Weekend Open Forum

Here's the place to have a winter weekend party...or a least a heartwarming chat with fellow members!

'Powell Put' Sparks Surge In Stocks, Bonds, & The Dollar; Bullion & Black Gold Flat While the Insanity in our World is Driven by Money Printing

Seems as another week concludes we see again Stocks both in the US and here in AUST have reached another all-time high. Seems Everything is still Awesome!

Take the US SP500 for example. It trades at a 2025 P/E of 20+

So the question may simply be: can the rates/growth/secular innovation dynamic be sustained long enough to allow corporate earnings to grow into the current market's valuation?

Only time will be able to answer that question.

USD put on some weight, trading near a 6 week high keeping the Aussie battler around USD$0.65

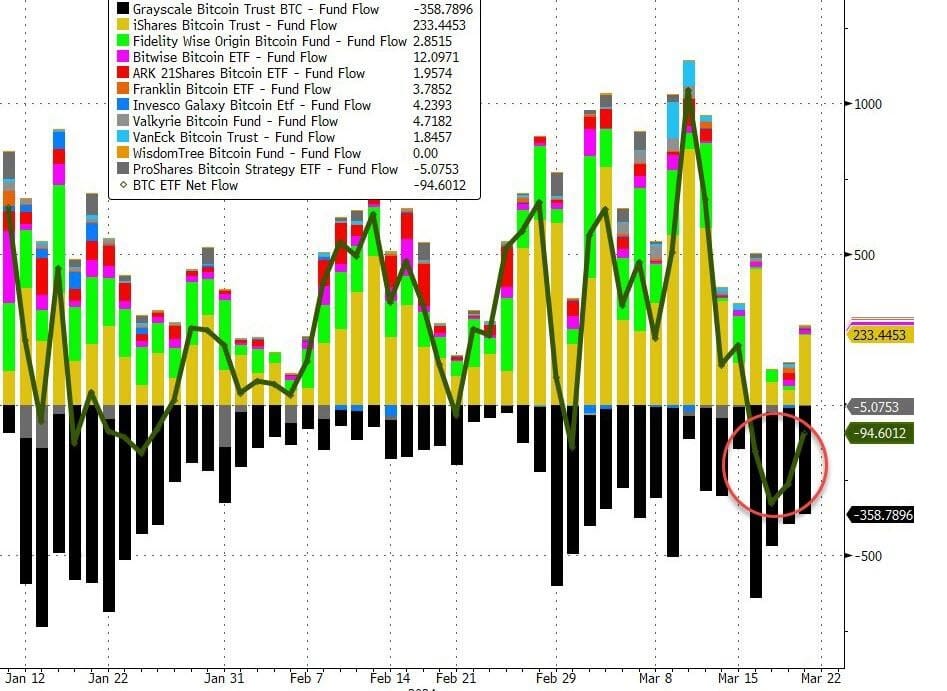

Bitcoin ETFs saw large net outflows last week...

Now you'll notice the BTC outflows are all from the Grayscale Bitcoin Trust (GBTC). Their last outflow was a whopping USD$359 million and fears are that the top is in for Bitcoin and more outflows will suppress the BTC price.

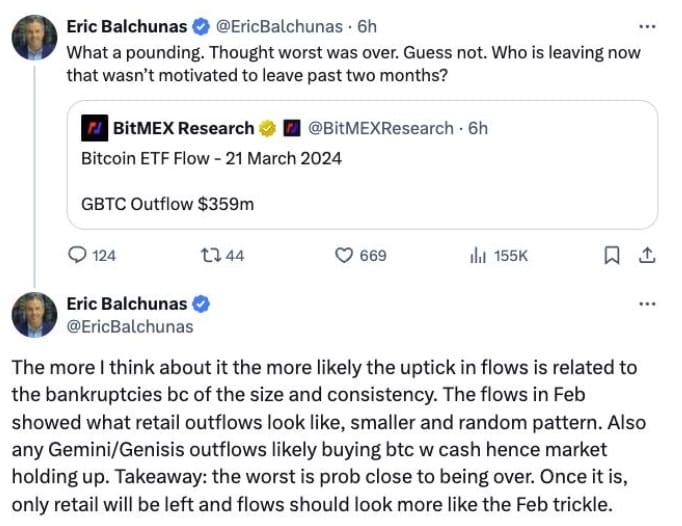

Senior Bloomberg ETF analyst Eric Balchunas speculated in a March 21 X post that much of Grayscale’s outflows could soon draw to a close, with the majority of them coming from bankruptcies of crypto firms due to their “size and consistency.”

