The Thought Police Have Arrived

Our freedoms are being trampled under the guise of 'safety', but it's all about control, as George Christenson points out.

Bank Blow-Up Sparks Big Bid For Bonds, Bullion, & Bitcoin

The biggest overnight newsmakers was FedSpeak, Yellen yellin', and bank blow-ups...

Take your pick:

The Good: KASHKARI: 3M, 6M INFLATION RATES 'BASICALLY THERE' AT 2%; WE DO NOT THINK ABOUT POLITICS NOR UPCOMING ELECTION

Bad: MESTER: EXPECT FED TO GAIN CONFIDENCE TO CUT 'LATER THIS YEAR', DON'T FEEL THERE'S ANY NEED TO RUSH RATE CUTS, NO URGENCY TO SLOW PACE OF BALANCE-SHEET REDUCTION NOW

Ugly: YELLEN SAYS INCENTIVES TO MOVE AWAY FROM DOLLAR EXIST, NATURAL SANCTIONED COUNTRIES TRY WORKAROUNDS ON DOLLAR; BUT UNAWARE OF ANY DEEP THREAT TO THE DOLLAR

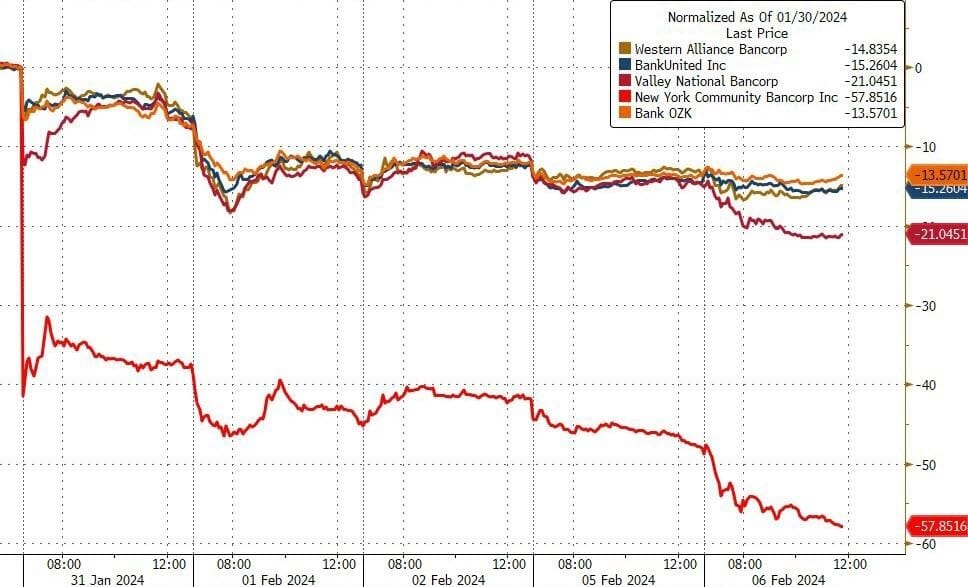

But ugliest of all was the regional banking system.

The KBW Regional Banking Index is down 15% from its December highs (which had basically run all the way back up to the pre-SVB levels) but down 12% in the last 5 days...

The next regional bank to drop? A few NY trading desks claimed that NYCB is 'idiosyncratic'...

*NEW YORK COMMUNITY BANCORP SINKS 22% TO HIT LOWEST SINCE 1997

that's just bullshit. It just happens to be the first domino to fall...

With bank bewilderment building, traders bid for bonds...

Bullion was also bid, with spot gold prices testing USD$2040...

And so was black gold, with WTI back above USD$73...

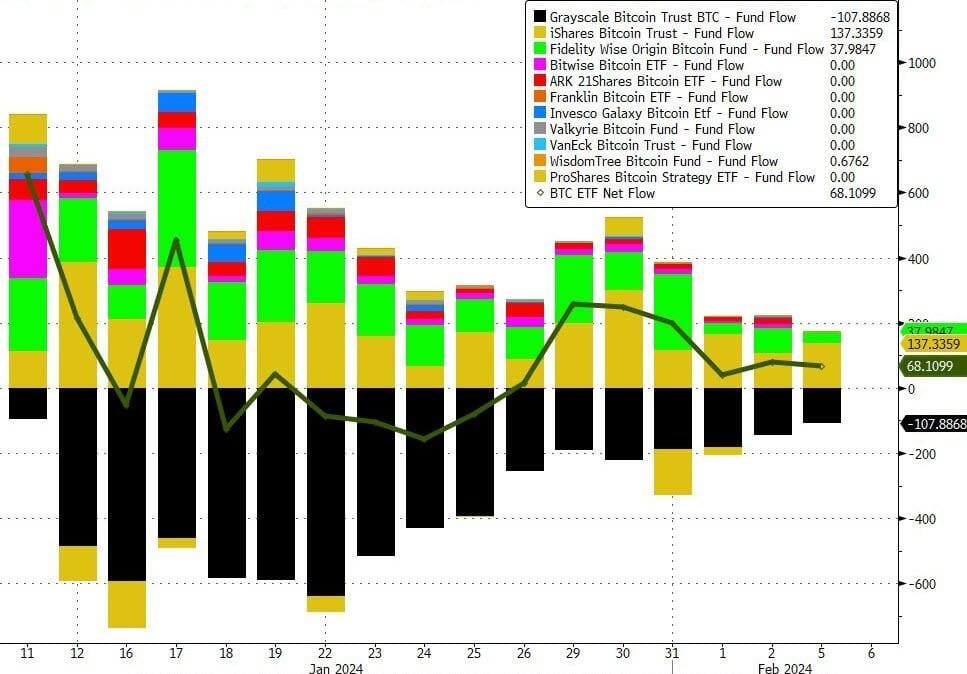

And crypto was bid.

Yesterday saw the 7th straight day of net inflows to Bitcoin ETFs...

...and Bitcoin rallied today, but only modestly and within its recent range around USD$43,000

Finally, as a reminder, Small banks are proper rooted without The Fed's (soon to be clubbed like a baby seal) BTFP bailout facility (red line)...

...and one can't help but notice the burgeoning balance sheet of the big banks - willing to scoop up small banks with the FDIC's help?

Don't believe us? Here's Jay Powell on Sunday:

"We looked at the larger banks' balance sheets, and it appears to be a manageable problem. There's some smaller and regional banks that have concentrated exposures in these areas that are challenged.

...

There will be expected losses.

It's a sizable problem... it doesn't appear to have the makings of the kind of crisis things that we've seen sometimes in the past.

I don't think there's much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the.. future.

...

There will be certainly be some banks that have to be closed or merged out of, out of existence because of this. That'll be smaller banks, I suspect, for the most part.

You know, these are losses. It's a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable."

Do you feel lucky, punk? Picking the right regional bank that will be bought before it's closed under FDIC?

Back here in Australia. Our RBA sat on their hands with rates. I don't expect any changes maybe until second half of 2024.

And the Big banks are beginning their deposit rate squeeze - that's offering lower deposit rates while maintaining (and in some cases increasing) lending rates.

Macq bank for example cut the interest rate a little on their Macquarie Cash Management Accelerator Account from 4.75% to 4.65%

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).