The Thought Police Have Arrived

Our freedoms are being trampled under the guise of 'safety', but it's all about control, as George Christenson points out.

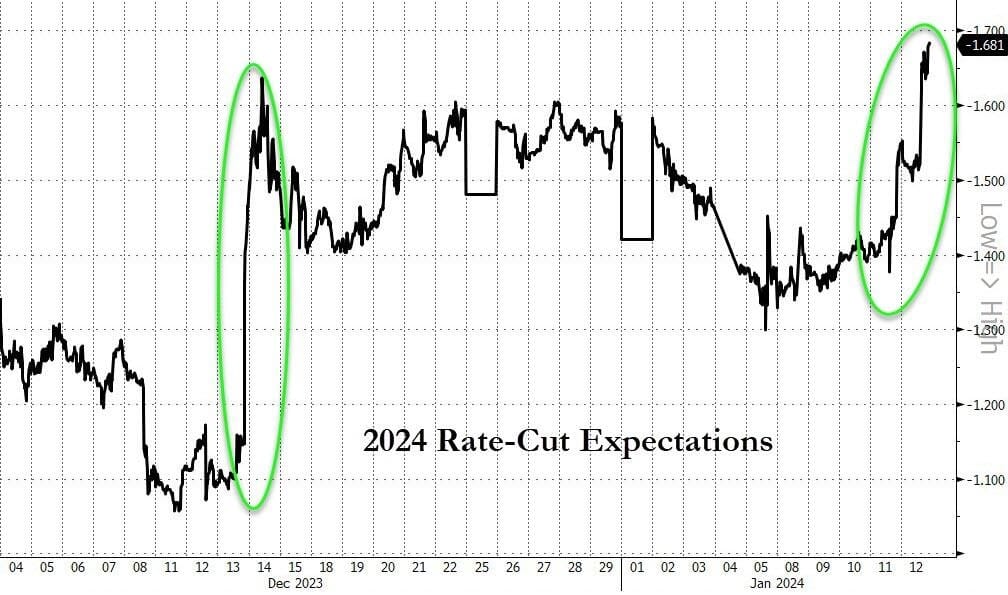

'Cooler-than-expected' PPI trumped 'hotter-than-expected' CPI last week and opened the floodgates for traders to bet on The Fed being dovish-er than they expect to be in 2024.

The $64 dollar question is will the US Fed comply on 20 MAR 2024?

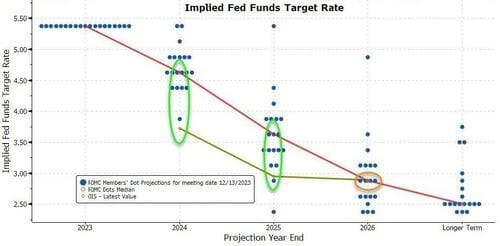

The current odds of a cut in March have soared above 80% (despite all the FedSpeak jawboning away from that)...

Expectations for 2024 rate-cuts exploded to new highs at 170bps (now fully pricing in 6 cuts and a 65% odds of a 7th cut)...

