ANDIKA BULLETin 4 MAR 2024

'Everything' Rallies after Fed Hints At Next 'QE' and USD$1 Trillion Every 100 Days!

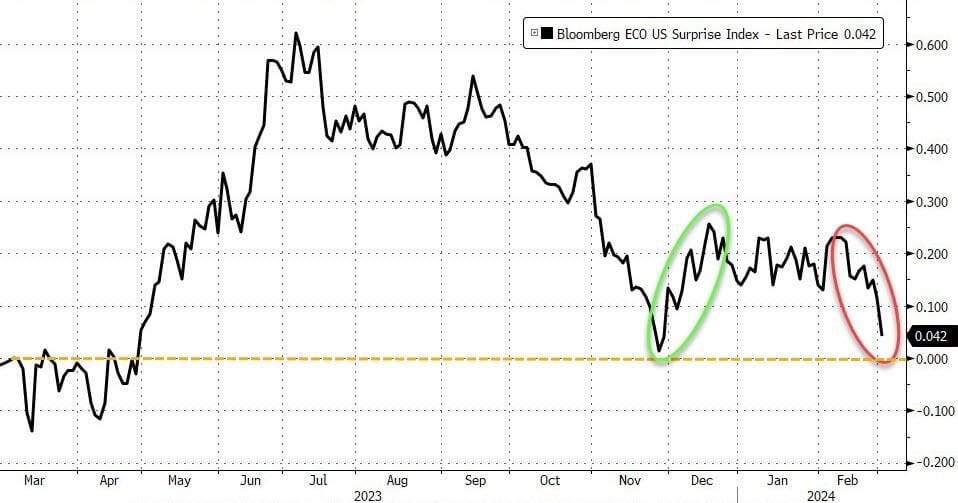

ISM Manufacturing was a terrible (in contraction for 15 straight months), Construction spending unexpectedly declined (first MoM drop since Dec 2022), UMich confidence declined (and inflation exp ticked higher) - all of which dragged US Macro surprise index back near neutral...

And although 'bad news is good news', it was Fed's Waller's remarks that prompted the market's "everything is awesome" response as he hinted that The Fed would unveil a new QE 'Reverse Twist' for its balance-sheet (buying short-term Treasuries and dumping Agency MBS).

The timing of Waller's comments are convenient too as shifting The Fed's holdings towards Bills perfectly complement's The Treasury's recently stated expectation that their Bill-share will rise above their prior 20% guideline.

In other words: Treasury is going to issue more bills, and Fed will buy more of them as well.

Waller's comments come as Dallas Fed chief Lorie Logan reiterated it’ll likely be appropriate to start slowing the pace at which it shrinks its balance sheet.

