EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

"Healthy" and Cheap Fast Food Chimichanga seller has boom ASX start while Nvidia has its worst day in 2 months

So today is the shortest day of the year - the Winter Solstice, also called the hibernal solstice, occurs when either of Earth's poles reaches its maximum tilt away from the Sun.

Now you want an example of local market insanity then look no further than the IPO listing of Guzman y Gomez yesterday. GYG +36.36% stormed out of the blocks and was the Australia's best IPO in years. The issue price was $22 and the stock hit a high $30.99 before closing at $30 –2x the $15 valuation Morningstar put on the stock!

From AFR's Street Talk

Documents presented by Guzman y Gomez’s largest shareholder, TDM Growth Partners, to its backers in 2018, and now obtained by Street Talk, show the restaurant chain missed every projection on key financial metrics for both FY22 and FY23.

For starters, those documents suggest the company would have 248 stores in Australia – and another 20 overseas – by the end of June last year. In reality, it was 38 stores short of the target come IPO time – not a good look when you consider its lofty ambitions of serving burritos from 1000 locations in Australia within two decades.

More importantly, Guzman y Gomez forecast a base case EBIT of $31 million for FY23. That’s nearly eight-times – yes, that’s not a typo – higher than the actual pro forma EBIT of $3.7 million that earns a mention in the IPO prospectus.

The bottom line is this – Guzman y Gomez hasn’t been growing as fast, or is as profitable, as management had previously predicted.

As for their "valuation" multiples. Back in 2018, when Guzman y Gomez was raising at a $125 million pre-money valuation, TDM Growth Partners reckoned it was hot to trot at a 13.2-times EV/EBITDA multiple. Fast-forward to 2024, and it’s defending a valuation of 32.6-times.

Anyone in GYG should be very careful.

Once upon a time there was this other fast food darling - Domino's Pizza (Now known just as Domino's) and here's their trading history.

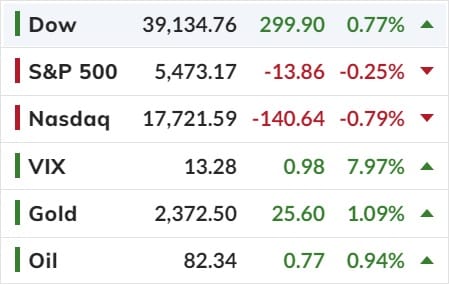

To the US Markets. Jobless claims not good, housing data bad, Philly Fed ugly... and that meant the US macro surprise index plunged to early-2019 lows... near the lowest level since 2016...

But that 'bad news' had no (good news) influence on rate-cut expectations (which worsened marginally).

That 'bad news' was also bad news for the momo names too as The Dow dramatically outperformed the rest of the majors today (the only index positive) with Nasdaq the biggest loser from Tuesday's cash close.

Notice Oil has been doing well lately? Oil prices extended gains now up to its highest since April.

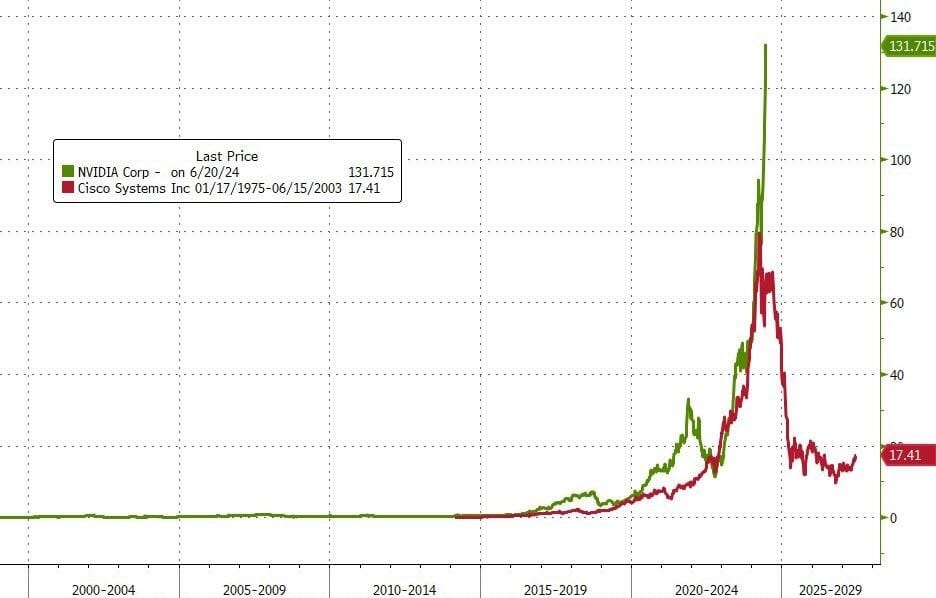

Finally, NVDA had a bad day - its worst day in two months - after hitting a new record high early in the day...

Arguably, it could be a tad overbought here? Blow-off-toppy?

America has cutting edge tech and we now have cutting edge Mexican fast food. Go figure!

Happy Friday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).