Where Mediocrity Rules

Janet Albrechtsen sums up the problem with the Liberal Party: Mediocrity.

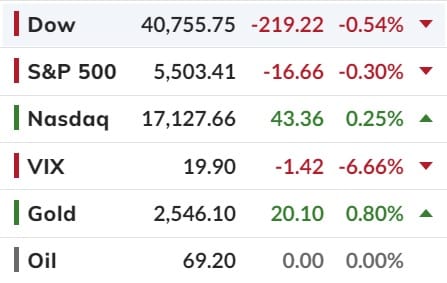

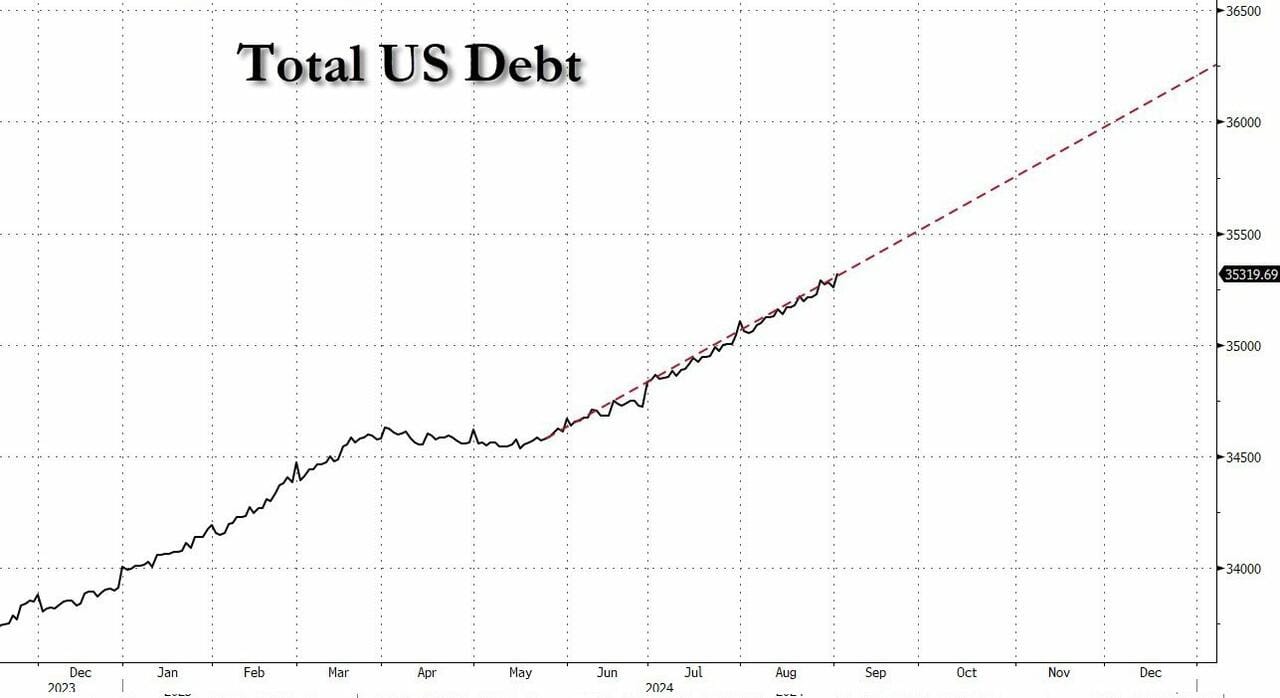

US Stocks Fade Ahead of Payrolls as Oil Convinced Hard-Landing Is Inevitable while US Debt will hit $36 Trillion inside 3 Months

So it appears the US market is now in wait-and-see mode ahead of tomorrow's critical payrolls report, following a busy start to the week when after two days of tech-led turmoil, the market was decidedly calmer today, with the S&P opening flat, rising, falling and then set to close modestly red on the day.

Oil suggesting imminent recession is coming. Despite another massive crude inventory draw, the 8th in the past 9 weeks soaring global recession fears overruled any good news from the OPEC+ decision to hold off on boosting output by at least 2 months. Compounding the negativity US debt is on pace to hit a record USD$36 trillion inside the next 3 months - Just in time for the Presidential Election!

Have a good weekend!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).