EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

'Bad Data' Sparks 'Buy All The Things'-Day, Despite Hawkish Powell as the USD puked

So Australia's economy grew just 0.2 per cent over the December quarter, and 1.5 per cent over the year according to the ABS which was lower than the increase in population meaning that economic activity per person fell again! So we're in a per capita recession and those dummies over at the RBA should be thinking now when they'll be cutting rates when they next meet-up.

US Bonds, big-tech, bitcoin, and bullion all rallied today as the dollar dived after disappointing jobs data and a no-less-hawkish Fed Chair Powell.

This lead to a new record high for spot gold prices as the USD dived on a small % rise in rate-cut expectations.

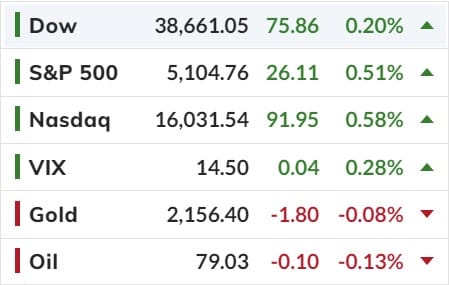

All the US Majors managed gains on the day but were well off the highs with The Dow lagging and Nasdaq and Small Caps leading...

After yesterday's insane day in crypto, Bitcoin recovered a lot of its crash-from-record-high losses, back above USD$67,000...

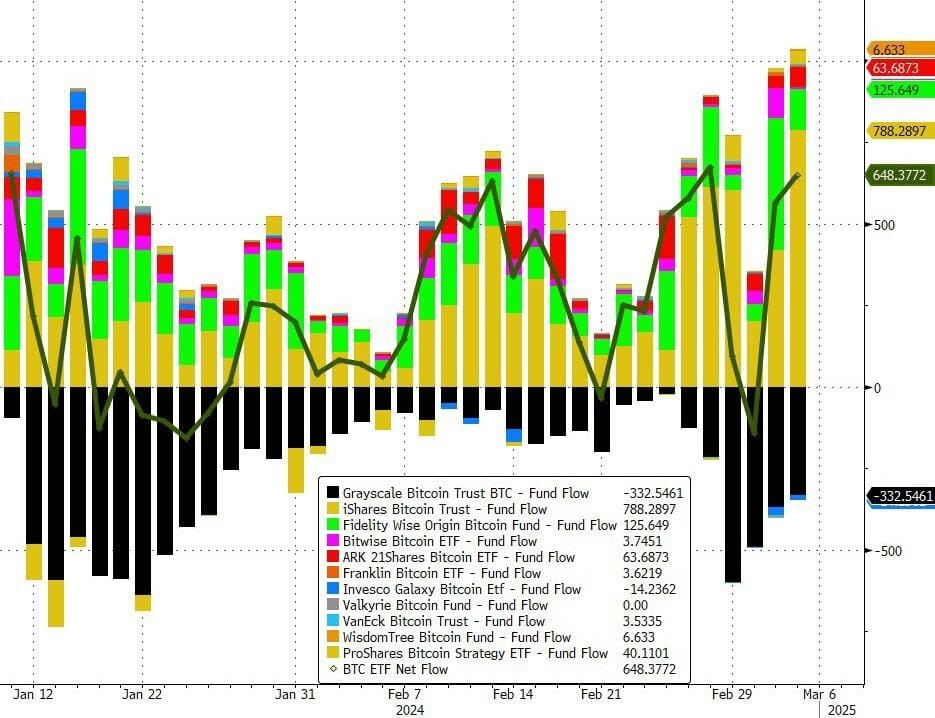

Which should not be total surprise given yesterday saw MASSIVE net inflows into BTC ETFs...

Not only are they HODLers they are rabid BTFDfers...

While massive amounts of money are still flowing into these listed BTC ETF's Bitcoin will be well bid for the foreseeable future.

Blackrock's IBIT is now over a USD$10bn ETF!!!

Finally, New York Community Bancorp was a total shitshow and deserves a section of its own. From USD$3.20 close to $1.70 lows... then former Treasury Secretary Mnuchin and his hot wife stepped in at USD$2 and the stock ripped up to $4.40... only to sink back basically to unchanged...

NYCB share price did not extend gains on the news or the cover? We're gonna need a bigger boat!

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).