ANDIKA BULLETin 21 AUG 2024

Gold Hits New Record High As Kamu-nism Spoils Stocks' Party

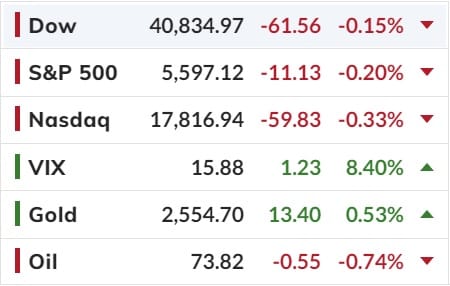

The S&P 500 has not had a nine-day win-streak since 2004 and it appears Kamu-nism was enough to stop stocks doing it againovernight as Harris unveiled her cunning plan, including 28% corporate tax, price-controls, 44.6% capital-gains tax, and last but not least, a tax on unrealised gains.

Nasdaq was the ugliest horse in the glue factoryovernight as the algos tried their hardest to maintain the win-streak.

ASX200 futs are pointing down 33 points for us.

Gold again was the shining light reaching a new all time high of USD$2,554.40

Digital gold Bitcoin ripped up above USD$61,000 during the Australia session but was then punched lower during the US session to USD$59,400

Finally, while markets have recovered, Deutsche Bank warned this morning in a note to clients that catalysts behind the retreat haven't necessarily evaporated. The firm outlined five key risks that remain that investors should watch:

- First, equity valuations are still at historic highs, with the market trading in moderately overweight territory, the bank said. This made some on Wall Street uneasy even before August's sell-off and continues to be a point of anxiety as investments pile in.

- Second, economic data remains vulnerable. Part of the reason equities dropped dramatically in August was a softer-than-expected nonfarm payrolls print, which disappointed estimates of 194,000. This was an unwelcome sign of weakness, but not a recessionary reading, DB said. That leaves room for even more disappointing data, which could bring larger consequences to investors if it were to happen.

- Third, monetary policy is getting increasingly tight on real terms, with DB noting that the real Fed funds rate recently hit its highest since 2007.

- Fourth, September has been a seasonally bad month for stocks over the past few years. The S&P 500 has fallen during the period for four straight years, and in seven of the past 10. DB says it's also been a bad month for fixed income, with the Bloomberg global bond aggregate falling during the past seven Septembers.

- Fifth, geopolitical tensions are still high. DB notes that Middle East conflicts contributed to an equity sell-off in April, while oil prices also hit their highs for the year around the same time. More recently, in August, oil saw their biggest single-day spike of the year on reports of further escalation, the firm said.

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).