Weekend Open Forum

Here's the place to have a winter weekend party...or a least a heartwarming chat with fellow members!

Powell Vows to Cut Rates while US Stocks, Home Prices, Rents and Food at All Time Highs to Underwrite Kamala's Election

With seven little words, Fed Chair Powell unleashed some chaos today as he confirmed "time has come for policy to adjust" and rate-cut expectations adjusted dovishly (though we note they were pretty much fully priced in for this after the Minutes).

September rate-cut expectations rose to 32bps (so around a 1/3rd chance of 50bps, 2/3 chance of 25bps)...

and this is the insane part. 2024 rate-cut expectations lifted to 104bps (just over 4 full cuts - well above the single-cut according to The Fed's Dot-Plot) and 213bps thru the end of 2025 so well over 8 full cuts is now being priced in!

Naturally Gold, bonds, crypto, and US stocks rallied while the US dollar tumbled to 2024 lows pushing the AUD to US$0.68

So back to the recent 818,000 job revision I noted Friday and Thursday. This is the catalyst for the Fed to begin the cuts because we all now know the job gains under Bidenomics was bogus.

Naturally it also pays to be sceptical as the last thing the Fed wants is for the establishment candidate Kamala isn't distracted by such trivial things as a market crash so the Fed will now do everything to ensure the mkts keep on pumping higher.

There are however four small problems with this.

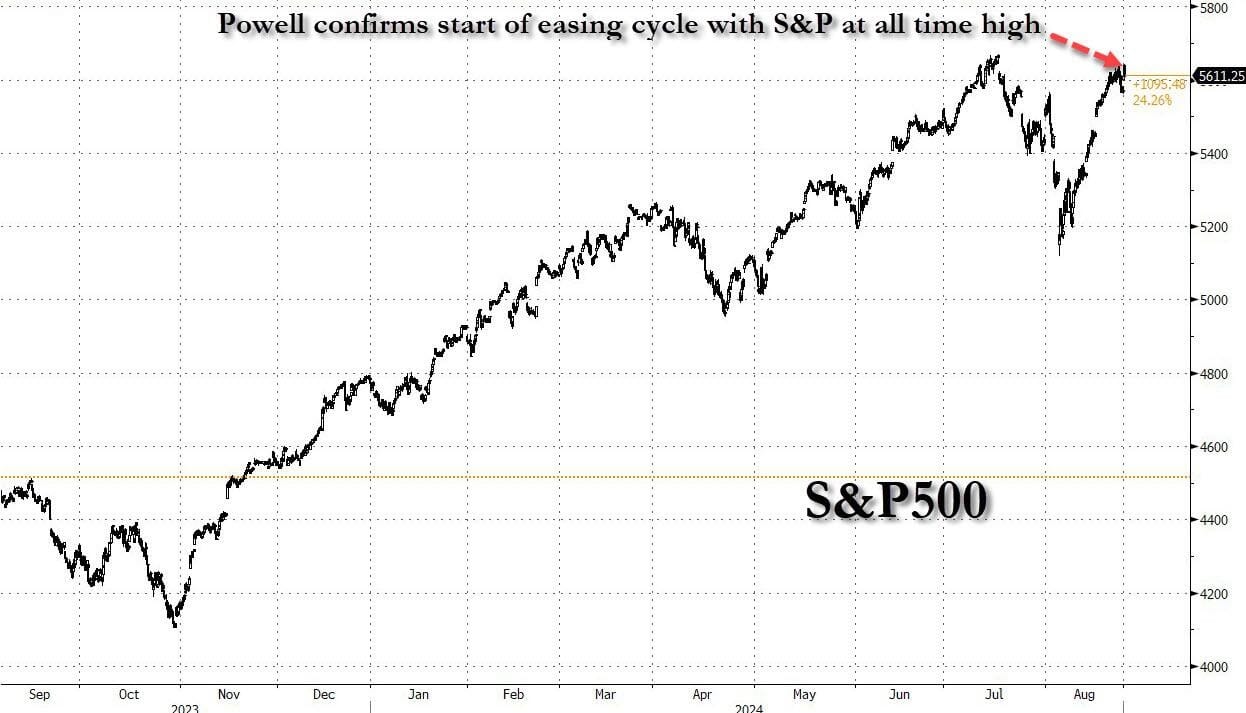

1: the Fed will end its tightening cycle and starts the next easing cycle with US stocks at all time highs, something that has never before happened in the history of capital markets!

It means that, unless the current expansion ends in a gruesome recession which crushes the economy, the S&P is about to enter a full-blown bubble, which in turn will burst in even more spectacular fashion and force the Fed to not only cut back to ZIRP, but activate NIRP (just like Japan did years ago) and also go right back to QE and buying bonds ETFs. For now, however, as in the next three months ahead of the elections, all shall be well and should serve the all time high in the market to Kamala Harris on a silver platter.... which is precisely why the Fed is doing what it is doing.

