Weekend Open Forum

Here's the place to have a winter weekend party...or a least a heartwarming chat with fellow members!

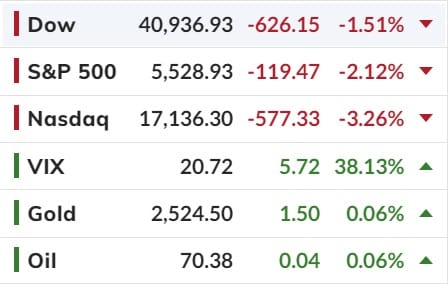

Dow Dumps, SP Sinks & Nasdaq Nukes as September Starts Off with Carnage Everywhere

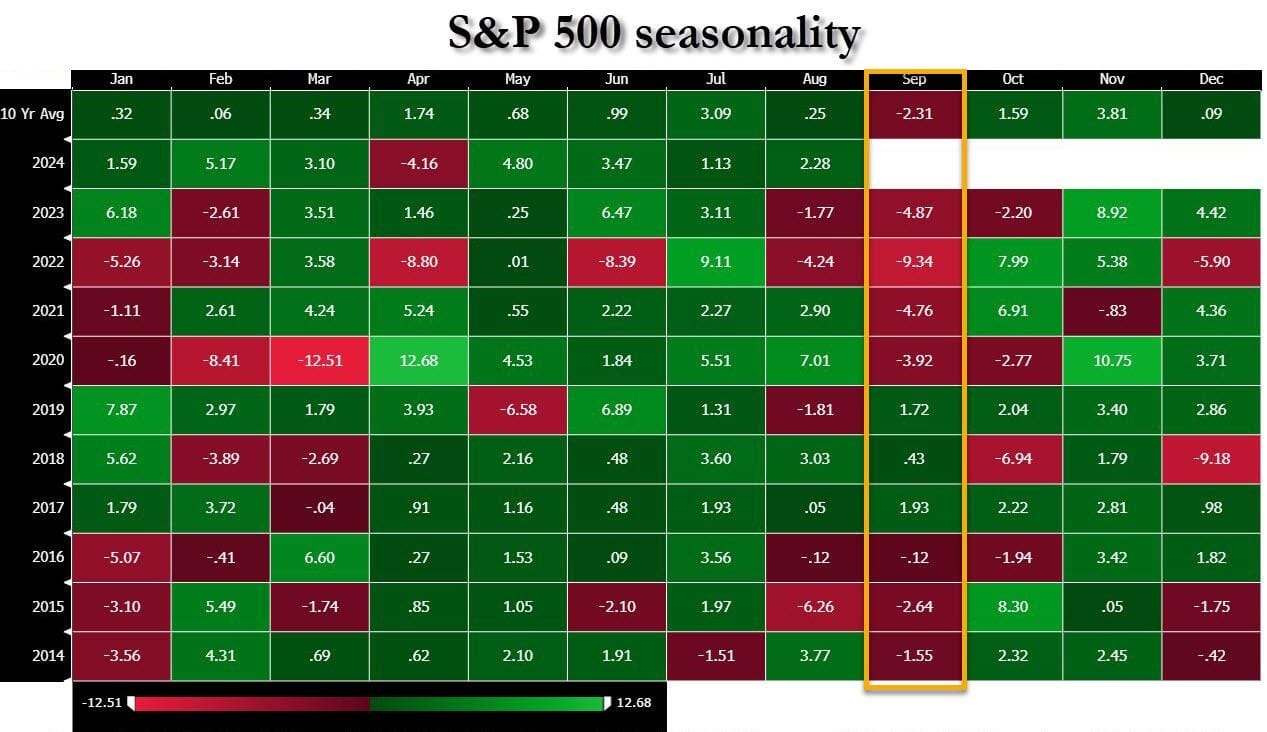

Traditionally the worst month for stocks, bonds, gold and bitcoin, September started off with a bang - not a whimper - which saw the S&P plunge 2.4%, its biggest drop since the August 5 meltdown and the worst start to a month since May 2024 when the S&P plunged 2.8%

It wasn't just the S&P: the Dow (which has become a meaningless index) also tumbled back under 41,000, but the biggest loser by far was the increasingly fragile Nasdaq, which crashed more than 3%, its biggest drop also since the August 5 collapse, and the 3rd biggest one-day drop in the past year...

US mkt darling Nvidia plunge a massive 10% overnight and a whopping 18% in just the past week wiping out more than USD$280 billion in value, which makes it the biggest one-day market cap loss in history, surpassing Meta's previous record of $251BN in market cap lost after its February 2022 earnings report.

