EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

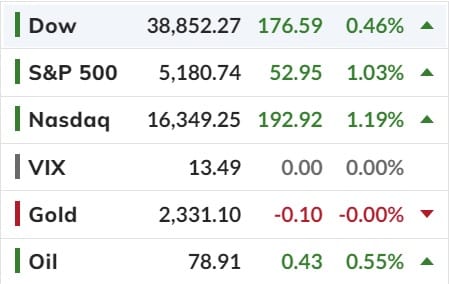

US Stock Market Extends Gains; Bonds & Bullion Bid while Buffett Builds Up Cash

More of the same overnight after last week's tepid payrolls and dovish Powell with gold, stocks, and bonds bid as rate-cut hopes inched higher.

The US market is now pricing in two rate-cuts in 2024 and three more cuts in 2025.

The Aussie market is now pricing in NO rate-cuts in 2024 and one cut in 2025.

The RBA will meet today and it is expected that they will maintain the current cash rate of 4.35% If they had any bias it would be towards a hike (which they won't do but just FYI)

For now the market appears to prefer the 'bad news' from declining growth expectations to the 'bad news' from soaring inflation prints...

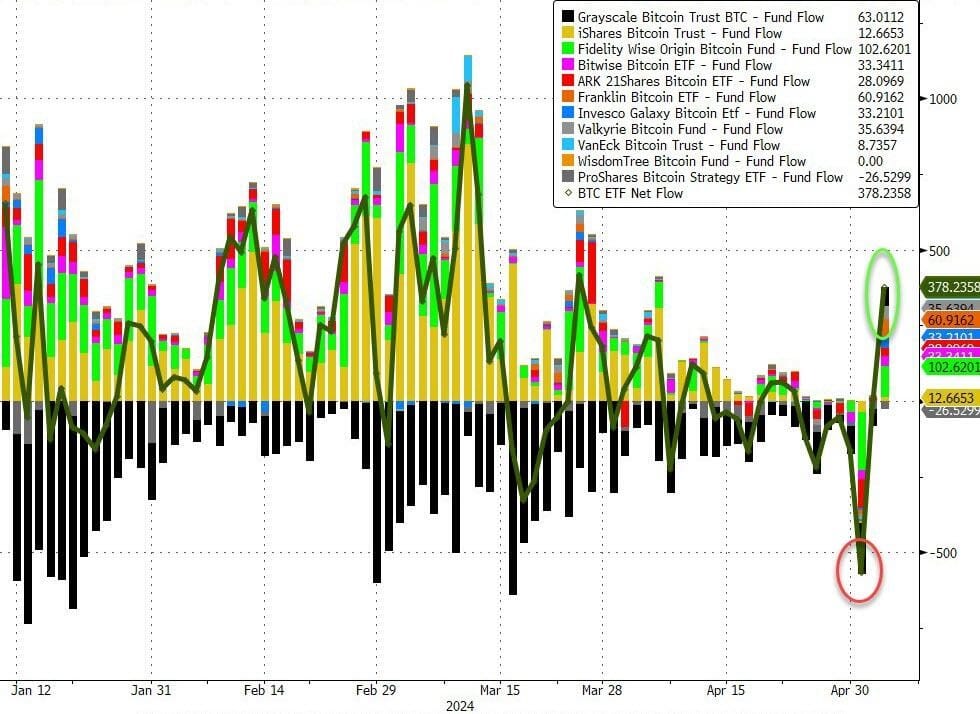

There was an early surge in bitcoin - up to USD$65,500 - was quickly sold following headlines that Robinhood had received a Wells Notice fro the SEC, which the SEC issues when it is planning to bring enforcement action against someone.

As a reminder, we saw huge net inflows into ETFs on Friday, so it will be fascinating to see what happen overnight...

Lastly, there's a reason why Warren Buffett has a record cashpile.

Berkshire Hathaway's cash pile hit another record high in the first quarter of USD$189 billion, the industrial giant said in its earnings release on Saturday.

That massive cash war chest will likely reach USD$200 billion by the end of the current quarter, Buffett told shareholders at a packed CHI Health Center today.

Bear that in mind...

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).