A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

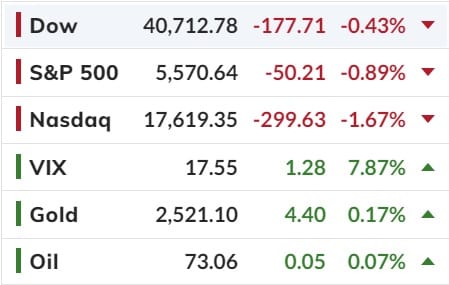

US Stocks & Bonds Slammed Ahead of J-Hole Aa FedSpeak Slows Rate-Cut Euphoria

As the world awaits tomorrow's words from Jay Powell (which is largely moot now given the FOMC Minutes), today's market action (stocks, bonds, and gold down; dollar up) was brought to you by notably less sanguine FedSpeak (walking the market back from four cut expectations) and disappointing macro data (reviving growth scares).

Continuing jobless claims hovering at multi-year highs (initial claims low), a blip higher in existing home sales (off record lows with new record high prices), a big puke in Chicago Fed's National Activity Index, a dismally weak manufacturing sentiment survey.

The decline in 'dovishness' removed some of the Fed Put hype sent stocks lower overnight - most notably led by Nasdaq (as the selling started right as the US cash session opened). The Dow was the prettiest horse in the glue factory overnight (but all the majors were notably lower as tomorrow's Jackson Hole speech looms).

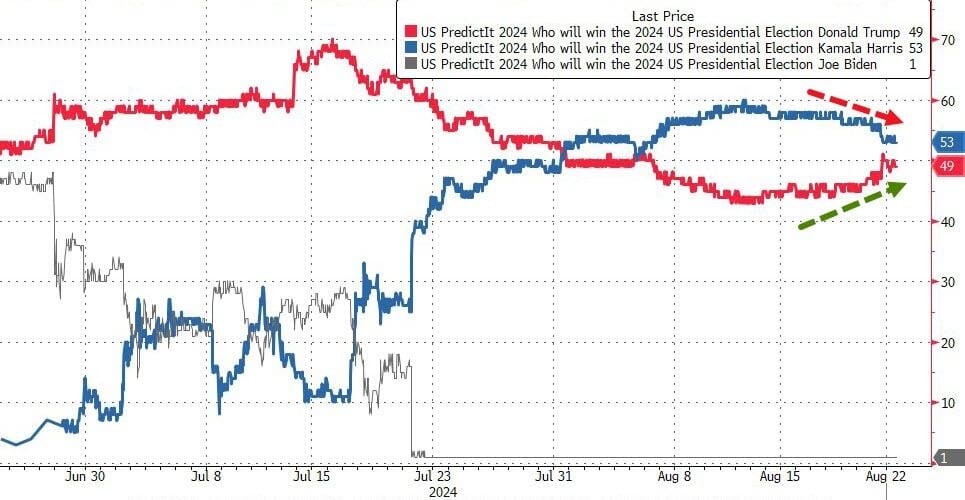

Finally, Kamala's honeymoon is fading fast as PredictIt shows the gap over Trump is now at its lowest since Aug 5th...

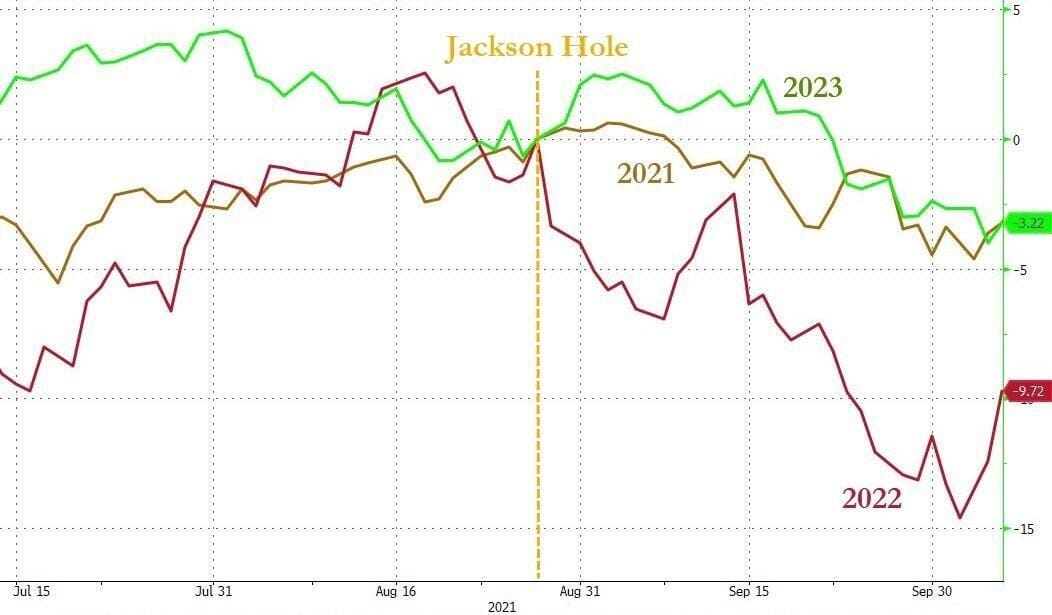

And one more thing... a reminder that the last few years has seen buying into J-Hole has become a 'sell the news' event after.

I'm assuming the selling started early...

Have a great weekend

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).