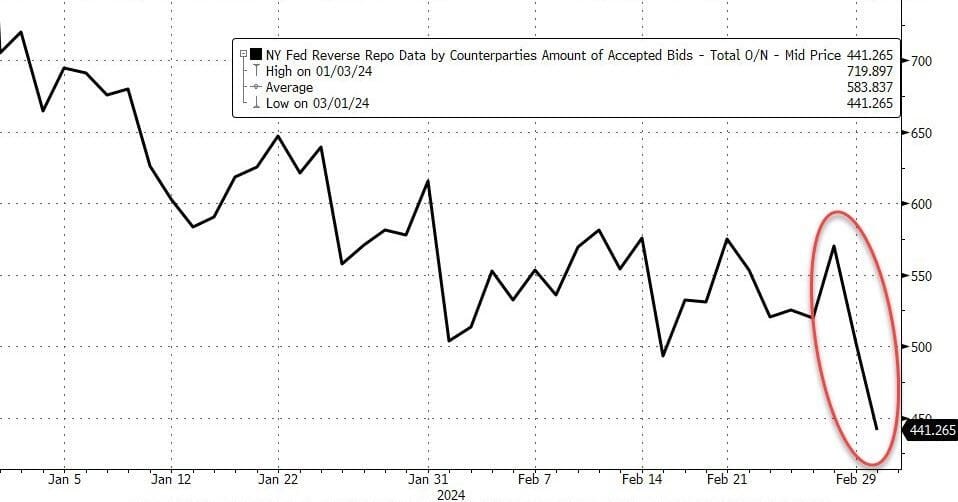

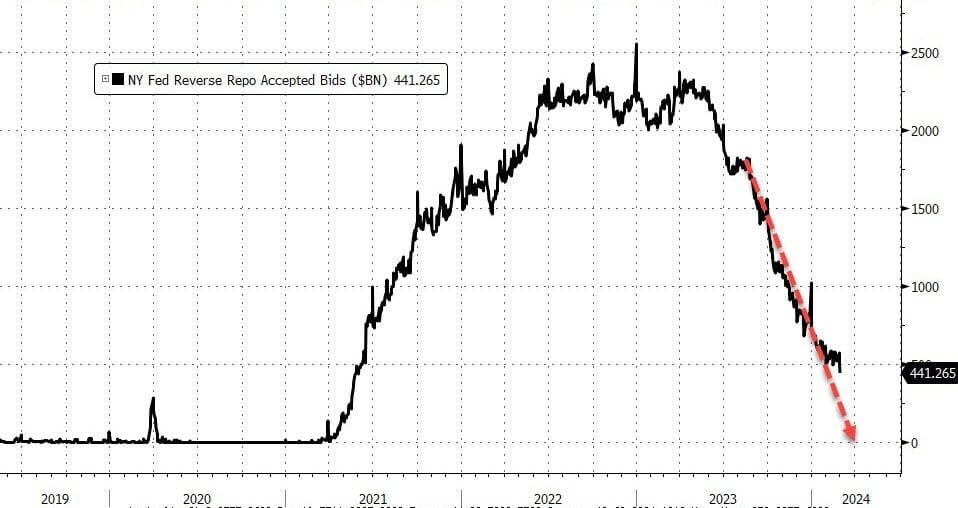

And Waller's comments come right on cue as The Fed's reverse repo facility saw a simply stunning $128BN of liquidity sucked out of it over the last two days (a 22% drop) across month-end...

Leaving the Ides of March in play for a liquidity crisis...

So unleash the US dollars...

And just like - everything was higher...

Stocks went vertical, gold soared, Treasury yields plunged (and the yield curve steepened... in a good way), oil ramped up too (and so did crypto, even after the week it had).

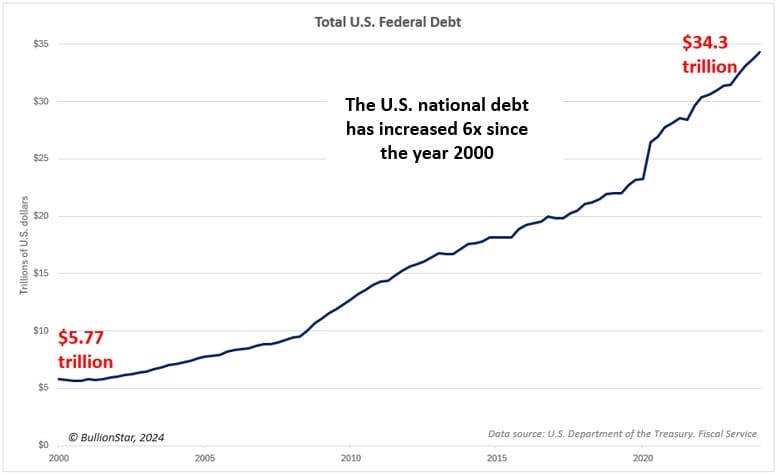

Meanwhile, here's a dose of reality the mkts just don't want to acknowledge.

And we're off: US debt rises by $89BN on the last day of February, to $34.471 trillion, a new record high.

Debt has increased by $280BN in February and by $470BN in the first two months of the year.

