A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

Crypto Carnage Continues as US Dollar Spikes, Yield Curve Steepens with 'Soft' Data Slumping

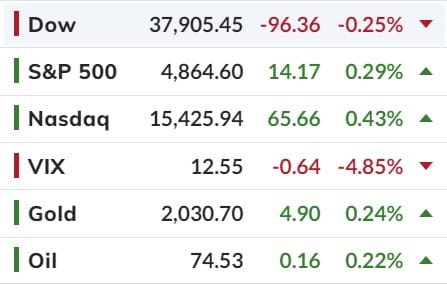

Richmond Fed manufacturing and Philly Fed services surveys both disappointed overnight - both signaling economic contraction, new orders declining, and employment pressures. The decline in business sentiment matches what we saw from New York last week and remains disconnected from the improvement we are seeing in consumer confidence...

...a product of the latter's likely focus on the stock market (and gasoline prices)... which was up again overnight (for the Nasdaq and S&P 500 hitting new record closing highs). Small Caps and The Dow ended the day red...

'Magnificent 7' stocks were higher overnight but not convincingly - are we back in the 3 days up, 3 days sideways trend?

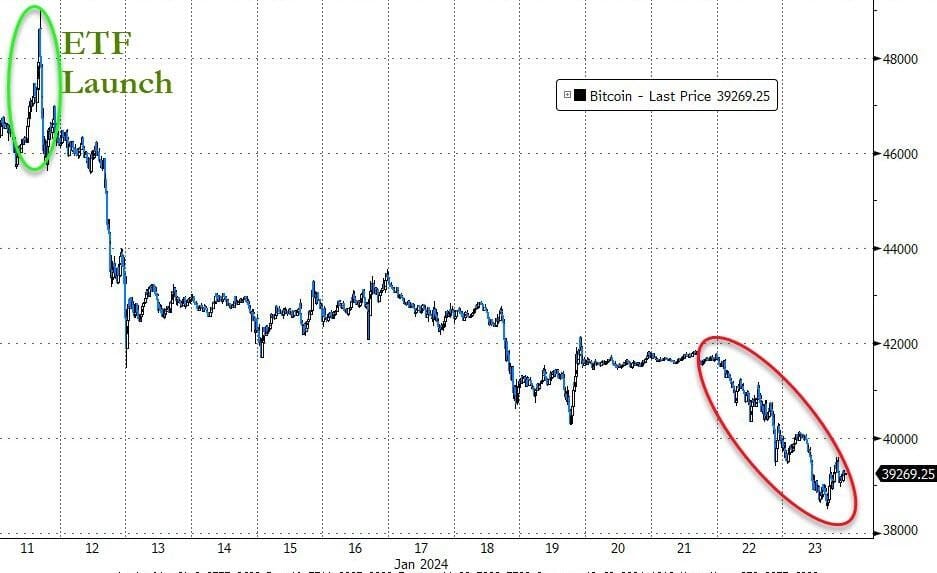

But crypto made the biggest headlines, tumbling below USD$39,000 at its lows overnight (from over USD$49,000 the day that the spot ETFs launched).

GBTC has been the dominant factor in outflows since inception (and yesterday saw the highest outflows since the new ETFs began with GBTC seeing a $640m reduction...

However, there could be another factor involved.

As CoinDesk reports, a large chunk of the exodus from GBTC was FTX's bankruptcy estate dumping 22 million shares, according to private data CoinDesk reviewed and two people familiar with the matter.

The 22 million shares it sold – which took FTX's GBTC ownership down to zero – were worth close to $1 billion.

So, instead of the GBTC outflows being recycled and netted off, a large portion of them is FTX liquidation-based - a one-off event, not a systemic pressure on the underlying crypto asset.

Finally, Chinese authorities tried (and failed) again to put a floor under their wealth-destroying equity-market-collapse - jawboning a multi-billion-dollar buying package (that barely managed to get the broadest measures of Chinese stocks higher)...

Asian traders are at their wit's end:

“I have reached the stage whereby my confidence as a trader is lost,” Singapore Hedge Fund 'Asia Genesis' CIO Chua Soon Hock wrote in a letter to investors. Reflecting on the unprecedented moves for China stocks (down) and Japan stocks (up), Chua wrote January “has proven that my past experience is no longer valid and instead, is working against me.”

“I still do not understand the inconsistency of China policy makers not fighting against deflation,” the fund manager continued, adding that:

“I have lost my knowledge, trading and psychological edge... The principle of risk-reward for both the short term and long term has turned on its head."

Revolution through routed wealth (do nothing - or keep pretending to do something - and hope it bottoms out - stuff that PM Albo does here in Australia) or wrecked buying power (stimmy-driven rebound sparks surge in inflation) - either way, not a good horizon for Beijing.

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).