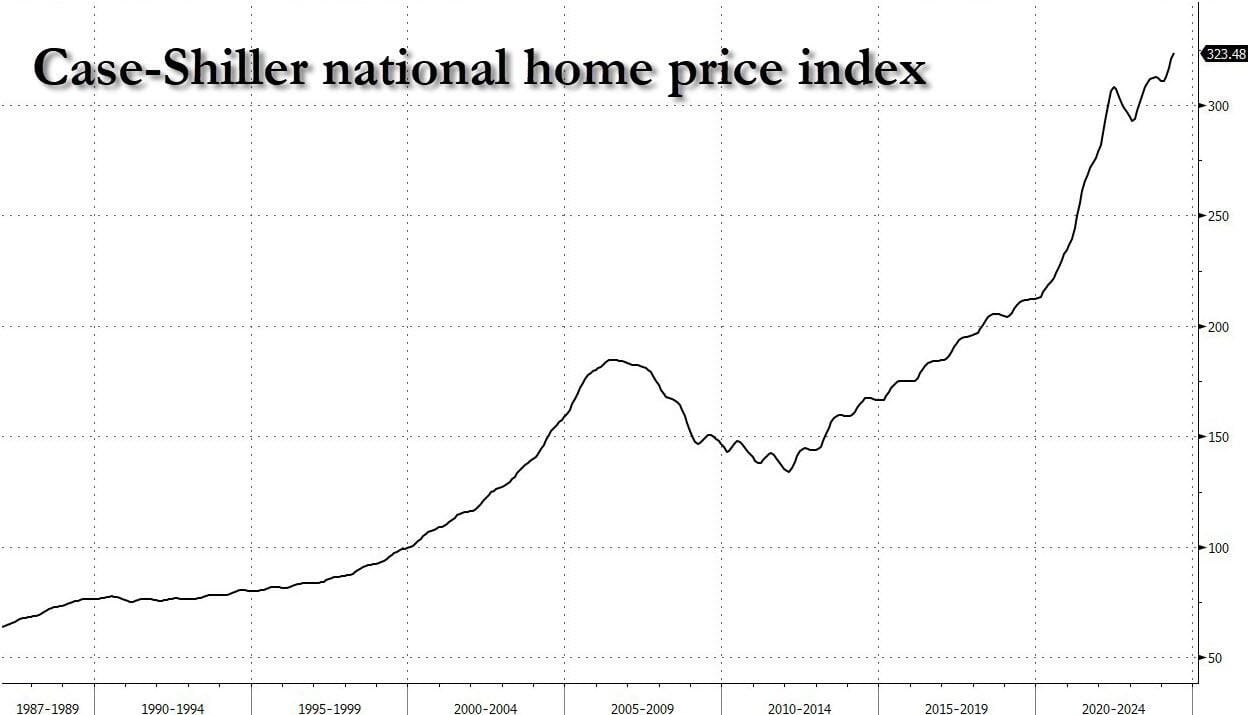

2: this is also the first time in history when the Fed has aborted a tightening cycle having achieved zero home price easing. Indeed, one look at the Case-Shiller index shows that home prices are the highest they have ever been.

And then you have Kamala's promise to provides USD$25,000 in new home purchase subsidies, which will go straight to the asking price, sending prices even higher.

In short, both home prices and rents, already at record high, are about to go record-er...