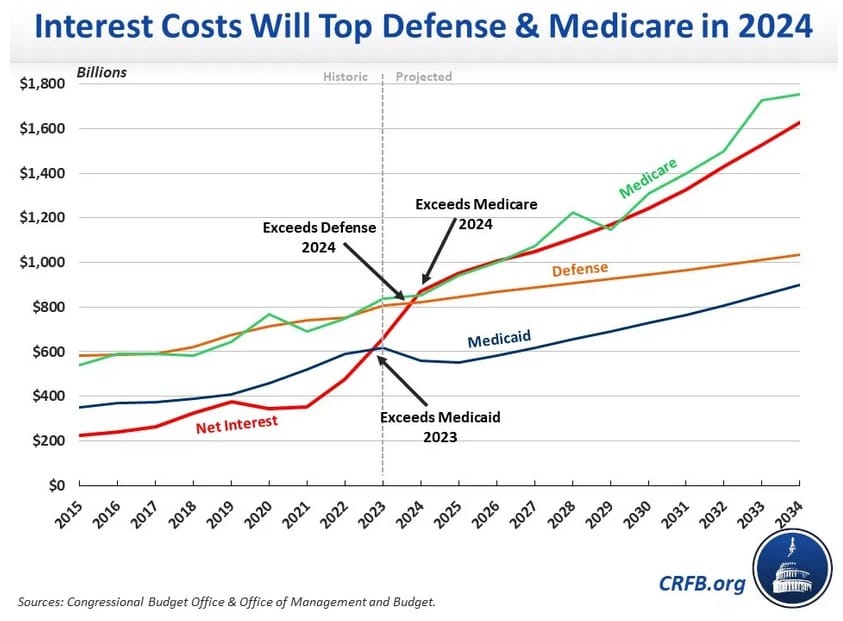

US national debt rising $1tn every 100 days ($32tn to $33tn took 92 days, $33tn to $34tn 106 days, $34tn to $35tn will take 95 days) financing domestic bliss & overseas wars makes the US budget deficit in the next 4 years = 9.3% of GDP.

At this pace debt will hit $37 trillion by year-end and $40 trillion by the end of 2025, two years early vs the CBO's forecast.

Which IMO means Gold and Bitcoin are going much, much higher!

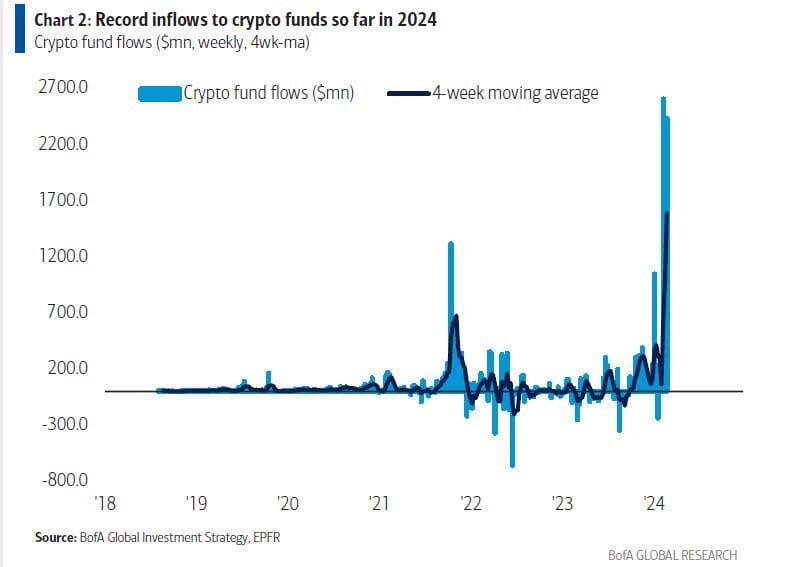

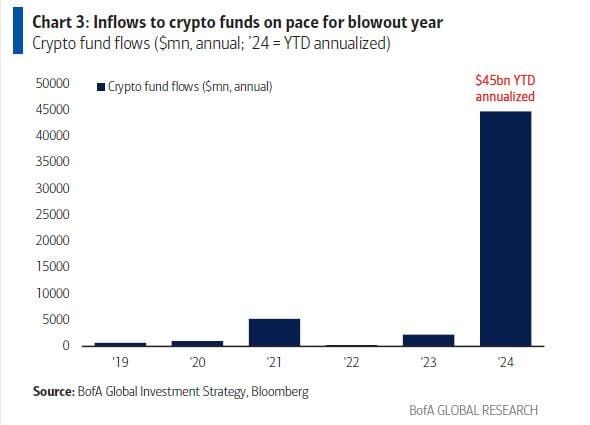

And increasingly that is no longer a secret: while stocks are up 5.0%, and even oil is finally starting to emerge from the doldrums rising 9.2% YTD, it is bitcoin that is once again the best performing asset in 2024 by a mile, up a whopping 39% in just two months (around 235% annualised). A big part of this is the recent approval of bitcoin ETFs, which has enabled record crypto fund inflows, to the tune of $7.7 billion already which blows all of 2021's $5.2 billion inflows (the year when bitcoin hit its previous all time high) away, which also means that the current explosion in crypto is taking place with far less leverage.

Annualised that, and you get a shocking number.

So to re-iterate - Bitcoin will be a lot higher if the inflows from these new ETF's keep there inflow rate up.

Back to the ballooning US Debt. The current annual interest cost is around USD $1 trillion and as time goes on the cost in servicing the US debt will exceed both the US defence budget and Medicare.

