EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

Stocks end August Flat After Early Collapse; Bonds & Gold Soar On Rate-Cut Hopes while Vix Collapses. Proof we're in a Massive La-La-Land Bubble

Amazingly the ASX200 after plunging over 500-points in the first 3-days of August on “Yen Carry Trade” & recession fears global equities performed a complete 360 with the ASX200 retracing over 90% of the initial decline.

In the US the S&P 500 traded in a 500+ point band in August (about 10%) as investors first became very concerned that an imminent recession was being ignored by the Fed, before becoming more convinced that a recession may not be that imminent and the Fed is poised to cut rates at its September meeting.

Along the way, the Nikkei dropped 12% in one day (only to reclaim almost all the lost ground by today, Sep-30) and the VIX spiked above 60 before receding back to 15 as uncertainty receded...

Results dominated the ASX last week.

Winners: Nanosonics (NAN +19.2%, Bega Cheese (BGA) +16.4%, Downer (DOW) +15.7%, Chorus (CNU) +9.6%, Worley (WOR) +7.9%, Zip (ZIP) +7.6%, IGO Ltd (IGO) +6.3%, and Westpac (WBC) +4%.

Losers: Johns Lyng Group (JLG) -29.3%, Kelsian Group (KLS) -25%, Tabcorp (TAH) -20.9%, NIB Holdings (NHF) -13.9%, Ramsay Health (RHC) -11.4%, Mineral Resources (MIN) -10.7%, Polynovo (PNV) -10.3%, and Perpetual (PPT) -5.9%.

Gold rallied to new record highs on the month, while Oil oscillated in a broad range but ended lower on the month.

The US dollar was down hard on the month but staged a decent comeback this week after testing near YTD lows while the opposite happened to the AU Dollar!

Bitcoin ended the month lower after recovering the early month losses and fading back to just under USD$59k

Let's now talk about bubbles and the fact we're in La-La-land both here in the Australia and the US.

Let me share with you this fact: all bubbles pop, and a "soft landing" is based on bubbles remaining unpopped. In the "soft landing" scenarios, mind-boggling bubbles remain at "permanently high plateaus" as gamblers rotate out of one soaring sector into another soaring sector, in an endless rotation that keeps the entire speculative bubble fully inflated forever--or close to forever, which in today's world is a few years.

In La-La-Land, there are no bubbles, just enthusiasm for new technologies with limitless potential to reap billions in new profits. It's not a bubble, we're assured, it's simply strong fundamentals: sales are soaring, profit margins are fattening, and there's no end in sight.

Investors have been bulking up their long equity positions yet again, leaving them unprepared for a potentially volatile US autumn/AU spring.

Such positioning means one of two things: market participants are either confident that the bull run will continue, or they have no choice but to chase the rally after being underweight earlier in the year. But the result is clear: a near unanimity in bullish views, which is always dangerous as it can lead to explosive bouts of volatility when the narrative turns, like we saw in the first days of August.

Some of the optimism is fair of course as the global economy is holding up and renewed confidence that Fed cuts are on the cards from September has fueled a recovery from this month’s lows. While Nvidia’s results last night where a bit of a bummer and failed to live up to investor hopes, record highs are in sight for the S&P 500 and the Stoxx Europe 600.

But things can and do change.

In March, 2002, two years after the dot-com bubble had topped out, Scott McNealy, co-founder and CEO of dot-com darling Sun Microsystems, wrote a now-famous encapsulation of the difference between strong fundamentals and a bubble:

"At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes which is very hard. And that assumes you pay no taxes on your dividends which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don't need any transparency. You don't need any footnotes. What were you thinking?"

