EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

'Dovish' Powell Destroys 'Hawkish' Dots; Sends US Stocks, Gold, & Bitcoin Soaring

ASX 200 Futs are pointing up 49 pts and today is also MAR24 Share and Index option expiry so expect some price movement.

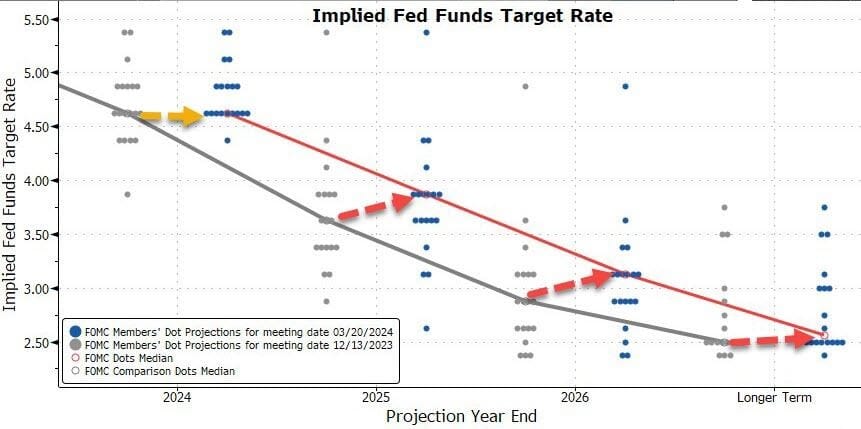

The FOMC dropped its dot-plot and it was unequivocally more hawkish than the Dec dots with 2024 flat at 3 cuts (though more voters moved towards only 50bps), but 2025 and beyond saw rate-cuts erased from the projections...

Then Powell stepped up to the lectern and dropped the dovish mic on any hawkish interpretation of the dots.

Powell reiterated his long-held view that the dot-plot does not amount to a "plan".

Powell calls the longer run interest rate change "pretty modest".

“I don’t think we know that,” Powell says about whether this will be a lasting trend.

However, Powell did admit rates are unlikely to be going ZIRP anytime soon:

“I don’t see rates going back down to that level but I think there’s tremendous uncertainty on that.”

If the Fed eases too much or too soon, he says, we could see inflation come back.

And if we ease too late, we could do unnecessary harm to employment.

“We want to be careful,” Powell says, stressing that "the risks are really two-sided here."

Powell signaled balance sheet reduction will slow (less QT >> more QE):

“We did not make any decisions today. The general sense of the committee is that it’ll be appropriate to slow the pace of runoff fairly soon, consistent with the plans we previously issued.”

Powell also rather dismissed the recent jump in inflation:

“There’s reason to think that there could be seasonal effects there,” Powell says about the January CPI and PCE figures, and then says that February PCE wasn’t “terribly high.”

So, wait, the seasonally-adjusted data is showing seasonal affects now?

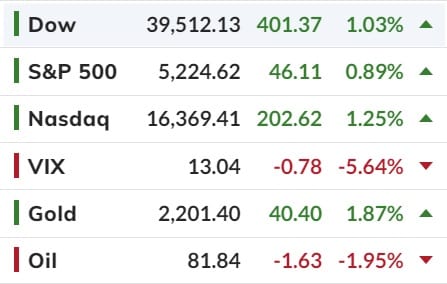

In the end, the odds of a rate-cut in June jumped to 67%...And Powell's dovish dance sent assets to the moon as the USD dollar dived...

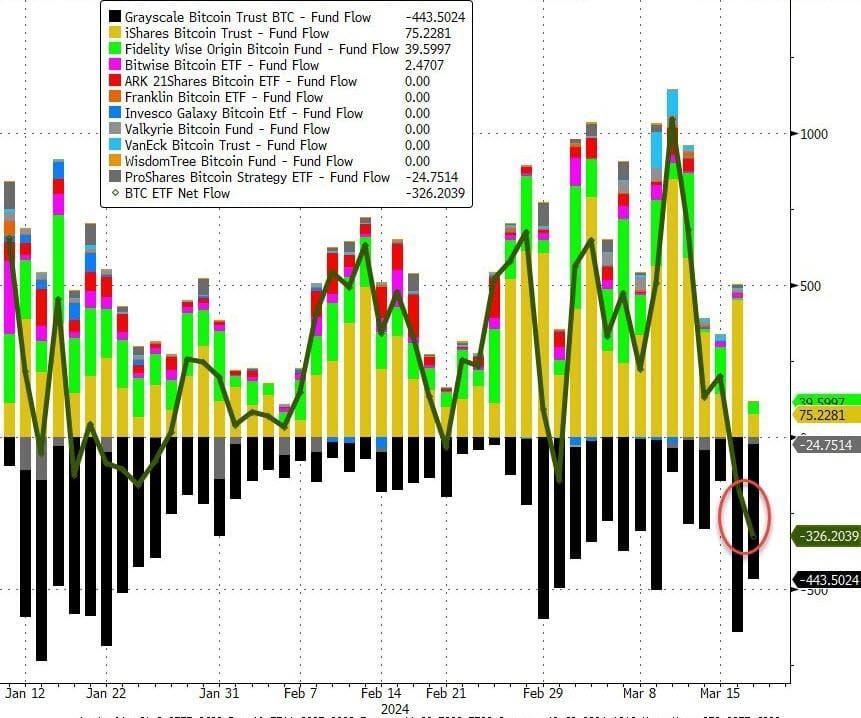

Which sent the old relic Gold to record highs while Bitcoin broke back over USD$67,000 which is very courageous after a record net outflow from BTC ETFs yesterday...

So Stocks soared higher - new record highs for the S&P, Dow, and Nasdaq - with Small Caps exploding to one of the best day of the year so far...

Not long now until we see Dow 40,000!

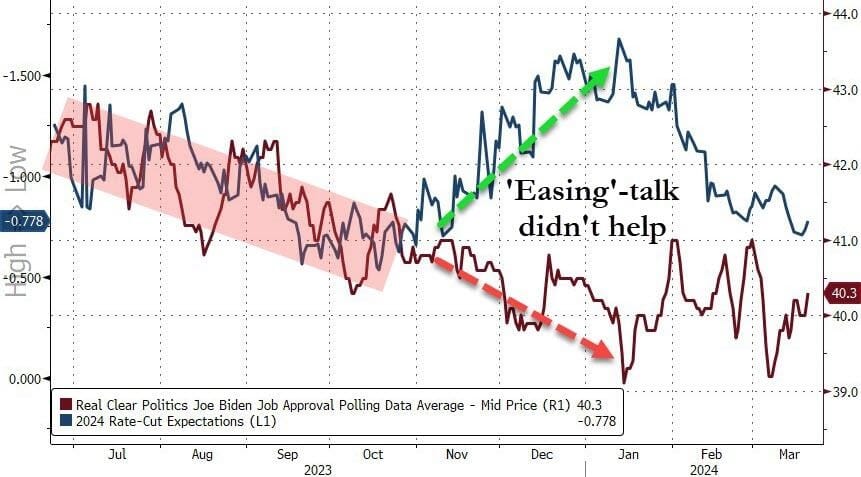

Which is funny because stocks didn't give a rats about rate-cut expectations anyway...

and of course, like clockwork MAG7 stocks soared to a new higher record high...

Finally, is this what The Fed fears? Inflation 2024 vs inflation of 1984???

Or is a Biden loss a bigger worry?

They tried to jawbone the big pivot/easing of rate-cut expectations and it showed no impact on Biden's approval rating, So what next? Massive QE?

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).