Australia’s Bureaucratic Blanket

The bureaucrats are smothering the nation’s spirit as the entrenched and privileged elite grow in power.

US Stocks, Bonds, & Bullion Soar Amid Political Panic & Macro Meltdown while FOMC Minutes Show "Vast Majority" Expect Economy to Cool, See Deflationary Effects of AI on Holiday-Shortened Day

On the shortened US Independence Day holiday trading day the S&P and Nasdaq 100 managed to close at record highs while Bond yields and the US Dollar tumbled. The primary drivers of price action was a slew of soft economic data. The highlight was the woeful ISM Services PMI which saw the headline fall back into contractionary territory, printing the lowest level in four years, amid a slump in business activity and new orders, while both prices and employment dipped too

FOMC Minutes, released after the shorten US market close, revealed little new about the Fed's policy path.

Here are the key takeaways from minutes of the Federal Reserve's June 11-12 meeting, released Wednesday (via Bloomberg):

Willing to wait...

Officials did not expect it would appropriate to lower borrowing costs until “additional information had emerged to give them greater confidence” that inflation was moving toward their 2% goal

Economic expectations...

The “vast majority” of Fed officials assessed that economic growth “appeared to be gradually cooling...

...and most participants remarked that they viewed the current policy stance as restrictive”

Officials said inflation progress was evident in smaller monthly gains in the core personal consumption expenditures price index and supported by May consumer price data that were released hours before the rate decision

They appear set of the narrative that AI will save the world too (through deflation)...

Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead. The factors included continued easing of demand–supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, or the prospect of additional supply-side improvements.

The latter prospect included the possibility of a boost to productivity associated with businesses’ deployment of artificial intelligence–related technology. Participants observed that longer-term inflation expectations had remained well anchored and viewed this anchoring as underpinning the disinflation process. Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably toward 2 percent

But The Fed seems divided on how to 'react' to data (markets or macro)...

Some officials emphasized the need for patience in allowing high rates to continue to restrain demand...

...while others noted that if inflation were to remain elevated or increase further, rates “might need to be raised”

A “number” of officials said the Fed needs to stand ready to respond to unexpected weakness, and several flagged that a further drop in demand may push up unemployment rather than just reduce job openings

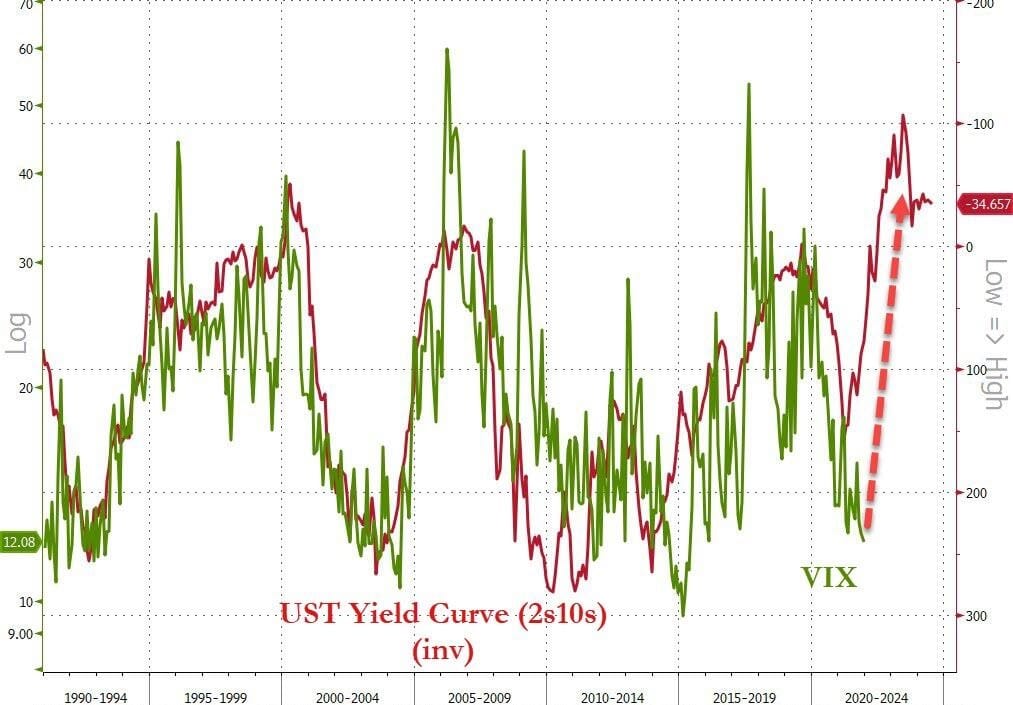

Major takeout I could find was the US yield curve is screaming that VIX is way too low..

and with jobless claims starting to rise quickly (and spread across states), means simultaneous stress on company balance sheets nationwide (more unemployment means lower demand, stressing the balance sheets of companies who will hang on to their employees for as long as they can) which feeds through to increased equity volatility.

Be prepared.

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).