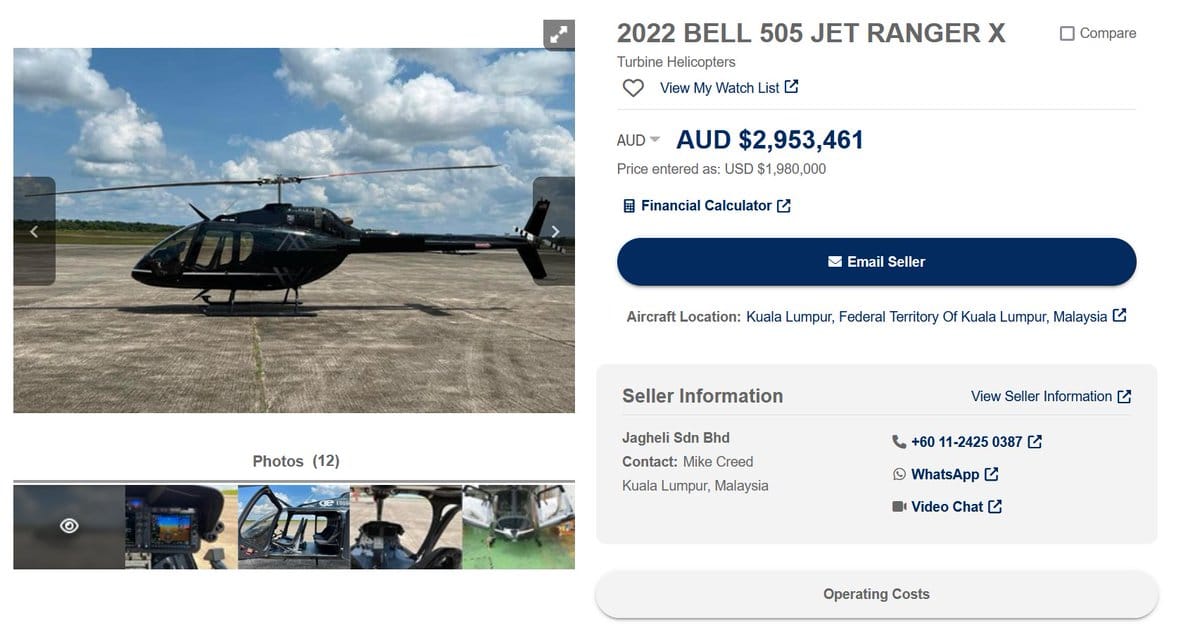

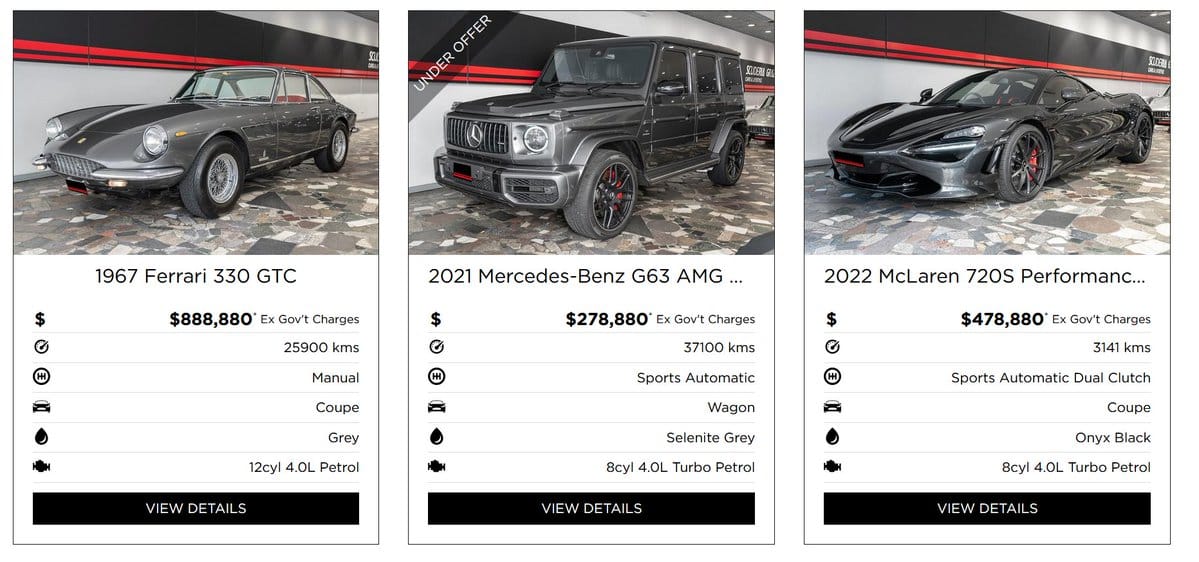

Here's one example of how the Sydney property market compares according to the CEO of Freelancer - Matt Barry.

And here are some of the toys he spoke about.

Barrie went on to point out you could literally buy every home in a vibrant Japanese town for the price of a house in Bellevue Hill.

And that led me to another set of data about the wealthiest country in Europe; Switzerland.

In Switzerland, nearly 15% of adults are millionaires even though the Swiss are outside the global top ten of income earners.

One interesting data point is that just 41% of Swiss own their own homes (its 66% in Australia), choosing to be long term renters instead.

That frees up capital to invest in other assets which provide income and growth. The Swiss also invest in themselves with an average of 5 - 10% of income spent on improving their practical knowledge (not just diplomas).

This makes them among the worlds most diversified and considered investors. Coupled with the savings mentality, they save close to 20% of annual income, it's put many Swiss in an enviable financial position compared with their global peers.

And it's all done with a much lower home ownership level than in many Western countries.

That should tell us something.

Home ownership is not the be all and end all of financial security. In fact, history shows that buying overpriced real estate can actually destroy individual wealth.

That's something to think about before you bid on that $22 million off-beach penthouse in Bondi!

“It is neither wealth nor splendour; but tranquility and occupation which give you happiness."

Thomas Jefferson