AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

Horrible US housing data and anecdotally awful manufacturing signals from Texas were the only macro of note as the world awaits an avalanche of FedSpeak and the latest core PCE print later in the week.

Rate-cut expectations continue to slide (June is now a 50-50 for the start and 2024 now pricing in only 3 cuts)...

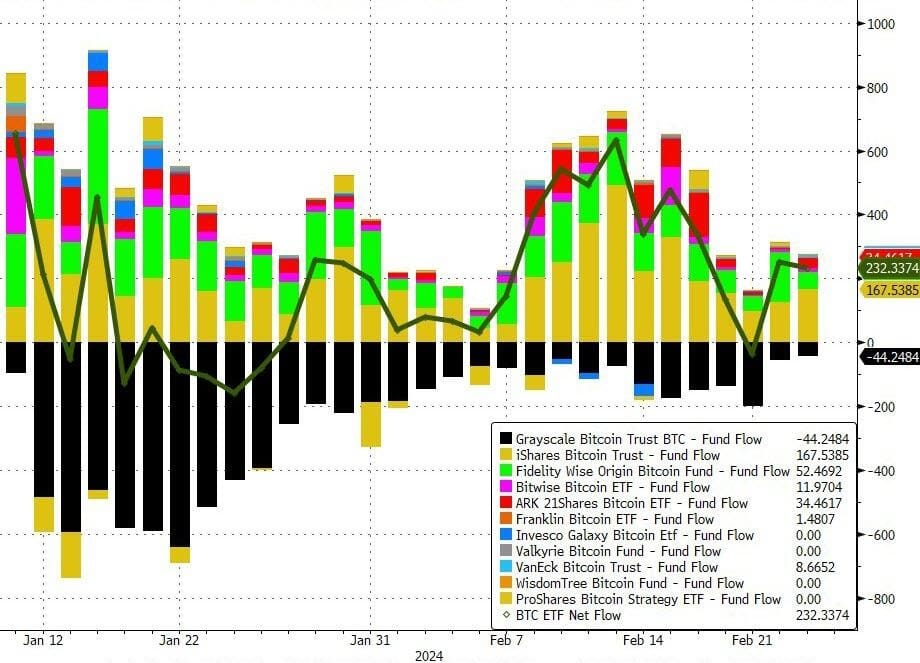

The big overnight move was in Bitcoin which soared up above USD$54,500 today, the highest since early Dec 2021...

As inflows keeping on flowing into the number one crypto.

Meanwhile, Mag7 stocks continued to limp lower after NVDA's exuberance last week...

Finally, NVDA was only able to add a de minimum 0.6% today, losing momentum three times intraday and completing an inside day (lower high and higher low)...

It does make you wonder, eh?

Relax! At least we have Bitcoin...

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).