In line with Balchunas, pseudonymous independent researcher ErgoBTC suggested that approximately USD$1.1 billion worth of GBTC outflows over the last few weeks appears to have come from bankrupt crypto lender Genesis.

Pseudonymous crypto market commentator WhalePanda offered a similar sentiment, pointing to a March 19 statement from Genesis that said the firm would be returning assets to creditors “in kind” — meaning that the defunct lender would be selling a lot of GBTC shares for Bitcoin.

On Feb. 14, Genesis received approval from a United States court to begin liqudiating its $1.3 billion worth of GBTC shares in a bid to repay its creditors.

So there is a more creditable reason why the BTC price has recently come back. Once the GBTC outlows become a trickle and the inflows from the likes of Blackrock and Fidelity continue this will re-apply a positive take up of more BTC.

Gold and Oil both ended unchanged.

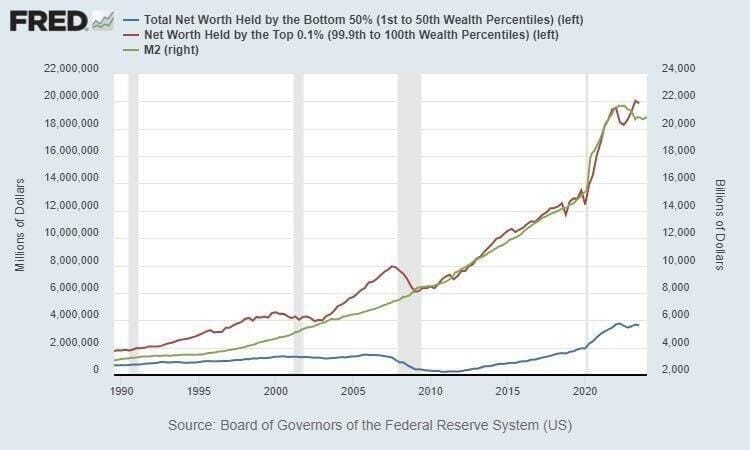

Finally, this chart was making the rounds on socials.

It clear compares the top 0.1% vs the bottom 50% and notice how the top 0.1% has been benefiting massively from the significant increase in the M2 money supply - you know the Fed Printing press.

It’s easy to get swept up in the chaos of the day-to-day volatility that exists in our world. Recently, our minds have been inundated with headlines about record breaking legal immigration here in Australia while in the US is been a case of massive illegal immigration, wars across the world, small battles within the larger “woke culture war”, ever increasing prices leading to what seem to be unstoppable Cost of Living crisis and the decisions made by central banks around the world. In the midst of all of this chaos it is important to take a step back and remind yourself of what lies at the core of most of these issues; the fact that we’ve completely broken 'money.'

What do I mean by broken 'money?'

When you break money, the most important tool humans use to facilitate economic activity, a ripple effect of negative consequences begins to emanate from the root of the world’s engine. Those ripples create the momentum that leads to chaos that we are witnessing today.

Broken money leads people to store their value in sub optimal vehicles like housing. This drives the cost of real estate up unnaturally and increases the gap between the “haves” and the “have nots”. Sowing seeds of animosity. Seeds that, when left to germinate and grow via the further degradation of the money people use, blossom into ugly flowers of Tyranny.

Broken money incentivises governments to allow their borders to be bum rushed by cheap legal (Aust) and illegal (USA) labourers who will take low paying jobs that enable the systemically fragile economy to keep chugging along while simultaneously increasing the cost of living chaos that already exists and a very tight housing market and diluting the values that the natives of Australia and America believe in.

The excess and decadence enabled by a world run on broken easy money allows people to live in a detached reality that leads them to push objectively false narratives. This is why there are running debates about woke gender politics and a retreat from merit based compensation.

All of this stems from broken money.

The chart above should act as a reminder to you all that the biggest problem in the world right now is the money. The chart above should also prove to you that the most powerful people throughout the economy are going to fight tooth and nail to protect the broken money because they benefit massively from the fact that it is broken.

Keep this in mind as the chaos increases and narratives begin to form around using bitcoin as 'the new sound money.'

Happy Monday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).