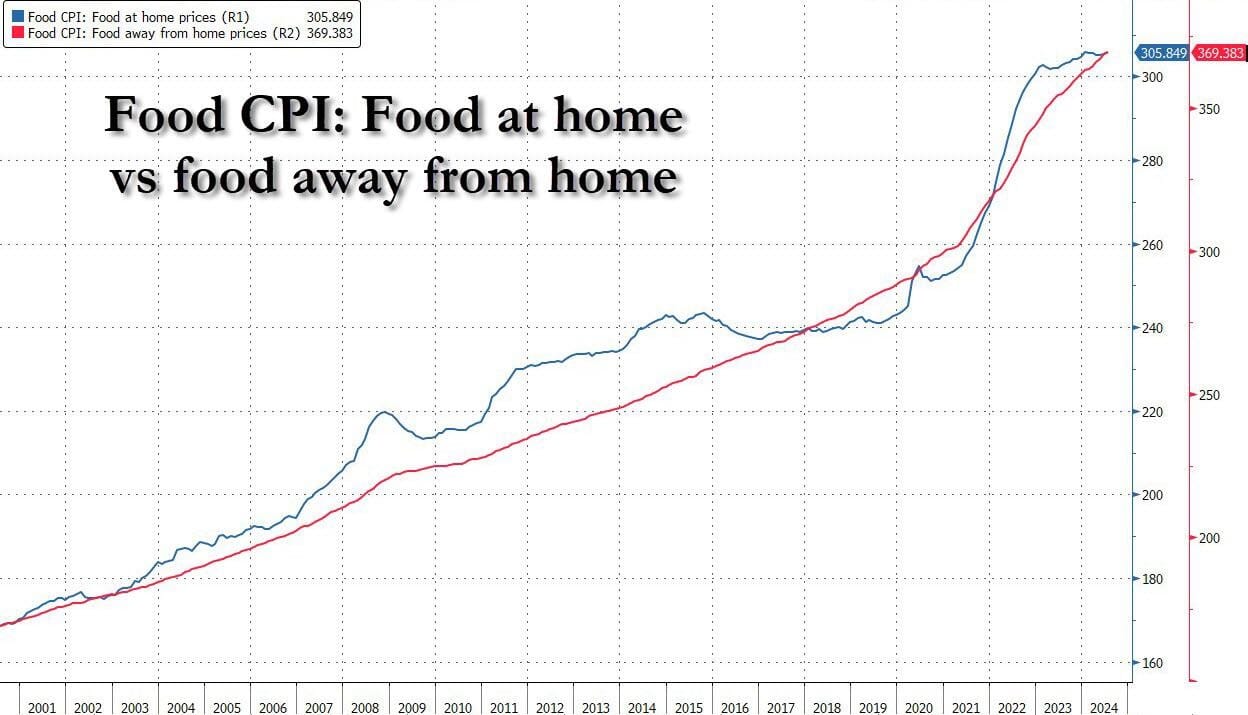

3: while one can technically live without housing or rent, one still needs to eat. And here we find another massive problem, because not only did the Fed's rate hikes not contain US stock, home or rent prices, but food prices - both at home and away from home - are also at all time high! And guess what cutting rates and stimulating the economy will do to food prices from this point on.

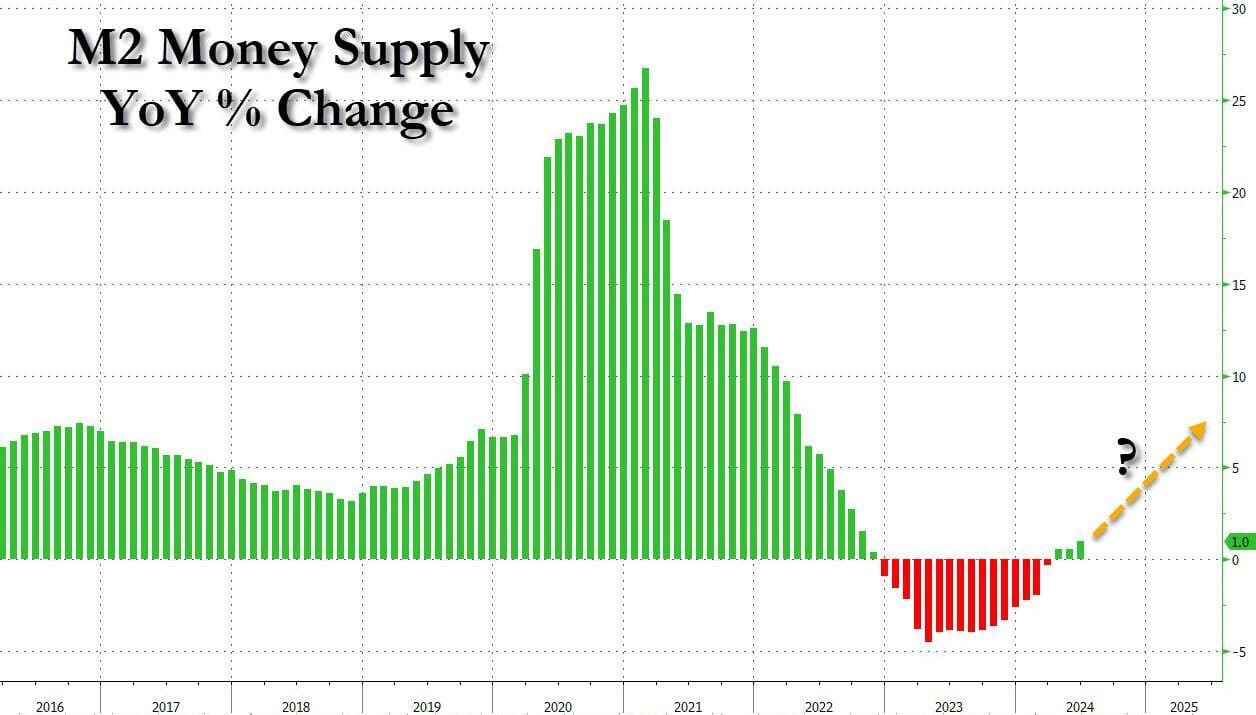

4: and final, the seeds of the next inflationary bubble are already set, because even as the Fed kept conditions tight (or even exceptionally tight), M2 - the broadest money aggregate tracked by the Fed - is once again rising after declining for the past three years.

Of course, there are countless other examples, because besides the above case studies, prices are at all time highs pretty much everywhere else too. But you get the message. The only question is what can possibly go wrong with the Fed launching an easing (i.e., monetary stimulus) cycle with prices for pretty much everything, stocks and homes included, at all time highs and rising.

The seeds are being planted for an event ever bigger than the 2008 GFC...

So brace yourselves.

There will be no ANDIKA BULLETin on Monday.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).