AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

When an establishment investment bank changes tune on an asset class, it signals an opportunity for profit.

At the time of writing Bitcoin is trading at a little over AUD $26,000. That's getting close to a 100 percent rise since we started buying just a few months ago.

It is also close to an all time high in terms of USD and the total Bitcoin market has a capitalisation of over USD $320 billion.

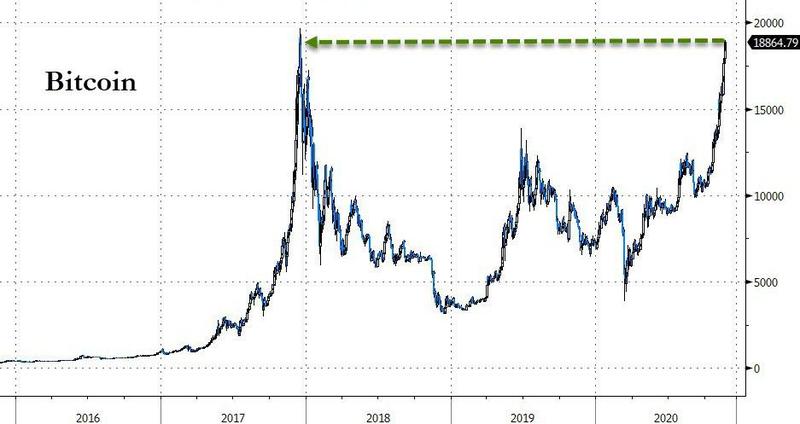

The chart above gives you some indication of just how volatile this asset class is. It is certainly not for the faint of heart investor but more people are wanting to gain exposure to it - because they can't afford not to.

As the phenomenon known as quantitative easing (money printing) takes root around the world, people are looking for a store of value outside of cash and bonds. This typically leads the migration of investment into stocks and real assets like real estate, gold and silver.

Bitcoin is now considered by many millennial investors as digital gold and as they have an increasing role in professional funds management, they are also investing in crypto.

Major companies are using Bitcoin for part of their treasury. Payment service providers (like Paypal) have also introduced it onto their platforms.

One company that has done both is Square. It bought 4,709 bitcoins, worth approximately $50 million. This represents about 1% of Square’s total assets as of the end of the second quarter of 2020.

Square believes that cryptocurrency is an instrument of economic empowerment and provides a way for the world to participate in a global monetary system, which aligns with the company’s purpose.

There is even a Bitcoin investment trust which is attracting the investment attention of Family Offices and Institutional Asset managers.

Even the investment banking giant JP Morgan seems to have had a change of heart. They recently wrote:

the potential long-term upside for bitcoin is considerable we think as it competes more intensely with gold as an "alternative" currency given that Millennials would become over time a more important component of investors’ universe.

I put in bold the phrase that jumped out at me. They now consider Bitcoin as having gold like elements. And here is the kicker:

Mechanically, the market cap of bitcoin would have to rise 10 times from here to match the total private sector investment to gold via ETFs or bars and coins.

That says to me the potential for Bitcoin is still massive from here. There are sure to be large swings in price which will test even the most experienced investor but the risk is likely worth the reward.

When an establishment investment bank likens Bitcoin to Gold and recognises that the current investment market capitalisation is one tenth of the other, there is an opportunity for profit.

It suggests that a convergence may take place where the capitalisation of both may meet. The only likely scenario where I can see that taking place is a huge rise in the price of Bitcoin.

If you are interested in Bitcoin or other crypto currencies, I'd encourage you to use EasyCrypto. I do and have been very happy with their service.