Australia's Economic Reckoning

Trump's tariffs have set the scene for a trade reckoning. Australia will have to move fast to make us competitive.

TL/DR: the countdown to the next stimmy has begun.

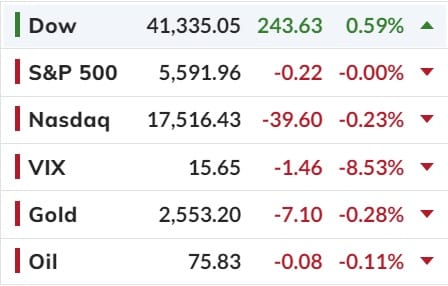

Overnight trade was all about Nvidia's earnings, and how the market would react to them, and... well, it left a bit to be desired.

While NVDA failed to reverse losses, the same can not be said for the Nasdaq which after tumbling almost 1.5% overnight, scrambled to rebound and even turned briefly green at one point, before it too also reversed and stumbled lower, dragging spoos with it. In fact, the only index that did well today was the Russell, because now that earnings season is officially over, all focus turns back to the Fed and the looming rate cut in September which will benefit heavily debt-laden small caps more than all other companies.

And let's not forget the overnight much hotter than expected revised GDP print, which came in at 3% from 2.8%, and was entirely on the back of a spike in personal spending which was also revised up to 2.9% from 2.3%

which of course is a total joke when one considers the record implosion in ultra discount retailer Dollar General - which now caters to not just the lower class but also a substantial portion of the "middle class" - which suffered its biggest market cap drop on record, and sent its stock price to 6 year low!

Further, moments ago two other discretionary consumer icons, Lululemon and Ulta Beauty, reported catastrophic results.

Ulta shares plunged as much as 8% in afterhours trading after the cosmetics retailer lowered its annual projections for comparable sales and profit following weaker-than-expected second-quarter results. Watch as Buffett bails out of the name as quickly as he got in.

But wait, there's more because if ULTA was bad, LULU was just as ugly.

As Bloomberg notes, the company lowered its sales and profit outlook for the year, adding to concerns on Wall Street that frugal consumers are no longer shelling out for pricey yoga pants and that increased competition is siphoning off customers.

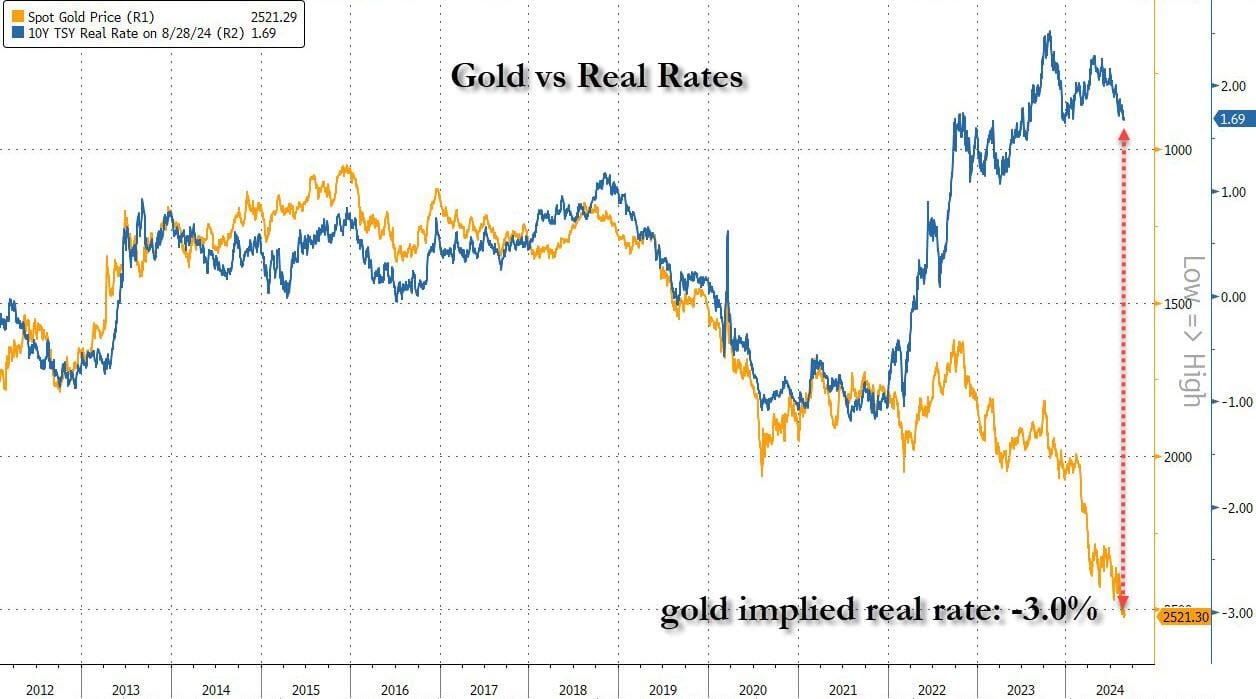

The above Dollar General chart of course reeks of massive fiscal or monetary looming stimulus, whether it is under president Kamala or Trump, something which gold is clearly sniffing out as it hits another record high of USD$2,553.80, and strongly suggests that real rates should be about 4.5% lower, at -3.0%!

So glad it's the weekend. Have a good one.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).