The Thought Police Have Arrived

Our freedoms are being trampled under the guise of 'safety', but it's all about control, as George Christenson points out.

One month after the Aug 5 Kamala Karry Trade Krash, we got part 2 and boy was it an epic flush: everything - like literally everything - and certainly anything with a high beta or even a trace of momentum, imploded with a sheer violence that made Aug 5 look like amateur hour. And unlike Aug 5, the puke was only at the beginning with stocks spiking from the first moment of trading, this time it was the other way around, with stocks pushing higher to start the day before falling apart, and ending a catastrophic week in the worst way possible: on a downtick.

It all started with the August US payrolls. the number wasn't terrible: at 142K, it missed the estimate of 165K but rebounded sharply from last month's (downward revised) 89K and the unemployment rate actually dropped as the number of employed workers jumped by the most since March (even if the composition was terrible, consisting entirely of part-time, illegal workers).

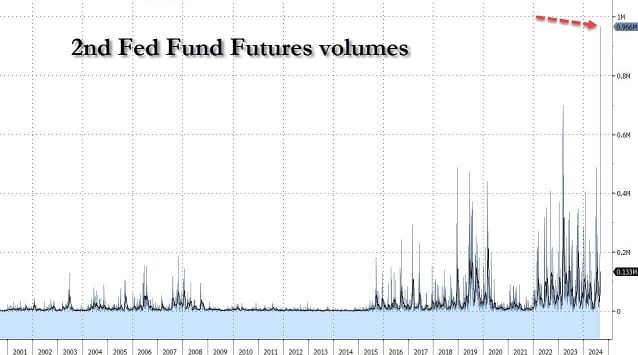

What unfolded was a record number of Fed Fund futures were traded (which are derivatives based on the federal funds rate, the U.S. overnight interbank lending rate on reserves deposited with the Fed) reached nearly 1m contracts the highest for any contract since their inception in 1988. Trading volume in the October contract surpasses previous record from March 2023, when collapse of Silicon Valley Bank reverberated through financial markets!

And while we don't know for a fact if that's what happened, it seems fair to guess that these unprecedented, wild swings in what is the market's most important pricing Fed pricing indicator, sparked a relentless liquidation across all assets, which hit - in no particular order - US stocks...

Oil, Bitcoin and even Gold also all tanked.

US mkt darling Nvidia is now down more than 30% from its all time high! That's a warning to you CBA!

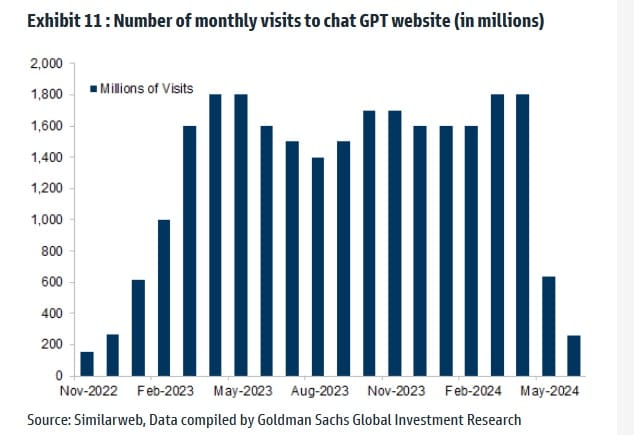

At also it now appears the AI fad bubble has burst with a bit of a bang!

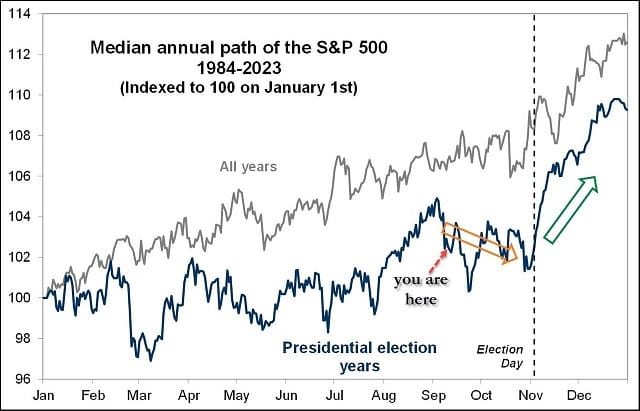

And while it is easy to speculate and assign a narrative to what happened based on prices, it is just as likely that today's - and this week's - price action is precisely what was expected to happen: as the following chart from Goldman makes clear, in presidential election years, stocks peak just before Labor day, before dumping all the way until the election, before blasting off higher once more. Well, you are here!

So expect some more mkt weakness until NOV 5.

Have a good weekend

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).