ANDIKA BULLETin 26 FEB 2024

US Market's General Dynamic Looks Like Potential Blow-Off-Top

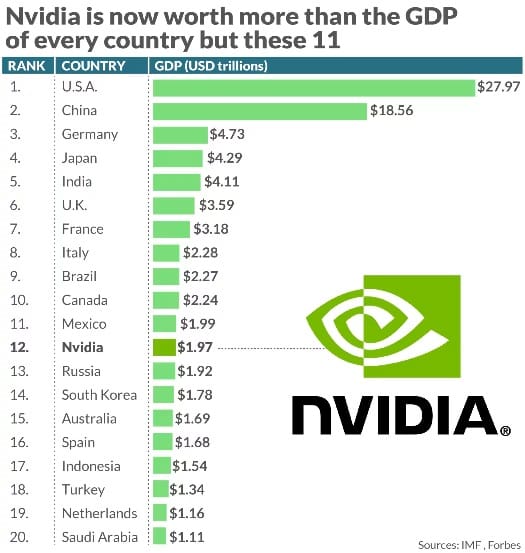

Ok, so everyone knows, NVDA is awesome, topping USD$2 trillion in market cap intraday this week (after a $2BN hike above consensus)...

Nvidia Corp.’s meteoric rise makes it not only the third-largest company in the U.S. in terms of market capitalization, but also bigger than most other countries’ economies, based on gross domestic product.

MAG7 stocks were obviously up on the week (the sixth in the last seven), but today's weakness took the basket back below its prior record high...

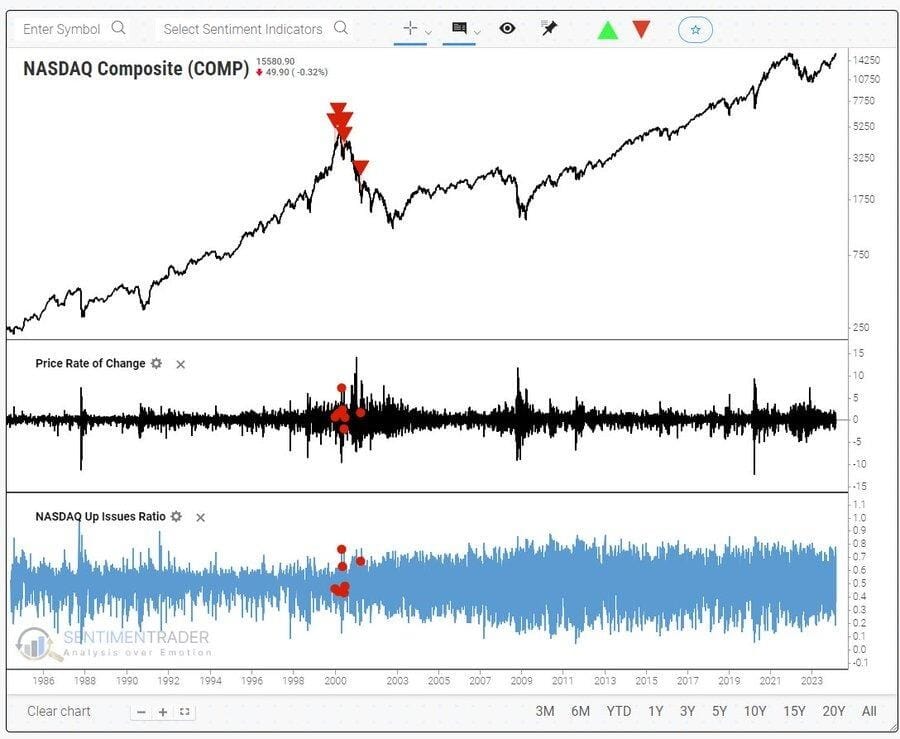

There's no way, right?

Cisco Systems was the market darling in 1999/2002 until it peaked and blew up!

Meanwhile, US Rate-cut expectations for 2024 continued to slide, now at just a 30% chance of 4 cuts (70% of 3)...

But US stocks don't care about The Fed... for now...

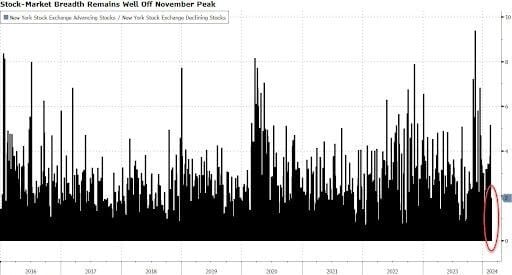

Finally, under the hood, it's kinda worrying...

the S&P jumped more than 2% on Thursday as investors cheered blowout results from Nvidia Corp., even though only 73% of its members advanced. That’s the lowest participation for an up day of this magnitude since the immediate aftermath of the 2020 election, when the S&P 500 gained 2.2% while only 47% of its members went up. Since then, 2% up days have been accompanied by an upward move in 92% of its stocks, on average, data compiled by Bloomberg show.

The performance divergence between the S&P 500 Index and individual stocks on the New York Stock Exchange was even more extreme. The index’s 2.1% rally came as less than 60% of stocks on the New York Stock Exchange advanced. The mismatch was seen just three other times in the past 60 years - 1987, 2008 and 2020, data compiled by Sentimentrader show.

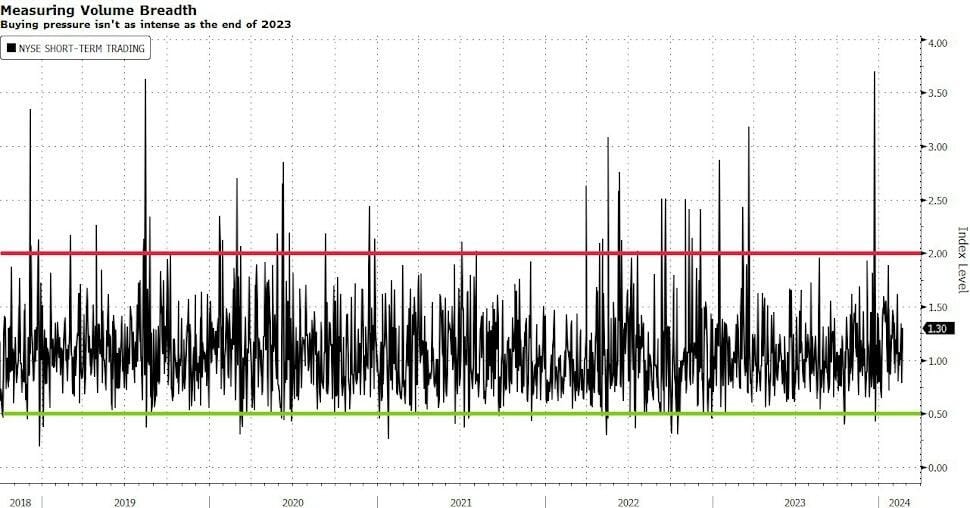

The Arms Index, also called the Short-Term Trading Index, or TRIN, compares the number of advancing and declining stocks to advancing and declining volume. Readings below 0.5 historically suggest there’s more demand for shares since that would mean volume is higher in the average up stock than down ones, while a move above 2.0 is a sign investors are dumping equities, according to market technicians. Following Thursday’s rally, it sat at a level of 1.3, meaning buying pressure was still well off its peak from late last year.

Of course, this time is different, right?

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).