Jihadi Preachers

The silence of many surrounding the vile hate speech of Muslim clerics says a lot about the threats within the West.

From 'Mag 7' To 'Fab 4' & 'Meh 3' continues Mega-Cap Tech Melt Up!

OK - we have a lot to get through so I'll try and get to the elephant in the room.

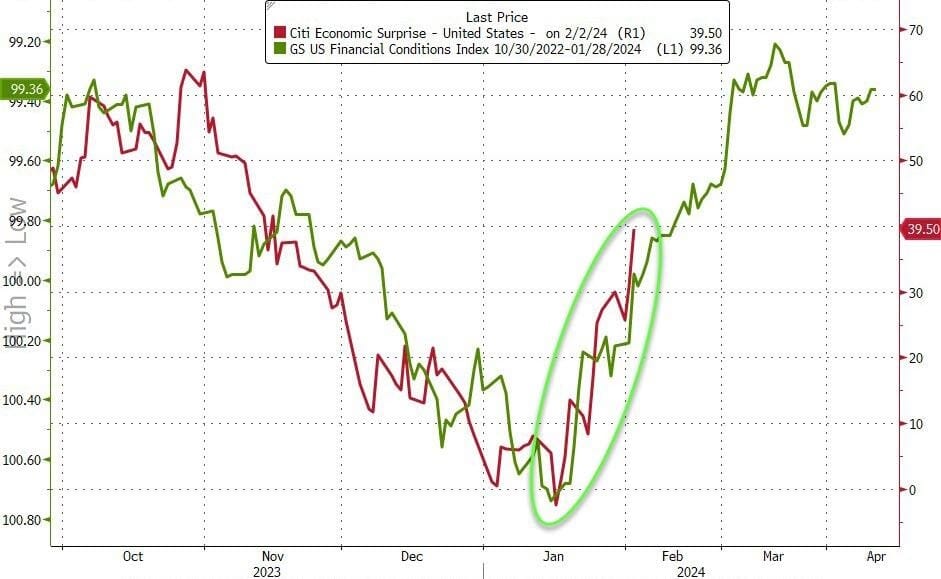

First things first, economic 'animal spirits' are back baby... and those who read my BULLETin's know why (as I have noted for months, the lagged effect of the massive loosening of financial conditions is now hitting and NOT doing The Fed's job)...

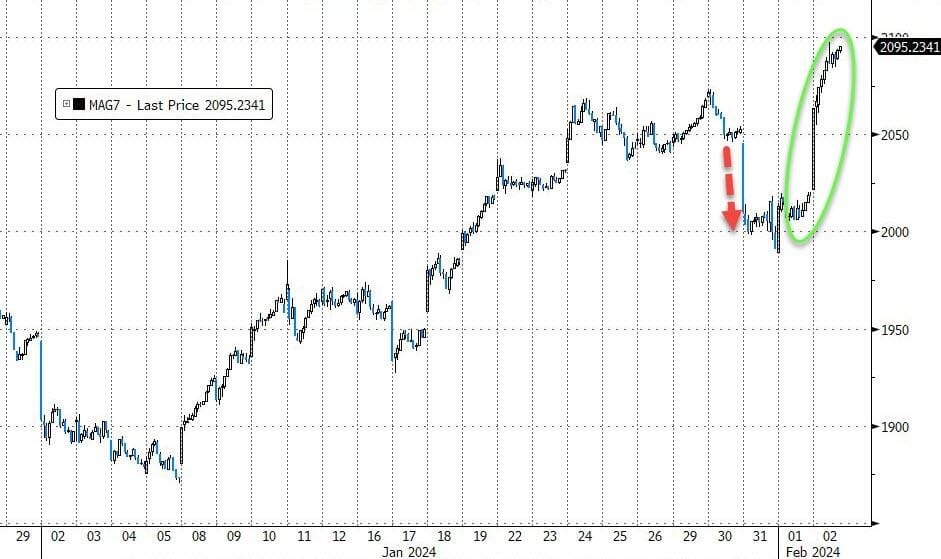

But, away from The Fed's Tyson-esque punch in the dove's face, it was all about 'The Magnificent 7' - the basket of 7 stocks soared to new highs this last week...

But the Mag 7 is now Fab 4...

The 'Fab 4' (AMZN, MSFT, NVDA, META) versus the 'Meh 3' (GOOGL, AAPL, TSLA), with the latter three lacking both earnings momentum and A.I. narratives right now.

