Where Mediocrity Rules

Janet Albrechtsen sums up the problem with the Liberal Party: Mediocrity.

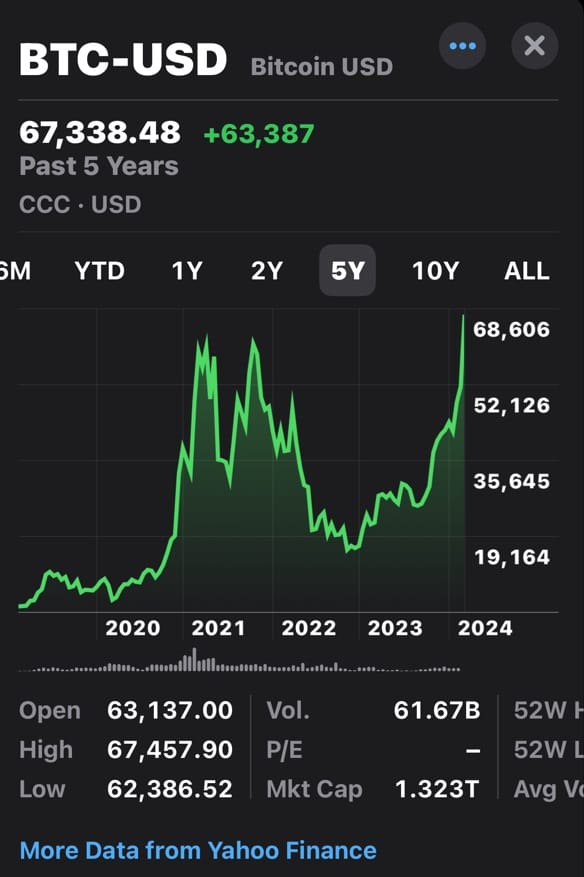

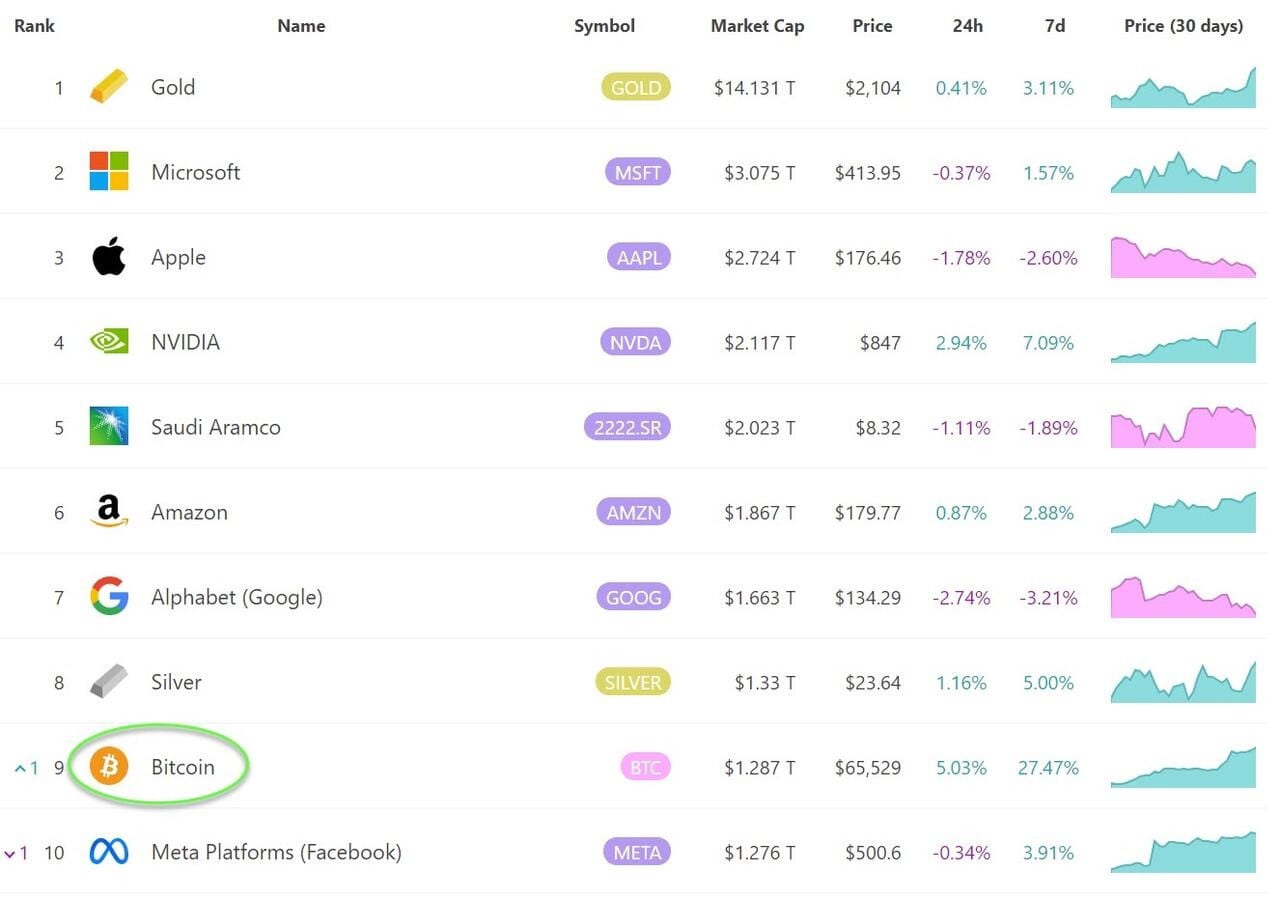

Gold & Bitcoin Close At Record Highs As Bonds & US Stocks Dip

A quiet macro day let the grown-ups play... and overnight saw gold and bitcoin roar up to record closing highs (amid rising breakevens and falling rate-cut expectations) as all eyes and ears and algos remain glued to any further hints of QE (Reverse Twist) as Fed's Waller revealed last week, and Fed's Bostic didn't help today.

In a commentary published on the Atlanta Fed website Monday, Bostic said he was worried that businesses have too much exuberance and could unleash a burst of new demand after a rate cut that adds to price pressures.

“This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” he said.

“ As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism.”

That could be another reason not to cut rates at a rushed pace, he told reporters in a press briefing.

“I would probably not anticipate they would be back to back” cuts, Bostic said.

“Given the uncertainty, I think there is some appeal to acting and then seeing how participants in the markets, businesses leaders and families respond to that.”

2024 rate-cut expectations drifted (hawkishly lower) to barely three cuts priced in for 2024 now...

And it appears Gold and Bitcoin got the hint with both soaring to a new record closing high (just shy of its intraday record high)...

Bitcoin topping USD $67,000

and smashing through $100,000 Aussie!

