Welcome Aboard!

George Christensen is now walking the corridors of power as a fearless journalist. I am pleased to announce a new collaboration.

Cryptos Soar On Ether ETF Hope as Downbeat Dimon Sends Gold & Silver To Record-er Highs

Big gains in crypto after Bloomberg's ETF guru Eric Balchunas upgraded his view of Spot Ether ETF approval to 75% (vote expected this week).

That sent Ethereum soaring back above USD$3,600 and Bitcoin to over USD$71,000

While Silver surges to USD$32 for the 1st time since 2013 with while the old relic spot Gold hitting USD$2,450 (since come back $20)

Other than the crypto run, it was a quite macro and micro day saw stocks start off strongly but fade after JPM CEO Jamie Dimon offered his now ubiquitous downbeat view of the foreseeable future.

"I'm cautiously pessimistic. We have the most complicated geopolitical situation that most of us have seen since World War II, if you study history. We don't really know the full effect of QT. I find it mysterious that, somehow, it had this beneficial effect, but it's not going to have a negative effect when it goes away. I personally think inflation is a little bigger than people think and that rates may surprise people."

Stocks were mixed as Nasdaq outperformed (with a big opening bump from Mag7 stocks) but The Dow was the big laggard. S&P fell back to unch and Small Caps ended with a small gain...

Finally, is this the week?

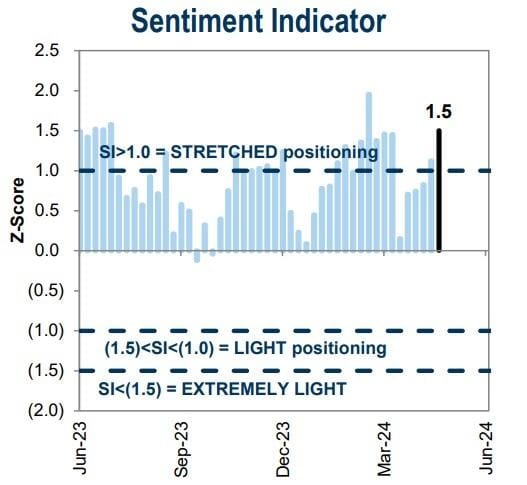

And Goldman is a little worried...Positioning at the US index level is stretched. The Sentiment Indicator (SI) is a measure of aggregate positioning and risk sentiment in the US equity market.

The Sentiment Indicator tracks investor positioning across the more than 80% of the US equity market that is owned by institutional, retail and foreign investors. To calculate the Sentiment Indicator we run a Principal Component Analysis (PCA) on six weekly and three monthly indicators that span these three investor types. Readings of +1.0 or higher have historically signalled stretched equity positioning.

The SI is 1.5...Brace for impact.

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).