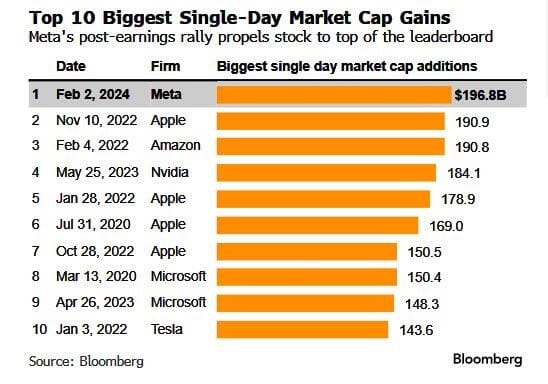

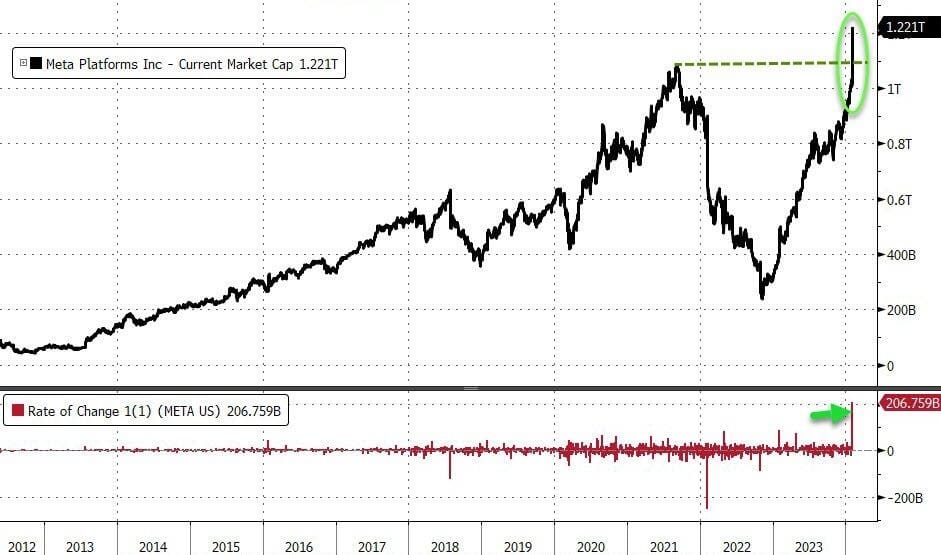

Case in point, after modestly beating earnings estimates, Facebook Meta MetAI enjoyed a 20%, or US$197 billion, surge in its market cap in one single day, which as shown in the table below was the single biggest market cap increase in history (and follows just two years after META also suffered the single biggest value destruction in market history when a quarter trillion in value vaporised). But what is even more notable is that all of the top 10 one-day market cap increases belong to Mag 7 companies.

The lunatic melt up by META which we recently learned owes the bulk of its ad revenue growth to China, and which on Friday rose by more than its entire value in late 2022 which tells me we are most definitely in another tech bubble.

And this bubble is happening while there is a renewed crisis in US regional Banks, have tumbled 9% in the past 2 days. Only unlike Q1 2023 when the US bank crisis was negative across markets, this time the market has learned its lesson that bank deflation is contagiously liquidity positive for risk assets (especially for investment grade debt and monopolistic tech like the Mag 7 errr Fab 4, translating into a repeat of the 2010s “QE bull” trade.

And while most investors are enjoying the meltup - even as Zuckerberg and Bezos are quietly dumping billions of their shares - as they rush to bid up these runaway tech giants, some are warning that the concentration among the top 7 names (and really, it's more like Fab 4, as already mentioned) is nearing, and in fact surpassing, the dot com bubble peak of 9 MAR 2000.

The Shot: The Magnificent 7 now comprises 29% of S&P 500 equity market cap and 22% of consensus 2024 net income.

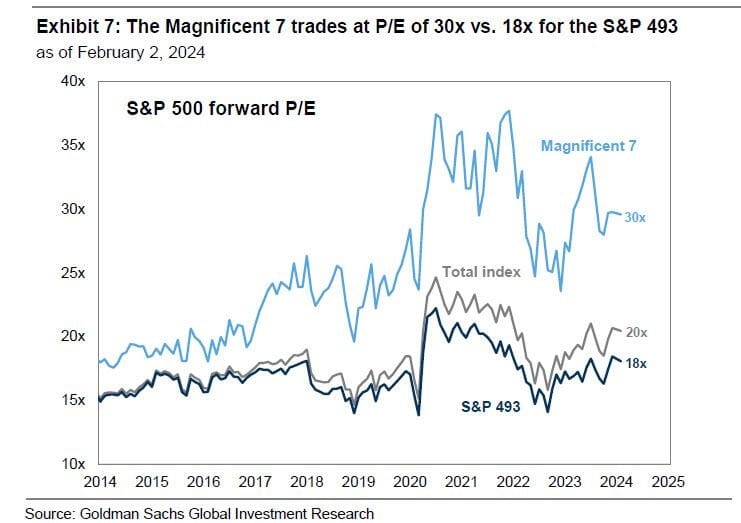

The Chaser: The Magnificent 7 stocks currently trade at a forward P/E multiple of 30x compared with 20x for the overall index and 18x for the remaining 493 S&P 500 companies.

Here's why they are dominating. The seven stocks have generated $523 billion in sales during 4Q representing a year/year increase of 14%. Putting that in context, revenue growth for the remaining 493 stocks was a comparatively paltry 2%. At the same time, margins for the seven stocks expanded by nearly to 23% vs. a 9% for the remaining 493 stocks in the S&P 500.

So any disappointment in the AI chatGPT bubble would also lead to a major repricing lower for the Mag 7 group.

My warning to all: investors who believe continued bullish consensus estimates do so at their own risk.

And finally, as one wise prognosticator noted.

Market is soaring because AI hasn't displaced any jobs.

Market is soaring because every tech company is betting AI will displace millions of jobs.

And so, 'you are here'...

...just remember, this didn't end well last time.

Do we see a repeat peak on 10 MAR 2024 or will the Fed spoil everything on 20 MAR 2024?

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).