EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

"everything is awesome"... so awesome The Fed needed a crisis-like 50bps cut to keep it awesome!

The week that was...

Let me tell you a very quick story and then think about how this will all end.

US Stocks are at record highs (no landing at all); home prices are at record highs (and rising fast); and US macro data has dramatically surprised to the upside since the last FOMC meeting.

But US bonds are around 35bps lower in yield (recession).

So it makes perfect sense that The Fed would slash rates by a crisis-like 50bps, right?

If there was a strong case for a 50 bps cut, Powell did not make it at his press conference. He repeatedly stressed that the US economy was strong, but we should see the strong move as a commitment to keep the economy strong.

When Powell was asked during the Q&A what his message to the US consumer is, Powell said that the US economy is in a good place and our decision is to keep it there. Really? A 50 bps cut as a message that the economy is strong? So if they cut by 75 bps the economy is booming? This sounds like something out of George Orwell’s 1984!

So why worry then?

The last time yields rose after a 50bps rate cut was in October 2008 and things didn't end too well that time.

But there's no recession ahead according to stocks, despite the market pricing in massive rate-cuts.

Meanwhile Crude oil prices rallied strongly this week off three-year lows. This was oil's best week since Oct 2023.

Bitcoin had a big week (best two weeks since July), pushing back above $64,000 to one-month highs while the old relic Gold soared to new record highs today, above $2,645 (with the best two weeks since April).

Finally, one can't help but wonder if we are about see That 70s Show replay in CPI.

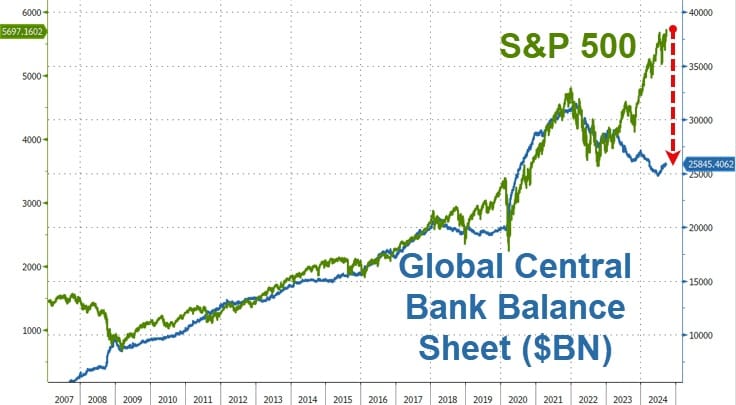

Does anyone really think global liquidity is about explode once again to enable that re-ignition of inflation?

or how much do stocks have to fall before The Fed Put is triggered?

Bear in mind that stocks have NEVER been more expensive relative to the economy (total US market cap back up to 200% of GDP...

Have a good weekend

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).