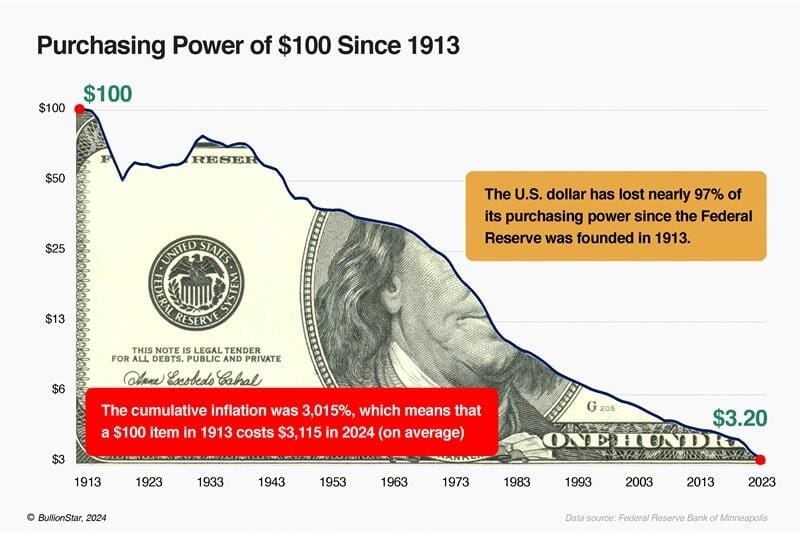

Since 1913, the American currency has lost a jaw-dropping 97% of its purchasing power with no end in sight. As long as the U.S. dollar remains an unbacked fiat currency, it is going to keep losing purchasing power as a function of time.

To summarise, Bitcoin began a powerful uptrend in the early-2020s and it is still in that same uptrend despite the choppy price action of the past few years. The factors that originally drove Bitcoins uptrend are still in effect and, in many cases, are accelerating. Over the next decade and beyond, we are going to see IMO a staggering increase in debt and the money supply, which will result in terrible inflation and, ultimately, hyperinflation. Though this piece focused primarily on the U.S. monetary and fiscal situation, make no mistake — practically every major economy including Australia is in the same boat and has its own version of the charts and data shown here.

Though the paper money supply will increase exponentially in the years ahead, the fixed supply of Bitcoin will is a recipe for much higher Bitcoin (and most likely Gold) prices.

Update:

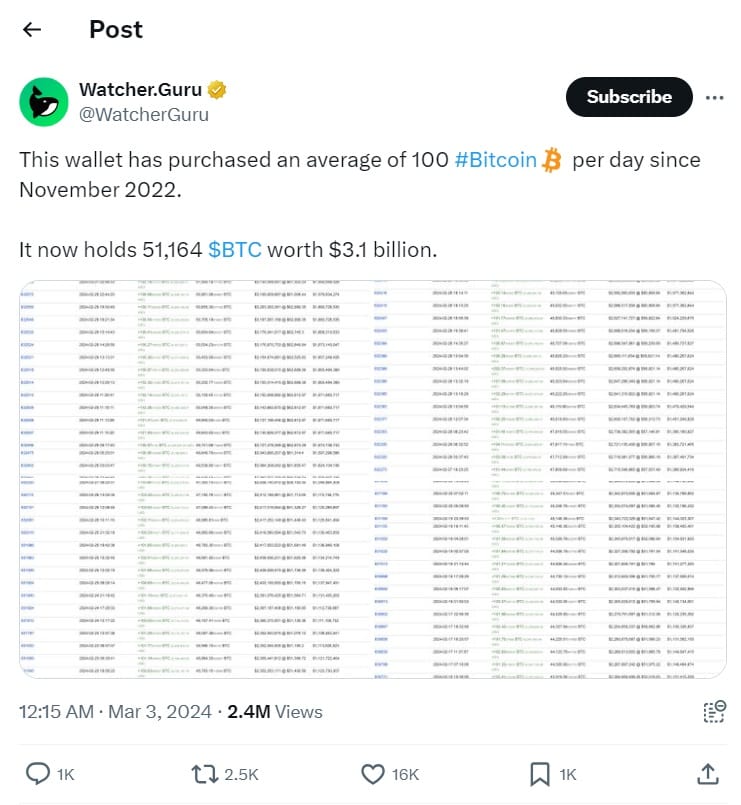

A mysterious Bitcoin buyer has quietly amassed billions worth of bitcoin over the past two years making the unknown address one of the largest single holders of the cryptocurrency as the race to a new all-time high continues. According to data from Bitinfocharts, after patiently buying bitcoin almost daily since November 2022, the whale’s wallet now holds over 54,164 BTC, worth around USD$3.2 billion, according to Decrypt.

While speculation around the identity of “Mr. 100” whale remains, sentiment in the cryptocurrency market is riding high, and the countless entities loading up on Bitcoin - especially in the recently launched ETFs - point to signs that the bull market is indeed back and running.

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).