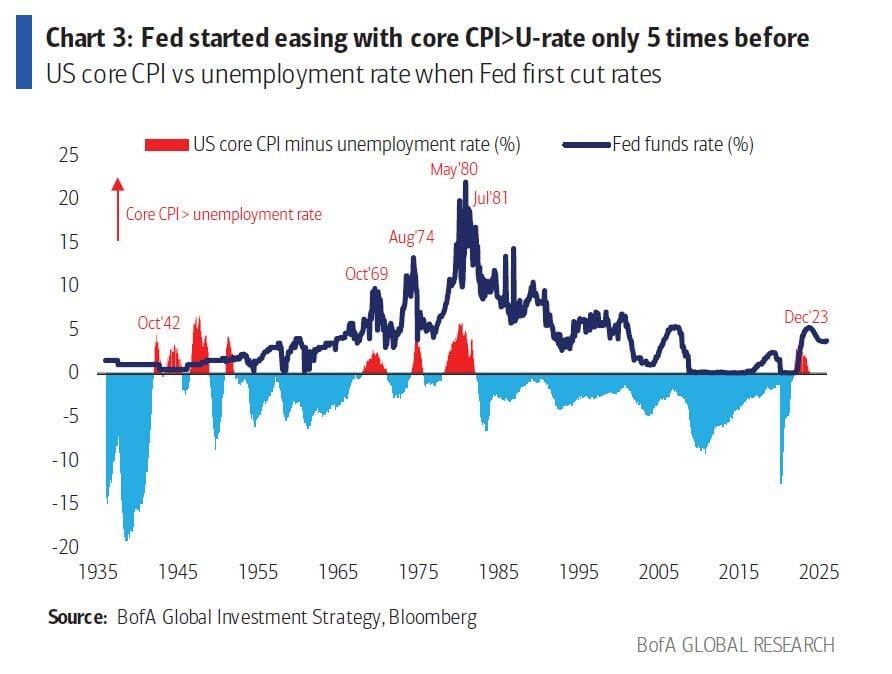

This quote from BofA CIO Michael Hartnet is really an eye opener. "on only 5 occasions in the past 90 years has the Fed cut rates when core CPI (now 4.0%) was higher than the unemployment rate (3.7%). Of those five occasions, the cuts were triggered by war once (Oct'42) and a recession four times (Oct'69, Aug'74, May'80, Jul'81)."

This up-coming 6th occasion is neither, suggesting one of three things: 1) war is about to break out; 2) the US economy is in far worse shape than the Biden administration will dare to admit (spoiler alert: it is), or 3) the political Fed is indeed gaming the monetary policy to prevent a recession in an election year.

Whatever the reason behind the Fed's shocking reversal, markets immediately went all-in on infallible Fed via cheap, leveraged, distressed assets (Breadth) which seasoned observers all know WILL END BADLY.

It gets better, it is now just 65 days until the 1st Fed cut (20 MAR 2024), 81 days until the US national debt goes up another $1tn to $35tn and 171 days until the US yield curve is inverted for the longest period since the 1929 crash (we all know what happened then). Oh, and capping it all off, we are just 298 days until the US election.

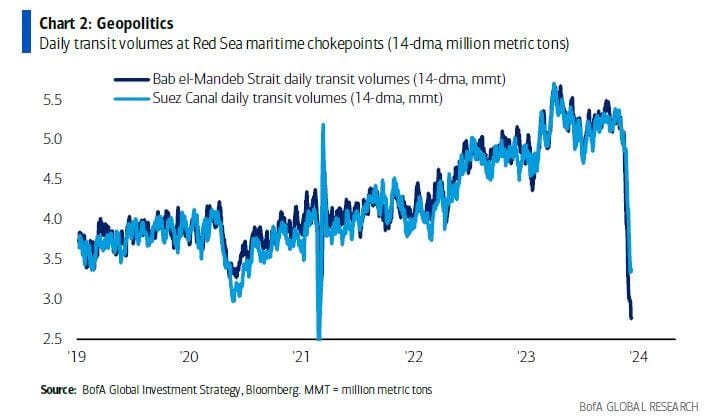

Ironically, the Fed is about to cut just as geopolitics unleashes yet another reflationary burst with a "supply driven inflation shock" hidden within the deteriorating geopolitical picture of another Middle Eastern War.

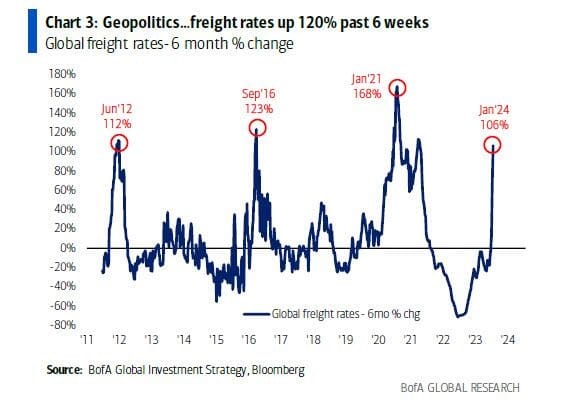

Transit volumes through Red Sea/Suez Canal are down 35-45% past 4 weeks.

And since the Red Sea accounts for 12% of world trade, and 30% of container traffic, no surprise that global freight rates up 120% past 6 weeks.

The Fed is ignoring the risk of a huge policy error - namely cutting rates and ending QT just as the next big ramp in inflation arrives...

Back to other things of interest. While inflation was on many people's minds, crypto also dominated the headlines with SEC Gensler dragged kicking-and-screaming across the finish-line of spot bitcoin ETF approval.

