EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

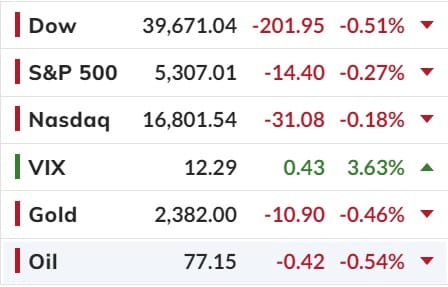

Nvidia Explodes Higher After Blowing Away Estimates while Hawkish Fed Minutes Hammer Stocks, Bonds, Gold, & Oil

An ugly home sales print (but record April home prices) combined with declining traffic and smaller spend data from Target threw some shade on the market early on but it was the FOMC Minutes that sparked the waterfall with their more hawkish comments.

Plenty of FedSpeak again overnight left stocks red by the close (despite a late day rebound attempt) with Small Caps lagging. Nasdaq was the prettiest horse in today's glue factory managing to ramp into the close and end unchanged.

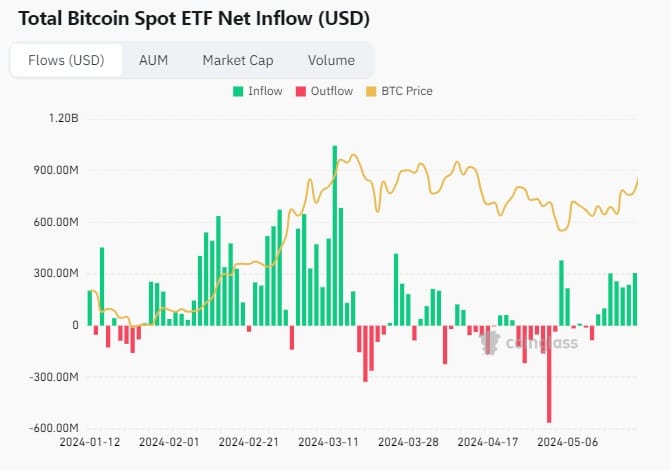

USD had a run up, Gold was clubbed like a baby seal overnight for its worst day since April and Cryptos actually held up well overnight - after another solid net inflow into BTC ETFs, and further hope for the approval of ETH ETFs.

But the big news overnight was Nvidia's result print. Nvidia has been called the mother of all earnings – the "single most important stock on the planet" according to Goldman - and for good reason: it accounts for 5% of the S&P.

here is what NVDA just reported for Q1:

If all that was not enough to send the stock soaring to all time highs, this shoudl seal the deal: the company also announced a 10 for 1 stock split, which guarantees that in a few weeks time, all retail investors will be piling into the suddenly "cheaper" stock.

And with all that, it's hardly a surprise that the stock is surging after hours, and is up about 4% trading in the mid $970s having earlier nearly jumped above $1,000 to a new all time high!

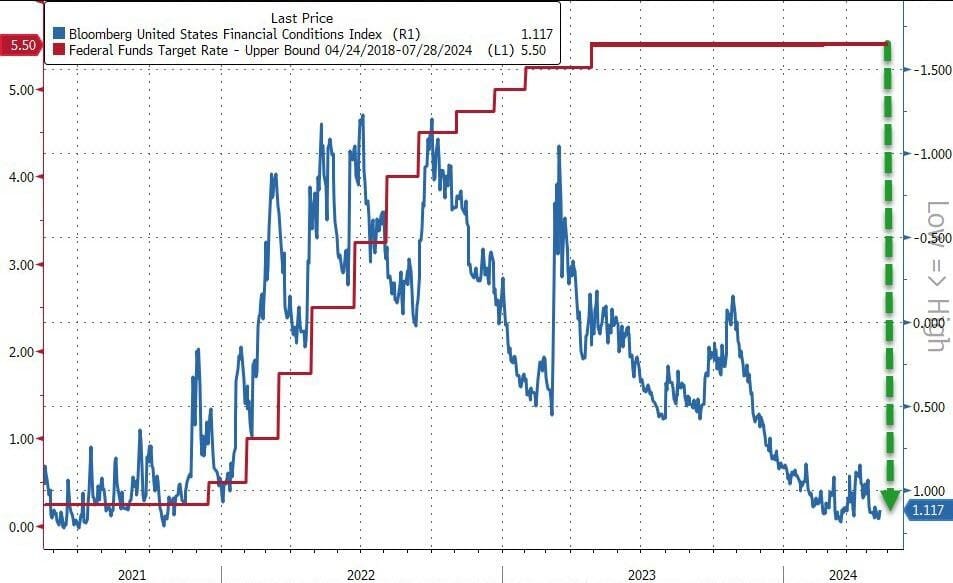

Finally, the FOMC Minutes showed some Fed members feared that despite a 'restrictive' monetary policy, financial conditions were too easy...

They are right!! And the reason financial conditions are so easy is because of the constant pivot jawboning about a possible rate-cut and premature victory celebrations by The Fed for vanquishing inflation... instead they conjured stagflation back to life, with stocks at record highs.

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).