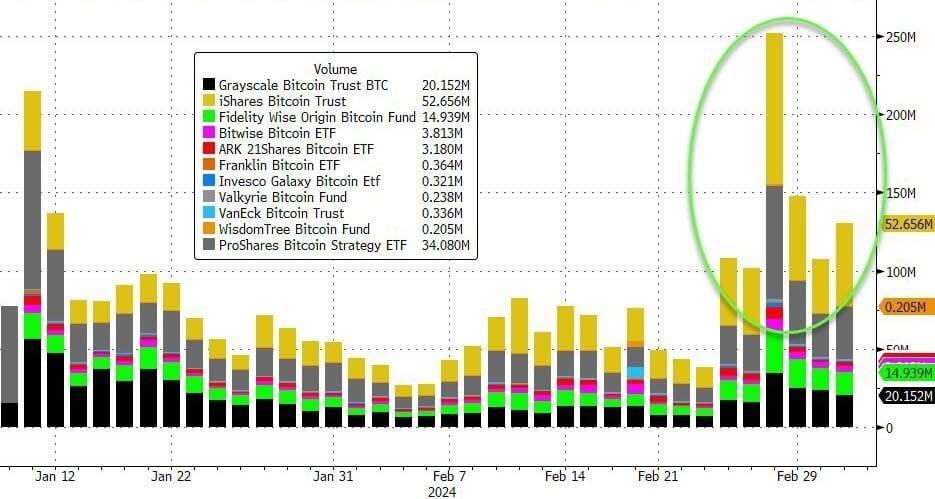

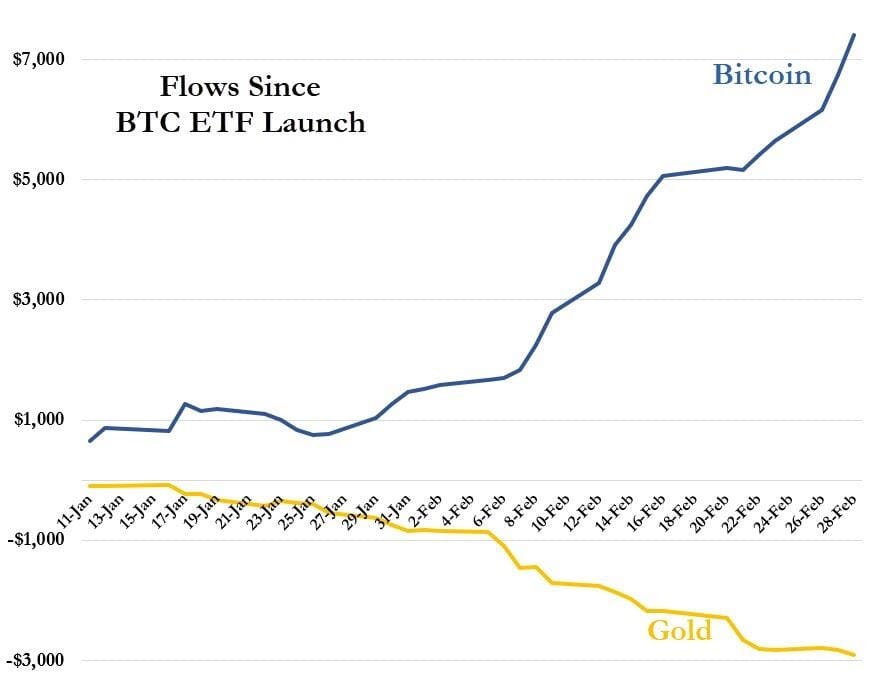

Again also helped by Inflows

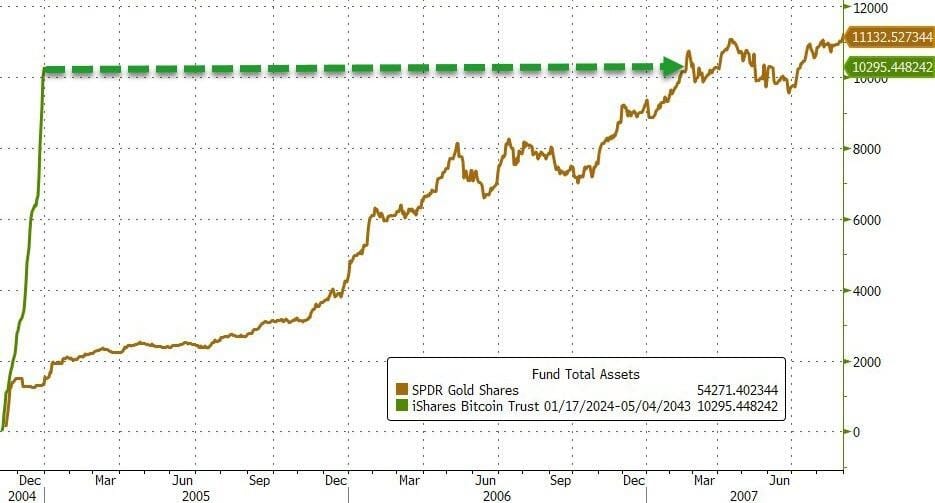

Speaking of gold, it took the first Gold ETF over two years before its AUM hit $10BN, BlackRock’s iShares Bitcoin Trust (IBIT) has amassed $10 billion in assets under management in just seven weeks!

Bitcoin ETF inflows have absolutely blown gold’s out of the water. Not even close, utterly dwarfed, decimated

In terms of current mkt cap, Bitcoin just overtook Meta.

Finally, as CoinDesk reports, more than 97% of BTC addresses are now "in the money," according to data tracked by analytics firm IntoTheBlock. That's the highest proportion since November 2021, when the largest cryptocurrency by market value hit a record high around $69,000.

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).