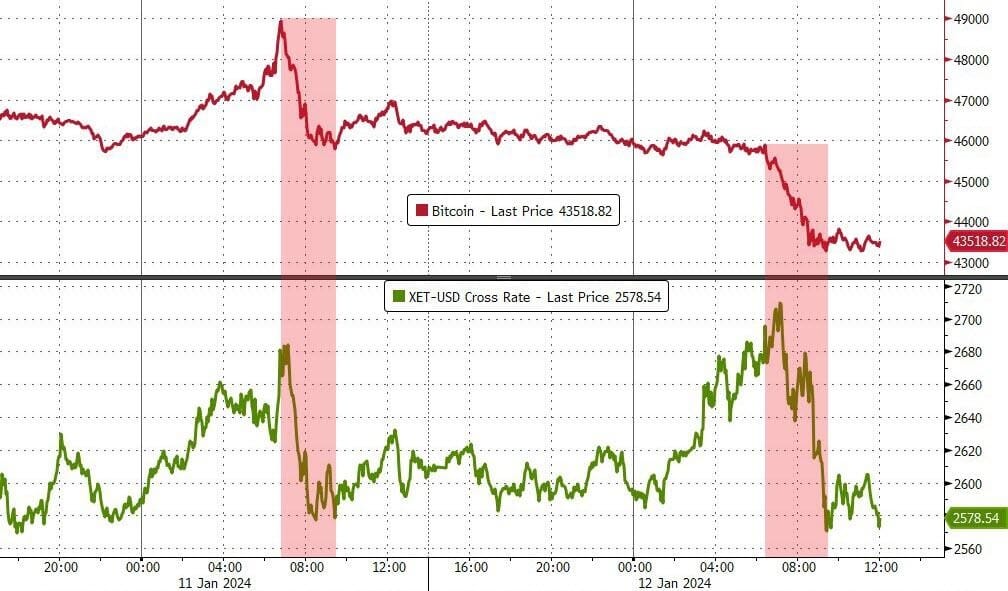

Bitcoin ended the week marginally lower (after early week gains evaporated on 'sell-the-news' flow)...

Finally, I note that on both the day that ETFs have been trading, the spot cryptocurrencies themselves have been aggressively sold from the US equity open to the European equity close - at which point selling stops...

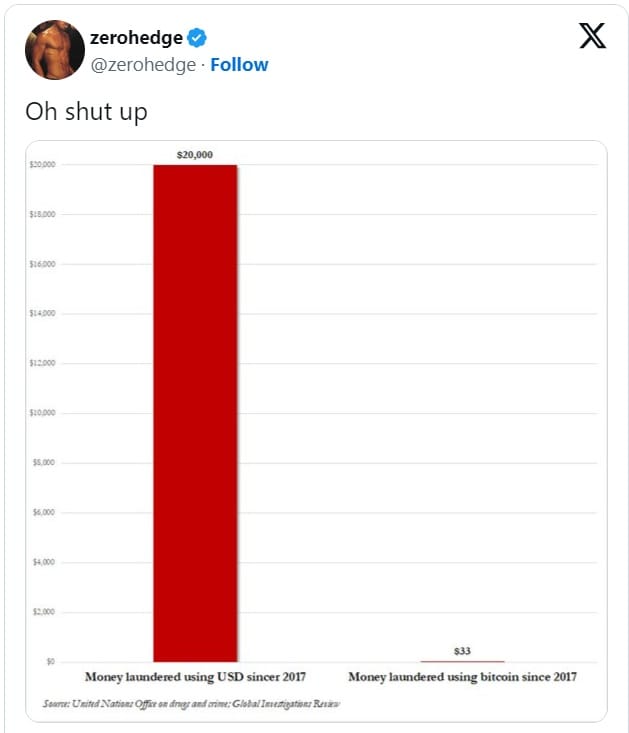

A suddenly tumbling crypto universe would be very convenient for Liz Warren, Gary Gensler, Jamie Dimon, Christine Lagarde, and a whole host of naysayers who were quick to point out Bitcoin's lack of worth for anything but the enablement of terrorism or child sex-trafficking... and all the worst bits of the bible.

These three words from the smart lads over at ZH seemed perfect for all that BS...

Remember to remember MLK on Monday so US markets are closed tonight.

I bet US grocery stores sold MLK merchandising...Your're bad hombres Woolworths and Aldi.

Happy Monday here in Australia!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).