Weekend Open Forum

Here's the place to have a winter weekend party...or a least a heartwarming chat with fellow members!

Big-Tech, Bullion, & Bitcoin Battered Before NVDA's Big Night while NVDA Dumps after Smashing Q2 Expectations But Guidance Is A "Mixed Bag"

It's been touted as "the most important earnings announcement ever" which refers to the Nvidia after market results and did they delivery a blockbuster set of quarterly numbers.

While the Q2 earnings were impressive, beating both estimates and the even loftier whisper numbers across the board, there was just a touch of weakness in the company's guidance: NVDA projected Q3 revenue will be $32.5 million, +/- 2%. While this was above the average estimate was $31.9 billion, it was below JPM's whisper of $32.95BN and certainly below the most optimistic sellside prediction of $37.9 billion.

Perhaps anticipating the potential market revulsion to the modest guidance disappointment, NVDA tried to appease investors by announcing a massive new $50 billion buyback .

While initially NVDA shares bounced on the big beat, the since dipped on the disappointing guidance, sliding as much as 6% after hours, and have since whiplashed by the results as the stock is still fighting for direction, swinging between gains and losses as traders digest the earnings. As a reminder, options markets had priced in a swing of 10% after hours, so for now the reaction is positive tame relative to expectations. At last check, the stock was down about 7% erasing much of its rebound and trading near session lows.

The big question: are the results (still) good enough for Jensen (Nvidia CEO) to keep signing tits? The answer - you bet.

At the time of writing this post NASDAQ futs were pointing down 220 pts or just over 1%

ASX200 futs pointing down 44 pts so a weaker start expect for us here in Australia

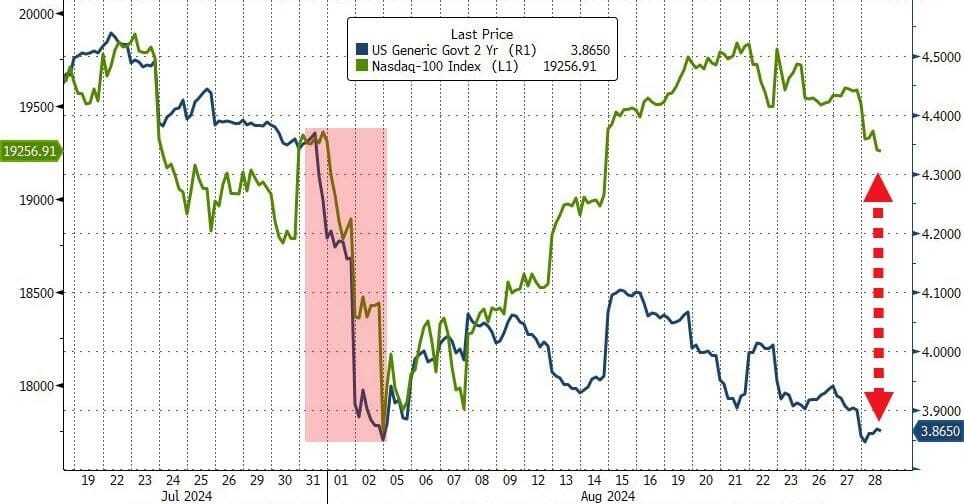

I'll finish with this chart.

Is it time for US stocks to catch back down to bonds' reality?

...and will NVDA after market be the trigger?

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).