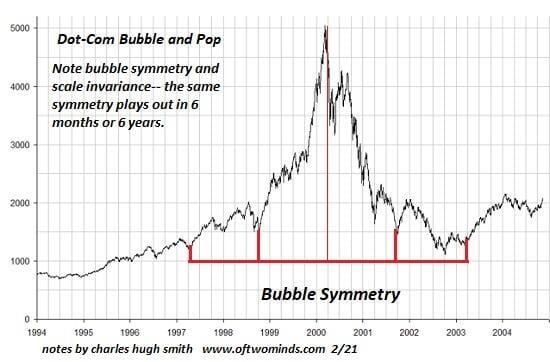

The chart of the dot-com bubble's euphoric ascent and eventual collapse is instructive: note how strong fundamentals eventually returned to the pre-La-La-Land level, wiping out all the wealth created by the bubble.

In response to the "weakening economy," a.k.a. the bubble popping, the Federal Reserve duly slashed rates, and talked up the "soft landing" fairy tale. Nothing stopped the bubble popping, something the leadership in China is discovering the hard way as their decades-long real estate bubble is popping despite a slew of subsidies, incentives, rate cuts and other forms of stimulus: even a Command Economy can't stop a bubble from deflating.

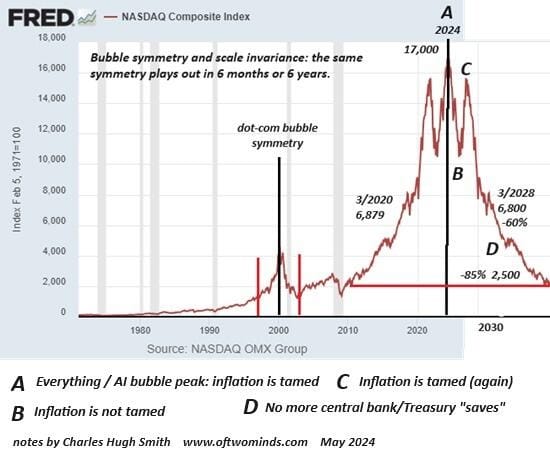

Which leads to this question: if the "soft landing" fairy tale is, well, a fairy tale, then what happens to the current Everything Bubble? If history is any guide, this chart of bubble symmetry will play out in the years ahead: strong fundamentals eventually return to the pre-La-La-Land level, wiping out all the wealth created by the bubble. Please take the time to actually study the chart below.

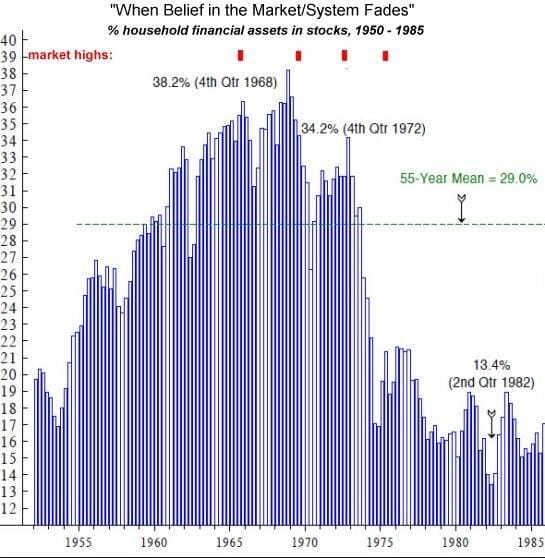

In the La-La-Land fairy tale, the solution is to play one's hot hand in speculation in a new sector, rotating seamlessly from one hot sector (AI) to the next, continuing to build wealth at each turn of the wheel. History tells a different story: all the punters and players keep playing until they run out of money or enthusiasm, and they all exit the casino. This is reflected in this chart of household wealth held in stocks in the choppy stagflationary era of the 1970s:

When everyone finally leaves the La-La-Land casino and abandons the fairy tale, household wealth held in stocks will become a fraction of what it was in the heady days of hot hands rotating into the next hot sector. It's OK to love fairy tales, for they appeal to our deepest emotions, our desires and our fears. But it's problematic when we let the fairy tale take over reality.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).