A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

BCrude, Crypto, & Mega-Cap Skid ahead Of Fed/BoJ. Albo & Grimm Jimm are nervous awaiting the JUN QTR CPI drop later today!

Some obvious Trader anxiety ahead of the major macro catalysts and the fact that approximately 40% of the S&P 500 is expected to report this week across all sectors making it the biggest and perhaps one of the most important weeks of earnings this season.

Meanwhile here in Australia everyone will be awaiting for the BOS JUN quarterly CPI print which will drop at 11.30am. Albo and Grimm Jim will be very much praying the JUN qtr CPI is at or below 3.6% otherwise if it isn't then the RBA could lift rate when they meet next week. Those economists who are paid a lot of money to guess wrong are expecting the annualised CPI to 3.8%!! Brace yourselves!

Nasdaq was the biggest loser (again) overnight dropping 222 pts with The Dow managing gains (as tech weighed on the S&P 500 too). The last few minutes of the day-session (before MSFT) saw a panic-bid hit the major indices (but it didn't last long)...

Microsoft reported soft Azure cloud subs and judging by the disappointing cloud numbers, chatbots, pardon AI is rapidly emerging as the next "3D TV" megadud.

The market did not take it quite that way and the stock is plunging 8% - or roughly $250 billion in market cap - in after hours trading on the small miss in cloud revenue.

That decline in MSFT mkt cap is 2X the mkt cap of our largest listed company - CBA!

Finally, the total market-cap of the Magnificent 7 stocks tumbled back below $15 trillion today (down over $2 trillion from its record highs) - in context, that is just a two-month low...

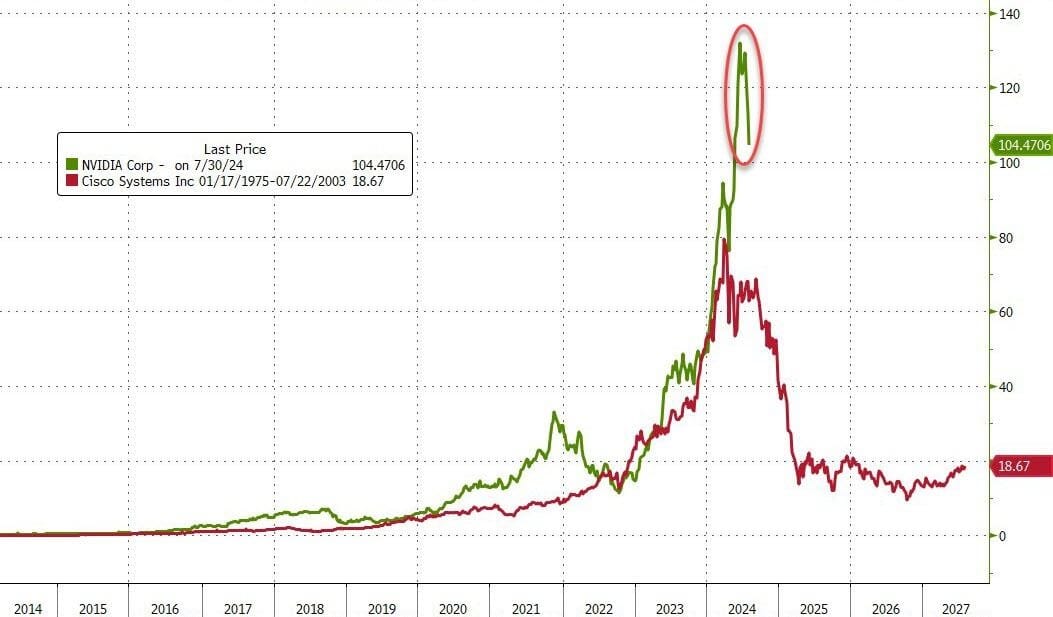

Plus Another ugly day for NVDA overnight (down 6.5%)...

...but of course, we will see what MSFT has to say about that tonight.

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).