Has the US mkt become a bit jittery? Are players startig to realise the reality?

Amid this carnage, which was at least in part sparked by the a stagflationary ISM print, which saw employment and new orders tumble while prices paid jumped, and hinted at a rebound in the US CPI.

Coupled with absolutely devastating commentary from the US PMI report, which hinted not so much at a recession as a manufacturing depression...

“A further downward lurch in the PMI points to the manufacturing sector acting as an increased drag on the economy midway through the third quarter. Forward looking indicators suggest this drag could intensify in the coming months.

“Slower than expected sales are causing warehouses to fill with unsold stock, and a dearth of new orders has prompted factories to cut production for the first time since January. Producers are also reducing payroll numbers for the first time this year and buying fewer inputs amid concerns about excess capacity.

“The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.

“Although falling demand for raw materials has taken pressure off supply chains, rising wages and high shipping rates continue to be widely reported as factors pushing up input costs, which are now rising at the fastest pace since April of last year.”

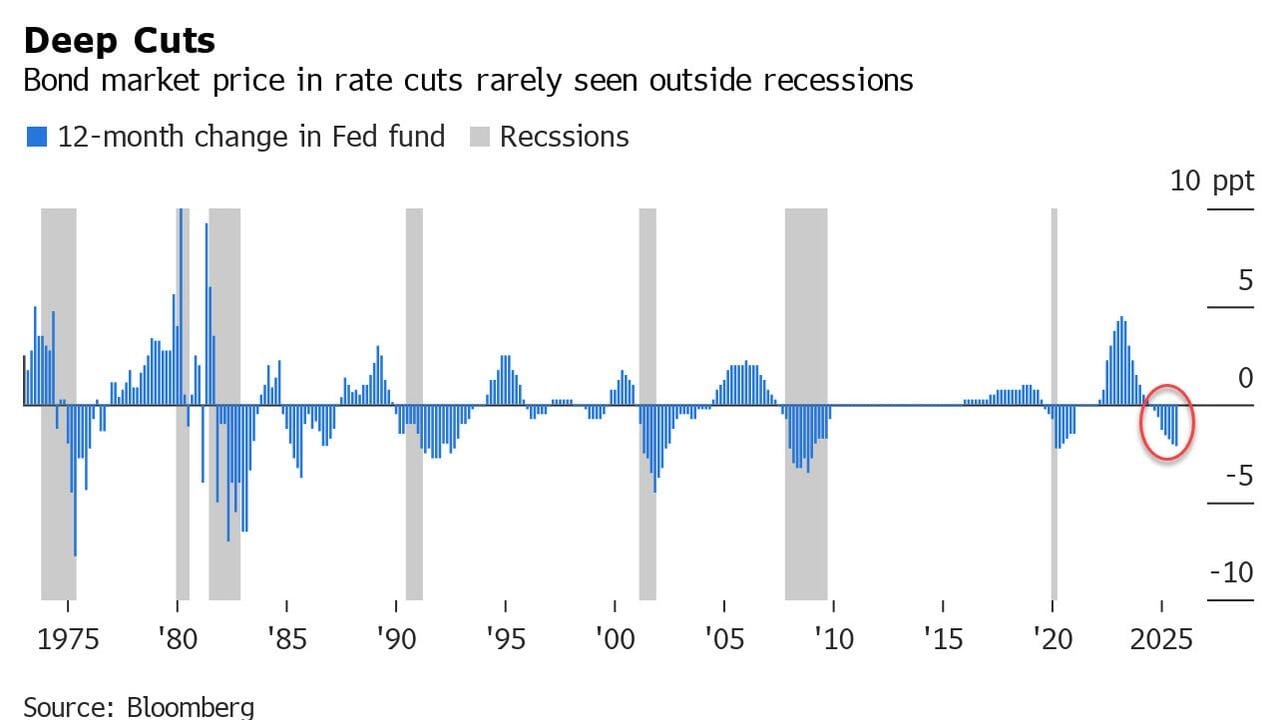

This is the real insanity, stocks - and bonds - have fully priced in more than 200bps of Fed rate cuts over the next 12 months, a pace of easing that is unheard of outside recessions

Think about it for a moment. We will soon see a Fed cut rates while stocks are near ALL TIME record highs, while the US residential property mkt valuations are also at near record highs so the Fed again will be 100% responsible for the next financial crisis.

Putting it all together: Overnight was brutal for most, but with the Nasdaq wiping out 3.1% or about 75% of its average September loss from the past decade in one trading day, it is likely that much of the pain is already in the history books. And we are confident that the BTFD crew will be up early tomorrow ready to start buying it all right back up...

Happy Wednesday

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).