Welcome Aboard!

George Christensen is now walking the corridors of power as a fearless journalist. I am pleased to announce a new collaboration.

The move to investment rarities is being driven by a crisis in confidence. Here's how you can profit from it.

Confidence is critical to our future. I have mentioned that many times before. It is more important than interest rates or taxes in propelling prosperity.

Without confidence, business will not invest, consumers will not spend and banks will not lend. Confidence creates jobs and creates the future.

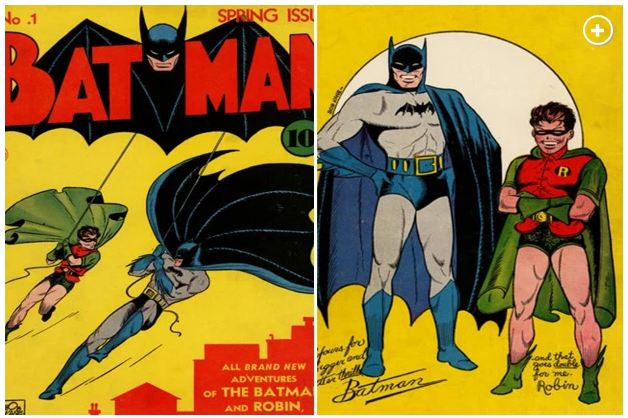

We are now seeing cracks in confidence, particularly in government. That in turn is seeing the allocation of depreciating dollars into the rare and portable. Some of these include things I simply attach no value to (like comic books) but anything that is limited and has demand can become a relative store of value.

Rare coins and other collectibles like motor vehicles are also exploding in value. In part this is because money is being debased like never before in modern history.

I write modern history because we have seen similar debasements in respect to fiat currencies many times previously, but rarely on the scale in respect to the global reserve currency.

To be sure, we have seen the catastrophic consequences of money printing in places like Zimbabwe and Venezuela. The currency of the latter is so worthless that the impoverished weave it into baskets in the hope of adding value!

Of course we are a long way from that but it is amazing how quickly a currency can devalue once confidence declines and the printing presses roll.

The closest comparison to the collapse of a global reserve currency was in ancient Rome. Over time the silver denarius contained less and less silver. It took less than a decade for it to be virtually silver free.

That debasement caused a collapse in confidence which ultimately contributed to the fall of the Roman Empire.

The American Empire finds itself in a similar position to that of ancient Rome. It has to keep printing to keep the economy alive. It also has the benefit of being the largest economy in the world so others (in worse shape) feel comfortable parking their money there.

That money is now chasing a store of value in stocks, commodities, collectables, and other, newer mediums - like Bitcoin.

The election of the Biden government will accelerate that trend. They will print more, tax more and regulate more. This will impact business and consumer confidence, leading to less investment and spending through fear of the future.

The smart money seems to have anticipated the trend and hence the comic book collectables are rising in price.

Let me be clear. I do not recommend you go our and buy a rare comic book. Personally I think that is crazy but every store of value is created by the demand of others. If enough people covet a rare commodity enough, the prices can reach ridiculous levels.

That may have only just begun.

In 2020, one investment wag coined the phrase 'Cash is Trash'. The way government is splashing it around, that observation is proving more accurate than ever.