EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

Big-Tech & Bitcoin Bounce, Regionals Red As Flotilla Of FedSpeak Hints Rates 'Higher For Longer'

The buyers are back in banks and big-tech overnight despite an avalanche of hawkish talk from Fed speakers. An ugly consumer credit print at the end of the trading day offset the fact that the US trade deficit narrowed last year by the most since 2009 as the value of imported goods declined and the services surplus increased.

The algos only had one thing in mind - S&P 500 hitting 5,000... and they managed to get to 4999.89 before the front-running failed.

The narrative is clearly being shifted back to 'higher for longer'.

Six Fed speakers overnight - all saying the same thing - don't expect cuts any time soon...

Yesterday we had:

And that followed Powell on Sunday who very clearly confirmed that 'higher for longer' view (no matter what 60 Minutes editing/voice-over said).

Of course, all that hawkishness hits the fan if a bank or two collapses...

And today's overnight session was all about NYCB (which is/was the 35th largest bank in the US) as it oscillated from total failure to heroic resurrection...

Some context might help...

The overall Regional Bank index rebounded solidly (but I note that we have seen this kind of rebound three times now in the last week and we're still a lot lower)...but ended the day lower...

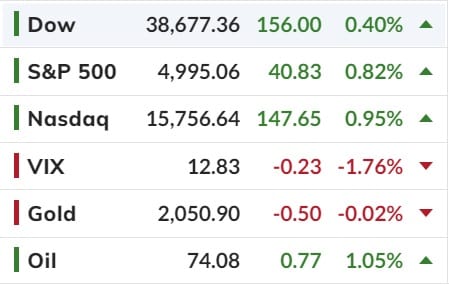

Nasdaq outperformed on the day, followed closely by the S&P 500. The Dow managed solid gains but Small Caps battled 'unch' in the last hour (and lost)...

Oh, and while you're celebrating, this analogy just keeps chugging along...

But hey, the nice people on CNBC said 'buy stocks, this ain't anything like 1990!'

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).