AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

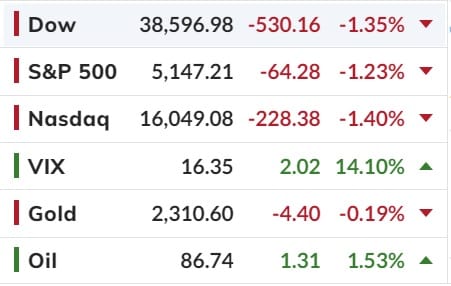

Gold, Bonds & Bitcoin Bid As Fed's Kashkari & Crude Slam US Stocks

ASX200 futs are down 63 pts.

An armada of FedSpeak overnight was pretty much all in the same direction - need more time on inflation, no rush to cut (but will cut), jobs strong - with the only divergence being the degree (Gooslbee, more dovishly worried about labor market due to rising delinquencies; to Kashkari, more hawkishly questioning any need to cut rates at all given how economy is doing).

In order of their appearance:

Everything was going swimmingly early on. Stocks saw jobless claims data and algos greenlit the buying panic.

The gains survived the various Fed speakers early on until Kashkari spoke and hinted at the potential of no rate-cuts and that seemed to trigger a wave of selling in stocks.

“In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target,” Kashkari said in a virtual event with LinkedIn on Thursday.

“If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.”

The decline in stocks also corresponded with a surge in oil prices driven by headlines around UAE cutting ties with Israel and Israel putting all of its global embassies on alert...

WTI topped USD$87 intra-day while Brent also topped USD$91 for the first time since Oct 2023...

It was an ugly day overall in stocks (among the ugliest in a while) with everything sliding from gains near 1% to losses near 1.5%. Nasdaq was the laggard (but basically everything was dumped together)... The Dow are down over 3% on this train wreck of a week (and we still have Friday's overnight session to run its course)

As Everything fell at the same time - around the crossover of Kashkari's comments and oil's spike but I note that bond yields also tumbled (very odd given oil's rise is inflationary and Kashkari's hawkish comments)...

Are bonds suddenly fearful of an oil-price-spike-induced recession? Rate-cut expectations also rose (back to 3 cuts in 2024)...

But it's all not bad news as Crypto had a huge overnight session, erasing all of Tuesday's tumble, back above USD$69,000...

And Gold hit a new record high for the sixth day in a row, above USD$2,300 (spot) for the first time before selling off late in the day...

Finally, which comes first? S&P 4800 or 10Y 3.5%?

I suspect we will see whether this mini-reversal is sustained after 0830ET tomorrow morning when the US nonfarm payrolls and unemployment rates drop plus a plethora of Fedspeakers so hang on.

Happy Friday and Have a good weekend.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).